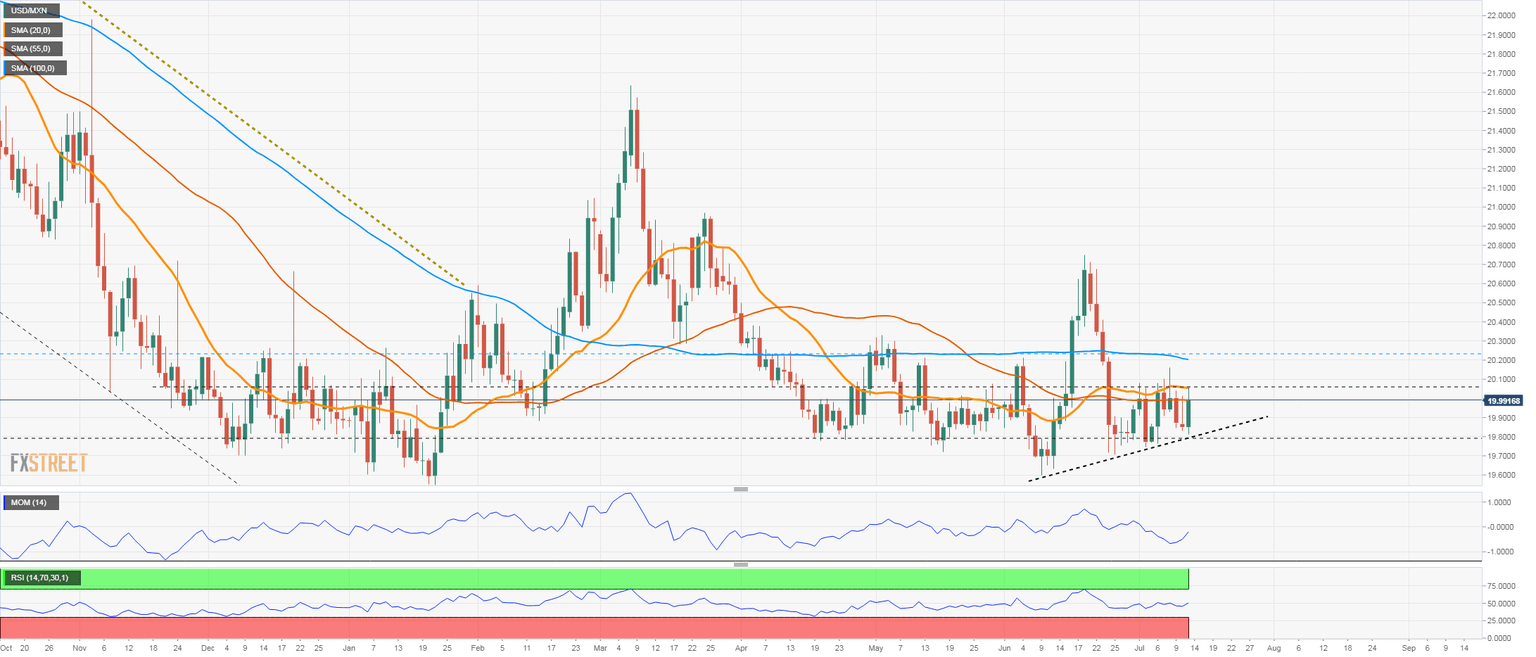

USD/MXN Price Analysis: Upside limited while below 20.05

- Mexican peso continues to trade sideways, bearish risk rises.

- USD/MXN testing the 20.05 area, supported by uptrend line.

The USD/MXN is rising again on Tuesday on the back of a stronger US dollar across the board. Gains are likely to remain limited as longs price continues to be unable to hold firm above 20.05. The area around 20.05 contains a horizontal resistance and also the 20-day moving average.

A break above 20.05 should point to more gains, with the target at 20.20, the 100-day moving average. The next resistance is located at 20.30.

The bias in the short-term is neutral. Technical indicators are biased modestly to the upside. A break under the 19.80 area (uptrend line) would change the bias to bearish, exposing the June low at 19.59.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.