USD/MXN grinds lower as bears eye 20.15 despite a firm US dollar

- The Mexican peso advances firm vs. the greenback, despite falling oil prices.

- An upbeat market sentiment boosts emerging market currencies.

- USD/MXN Price Forecast: Neutral biased, but up and downside risks remain.

The Mexican peso rallies firmly despite that the US Federal Reserve hiked rates for the first time in three years, but interest rates differentials still favor the Mexican peso. At 20.2964. the USD/MXN reflects the 5.50% differential between Mexico and the US.

In the meantime, European and US stock markets continue advancing during the day, reflecting the positive market sentiment. Meanwhile, oil prices dropped from daily highs near the $115.00 mark as Germany and Hungary backpedaled from a potential embargo on Russian oil, easing pressures on the black gold. That stopped the fall of the USD/MXN pair, as traders were looking to push the exchange rate towards February 23 daily low at 20.1558, short of the psychological 20.00 barrier.

Meanwhile, the US Dollar Index advances on the day some 0.96%, sitting at 98.536, putting a headwind for the USD/MXN.

Overnight, the USD/MXN opened near Monday’s low, around 20.30s. Once the North American session began following a bank’s holiday in Mexico, the Mexican peso strengthened as USD/MXN traders pushed the pair towards 20.2494 lows.

USD/MXN Price Forecast: Technical outlook

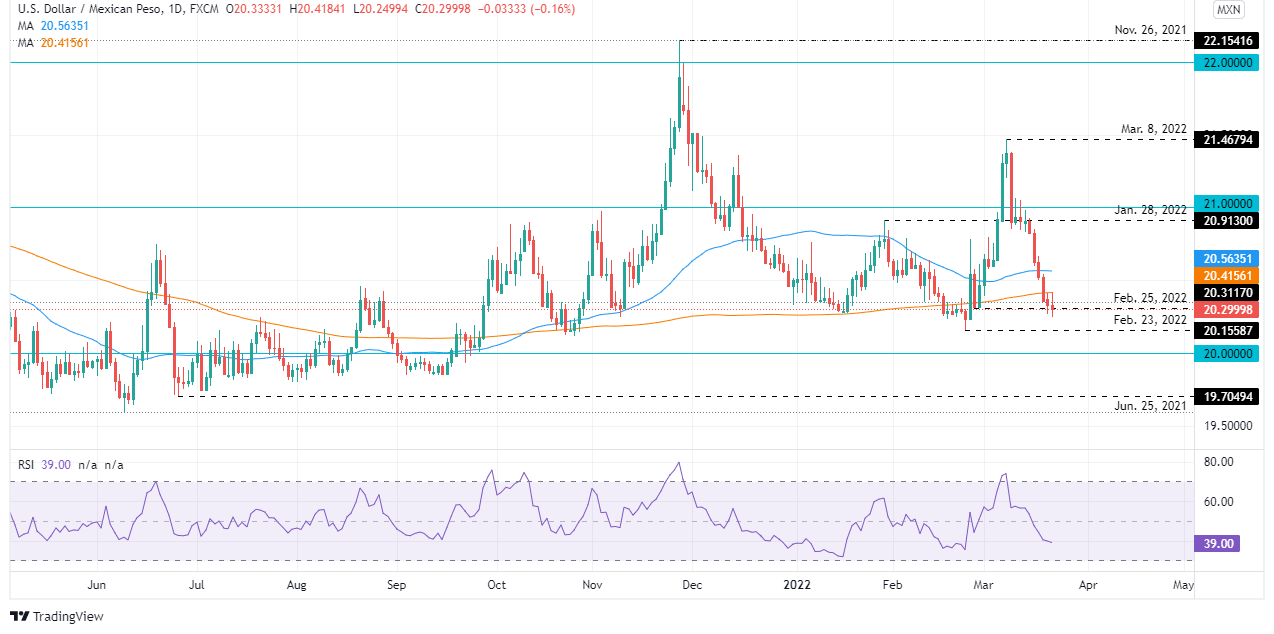

The USD/MXN bias is neutral, as depicted by the daily chart. On Friday last week, the USD/MXN broke below the 200-DMA at 20.4155, exacerbating a move towards the YTD lows. Nevertheless, USD/MXN traders need to be aware that a dampened market mood, would significantly affect Emerging Markets’ currencies, weakening the peso.

Upwards, the USD/MXN first resistance would be the 200-DMA at 20.4155. Breach of the latter would expose the 50-DMA at 20.5634, followed by the January 28 cycle high at 20.9130, short of the 21.00 barrier. On the flip side, the USD/MXN first support would be February 23 daily low at 20.1558, followed by the psychological 20.00 barrier and June 25, 2021 low at 19.7050.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.