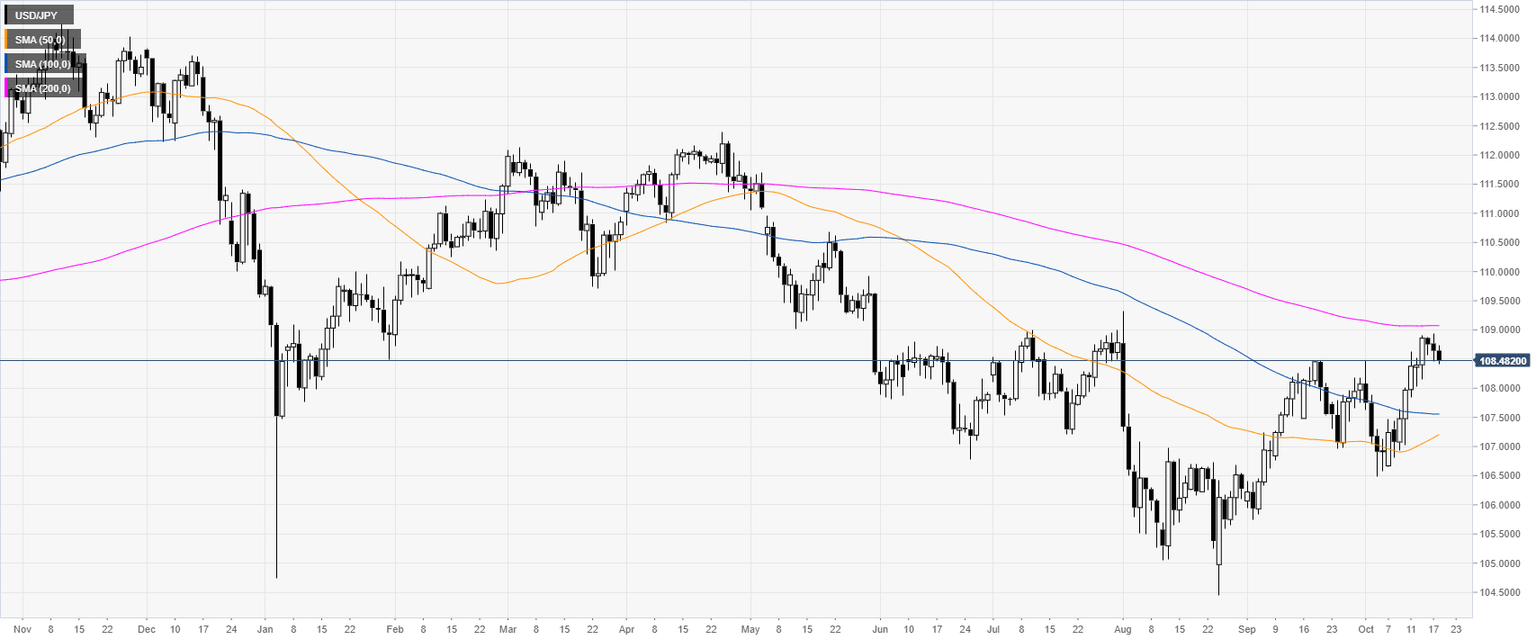

USD/JPY technical analysis: Greenback easing from monthly highs against Yen

- USD/JPY is trading at daily lows near 108.50 as the London session will soon come to an end.

- USD/JPY is giving back some of the gains made in the early October bull run.

USD/JPY daily chart

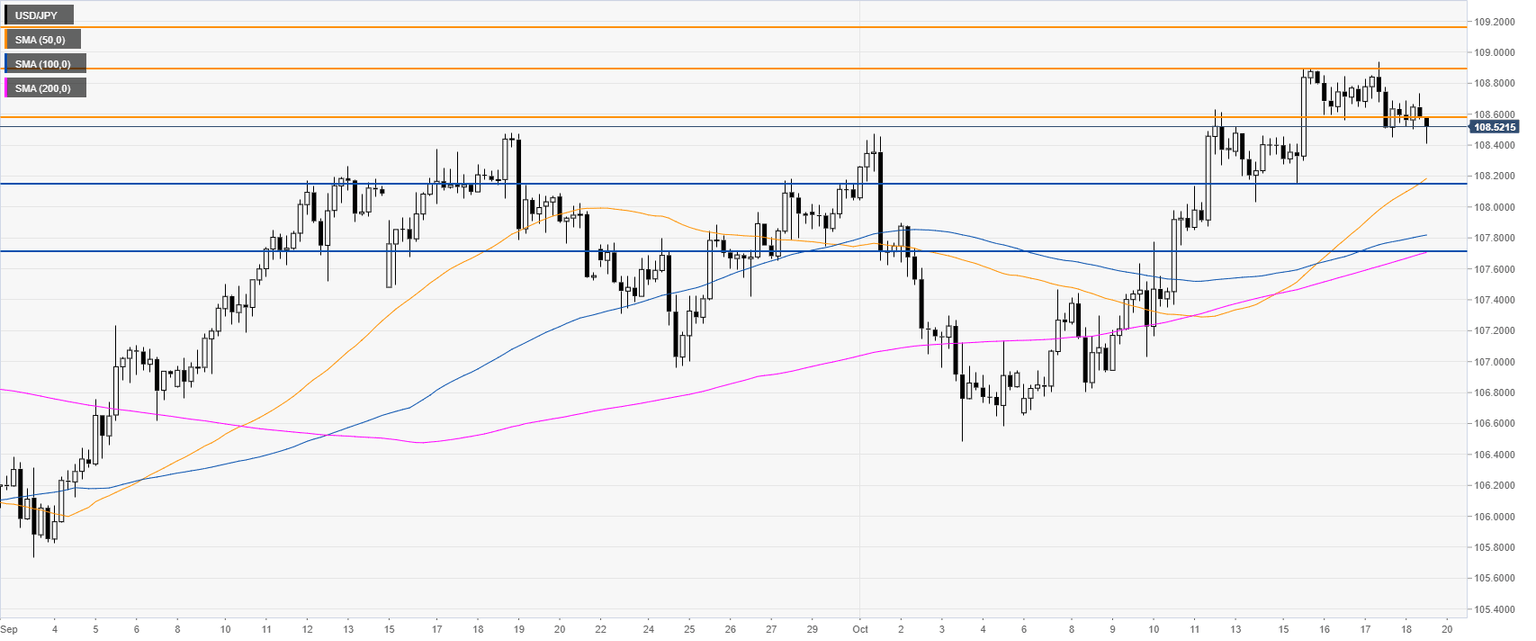

USD/JPY four-hour chart

USD/JPY 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst