USD/JPY slides as BoJ hawkish shift clashes with Fed dovish tilt

- USD/JPY drops below 146.00 as BoJ tightening signals gain traction.

- Fed dovish tilt pressures the US Dollar after Tuesday’s US CPI miss

- Yen Strengthens on BoJ Signals following higher than expected PPI data

USD/JPY is down for a second straight day on renewed expectations of the Bank of Japan (BoJ) tightening. The move is driven by hawkish remarks from Deputy Governor Shinichi Uchida and hotter-than-expected April PPI data, which contrast sharply with soft US inflation figures and growing speculation of Federal Reserve (Fed) rate cuts.

At the time of writing, USD/JPY is trading near 145.60, extending its decline from earlier at 146.00 as diverging central bank outlooks weigh on the pair.

BoJ hawkishness meets strong PPI

On Tuesday, Bank of Japan Deputy Governor Shinichi Uchida reaffirmed the central bank’s readiness to tighten policy further, even amid global uncertainties such as US trade moves. Speaking to lawmakers, Uchida acknowledged that Japan’s underlying inflation and long-term expectations may temporarily stagnate, but pointed to persistent upward pressure from a “very tight” labor market. He emphasized that rising wages and shipping costs will likely be passed on to consumers, supporting a sustainable inflation trend.

The Yen extended gains on Wednesday after Japan’s April Producer Price Index (PPI) came in as expected, up 4.0% YoY, highlighting ongoing upstream price pressures. The data, combined with Uchida’s hawkish tone, reinforced expectations that the BoJ may deliver another rate hike.

As a result, USD/JPY dropped below 146.00, driven by narrowing yield differentials and growing confidence in the BoJ’s tightening path.

Soft US inflation data and dovish Fed signals weigh on the US Dollar

Meanwhile, in the US, April’s Consumer Price Index (CPI) report came in below expectations on Tuesday. Headline inflation rose just 0.2% month-on-month, below the 0.3% forecast, while annual inflation eased to 2.3%, the lowest since early 2021. Core CPI also came in soft, reinforcing speculation that the Federal Reserve could begin cutting interest rates as early as September.

This disinflation trend, alongside dovish commentary from Fed officials, sent US Treasury yields lower and pressured the US Dollar. As a result, USD/JPY fell despite broader risk-on sentiment.

Looking ahead, Thursday’s US Producer Price Index (PPI) and Initial Jobless Claims will offer further insight into inflation and labor market trends. However, the key event will be Fed Chair Jerome Powell’s speech. Markets will be tuned in for confirmation of a dovish pivot—or any pushback against the growing expectations for rate cuts. His tone could be pivotal for short-term direction in USD/JPY and broader dollar sentiment.

USD/JPY - bullish or bearish at 146.00?

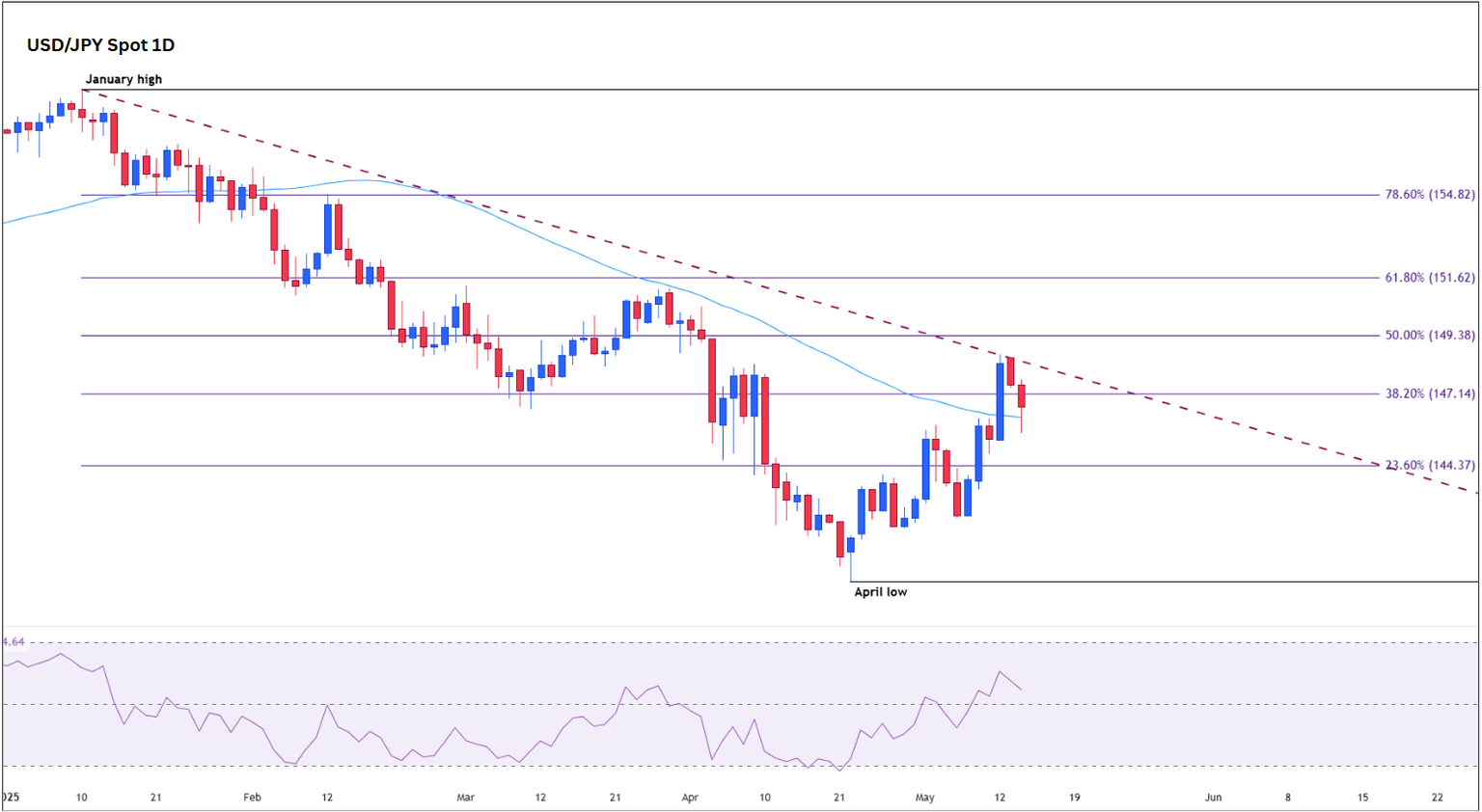

Technically, USD/JPY sits at a critical juncture. A confirmed breakout above the 50-day simple moving average (SMA) at 146.34 would signal renewed bullish momentum, opening the path toward resistance at 147.09—the 38.2% Fibonacci retracement of the January–April decline. Sustained strength could even target the psychological 150.00 level, particularly if US yields rebound or policy divergence between the Fed and BoJ widens.

USD/JPY daily chart

Conversely, failure to hold above 144.37 and a decisive break below the 20-day SMA would suggest fading bullish momentum, shifting focus toward 142.00 and potentially 140.00—especially if US data disappoints or market sentiment turns risk-off.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.