USD/JPY retreats as Trump-Powell tensions cap gains

- US Dollar retreats against the Japanese Yen, with Trump-Powell relations in focus.

- Interest rate expectations favour USD strength, but political uncertainty caps USD/JPY gains.

- USD/JPY retreats with resistance firming at 149.00.

The Japanese Yen (JPY) is attempting to recover a portion of recent losses against the US Dollar (USD) on Wednesday expectations that US President Donald Trump would fire Federal Reserve (Fed) Chair Jerome Powell heated up and then died down.

After three consecutive days of gains, USD/JPY reached an intraday high of 149.19 before retreating to trade near 148.00 at the time of writing.

While the US Dollar started Wednesday on a positive note, USD/JPY fell off a cliff in the US morning session on mounting concerns that President Trump may be considering the removal of Powell. Both the New York Times and Bloomberg said Trump was asking other officials whether he should let Powell go before his term is up in May 2026.

But then when asked directly, Trump commented, “We aren’t planning on doing anything — but we are very concerned.”

His remarks come amid criticism over the Fed’s $2.5 billion headquarters renovation and Powell's perceived resistance to easing monetary policy.

The ambiguity of Trump’s statement has added a layer of uncertainty to markets already grappling with shifting rate expectations and geopolitical trade risks.

US Consumer Price Index (CPI) data on Tuesday showed that the Federal Reserve (Fed) may refrain from cutting rates in the near term as inflation jumped at the consumer level. However, the Producer Price Index (PPI) data on Wednesday demonstrated otherwise as inflation was flat at the producer level in June.

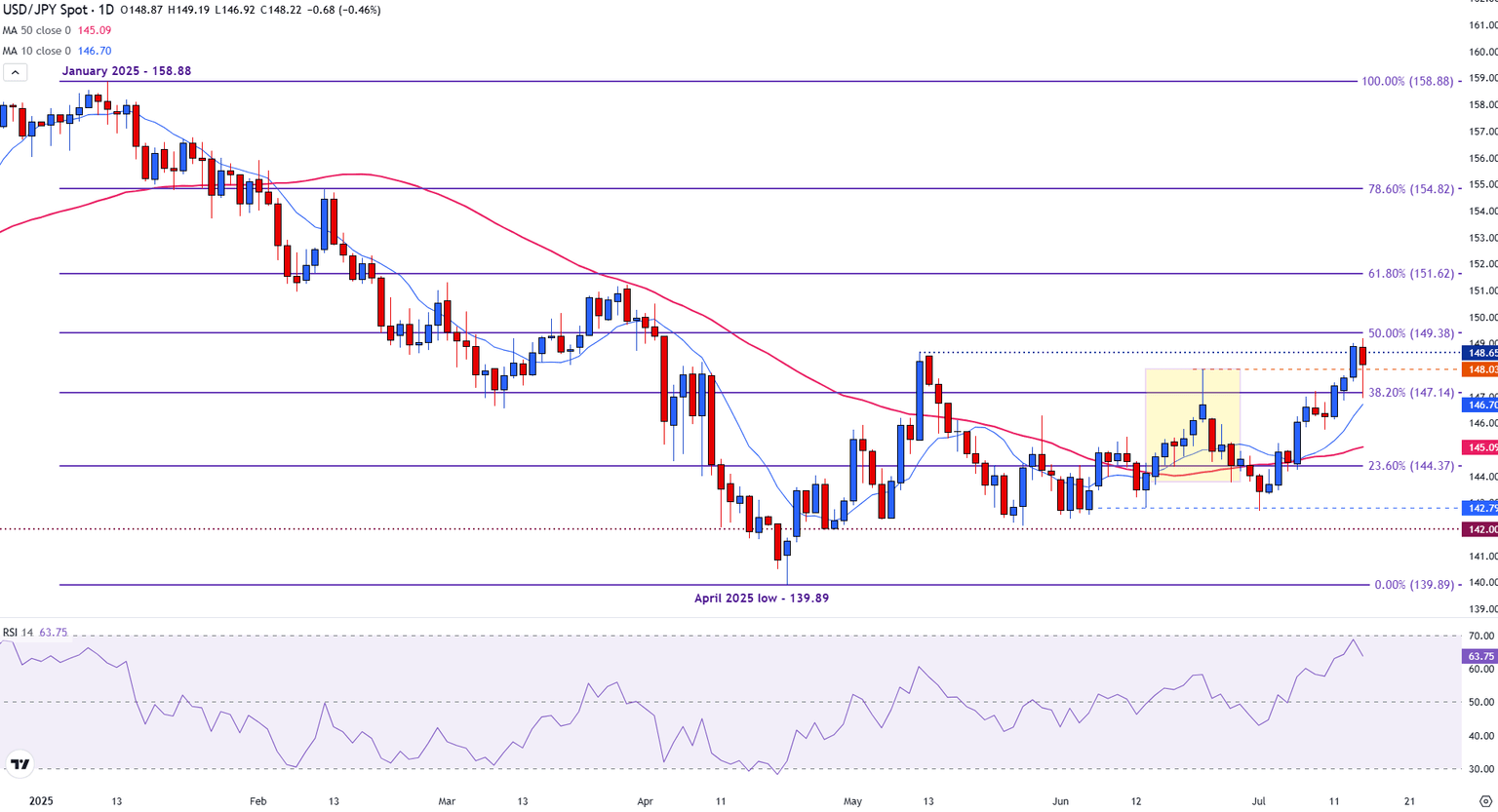

USD/JPY technical analysis: Psychological resistance remains firm at 149.00

USD/JPY daily chart

The USD/JPY daily chart shows a clear short-term uptrend, supported by the 10-day Simple Moving Average (SMA) crossing above the 50-day SMA. The pair recently broke above the 38.2% Fibonacci retracement level of the January-April decline, now holding as support at 147.14.

Although the pair experienced a slight pullback from this resistance, the Relative Strength Index (RSI) remains strong at 64, indicating continued upward strength without being overbought.

The 149.00 psychological level provides resistance with the 50% at 149.38 with a move higher opening the door for the psychological level of 150.00 and toward the next resistance level at the 61.8% retracement at 151.62.

Meanwhile, a clear move below 147.00 would suggest a possible pause in the rally or deeper retracement toward the 10-day SMA at 146.70 and the 50-day SMA near 145.00.

Overall, the technical picture favors buyers as long as key support levels hold.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.