USD/JPY Price Forecast: Refreshes almost three-week high near 145.00

- USD/JPY posts a fresh almost three-week high around 145.00 as the Japanese Yen underperforms.

- The BoJ left interest rates steady at 0.5% and indicated a delay in plans of hiking interest rates further.

- The US Dollar surrenders some of its initial gains ahead of US Manufacturing PMI data.

The USD/JPY pair surges almost 0.8% to near 144.80 during European trading hours on Thursday. The pair strengthens as the Japanese Yen (JPY) underperforms across the board, with the Bank of Japan (BoJ) indicating delay in plans of more interest rate hikes.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | -0.11% | 0.82% | 0.09% | 0.06% | 0.02% | 0.01% | |

| EUR | 0.07% | -0.04% | 0.92% | 0.13% | 0.13% | 0.09% | 0.07% | |

| GBP | 0.11% | 0.04% | 0.90% | 0.20% | 0.17% | 0.12% | 0.10% | |

| JPY | -0.82% | -0.92% | -0.90% | -0.75% | -0.76% | -0.85% | -0.89% | |

| CAD | -0.09% | -0.13% | -0.20% | 0.75% | -0.03% | -0.07% | -0.10% | |

| AUD | -0.06% | -0.13% | -0.17% | 0.76% | 0.03% | -0.04% | -0.05% | |

| NZD | -0.02% | -0.09% | -0.12% | 0.85% | 0.07% | 0.04% | -0.02% | |

| CHF | -0.01% | -0.07% | -0.10% | 0.89% | 0.10% | 0.05% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Earlier in the day, the BoJ kept interest rates steady at 0.5%, as expected, but expressed that additional tariffs imposed by United States (US) President Donald Trump on April 2 could hit the domestic economy and inflation.

We will enter a period in which both inflation and wage growth will likely slow somewhat. But we expect a positive cycle of rising wages and inflation to continue due to a severe labour shortage," BoJ Governor Kazuo Ueda said in the press conference, Reuters reported.

Additionally, the BoJ has cut Gross Domestic Product (GDP) forecast for fiscal year ending March 2026 significantly to 0.5% from prior estimates of 1.1%.

Meanwhile, US Dollar (USD) gives up some of its intraday gains ahead of the US final S&P Global and Manufacturing PMI data for April, which will be published in the North American session.

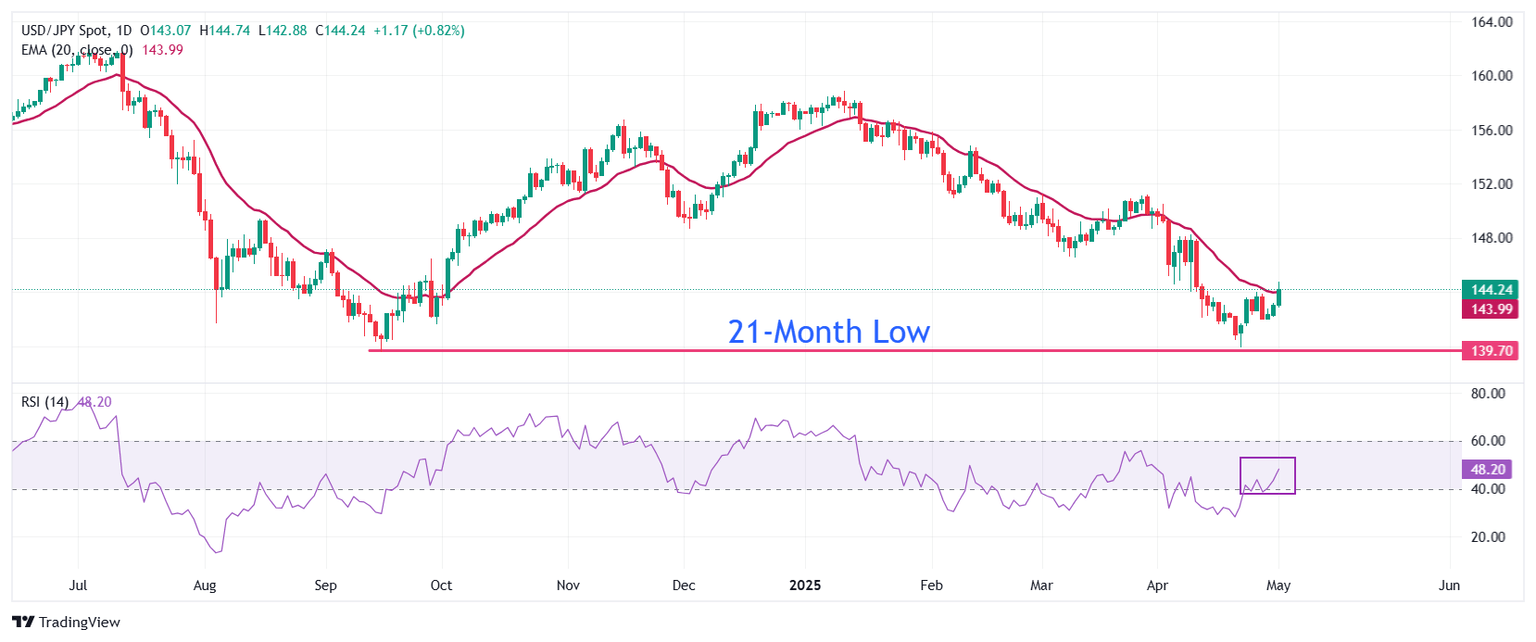

USD/JPY extends its recovery to near the 20-day Exponential Moving Average (EMA), which trades around 144.00. The pair started recovering after attracting bids near the 21-month low around 140.00.

The 14-day Relative Strength Index (RSI) rises into the 40.00-60.00 range, suggesting that the bearish momentum is over. However, the downside bias is intact.

The odds of the pair extending its recovery towards the March 11 low of 146.54 and the April 9 high of 148.28 would increase if it will break above the key resistance of 145.00.

The asset would face downside move towards the 28 July 2023 low of 138.00 and the 14 July 2023 of 137.25 after sliding below the September 16 low of 139.58.

USD/JPY daily chart

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Last release: Thu May 01, 2025 03:02

Frequency: Irregular

Actual: 0.5%

Consensus: 0.5%

Previous: 0.5%

Source: Bank of Japan

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.