USD/JPY Price Forecast: Jumps towards 144.00 as Powell speaks

- USD/JPY gains over 1%, trading at 143.69 after Fed Chair Powell suggests no rush to accelerate rate cuts.

- Despite recent gains, USD/JPY stays under key resistances like the 200-DMA and Ichimoku Cloud, maintaining a bearish outlook.

- Breaking above 144.00 could propel USD/JPY towards 145.00; a pullback to 143.46 and 143.39 is likely if resistances persist.

The USD/JPY climbed late in Monday’s North American session, gaining over 1%, and traded at 143.69 after the Federal Reserve Chair Jerome Powell crossed the newswires.

The Fed Chair said that goods and services inflation is broadly back to pre-pandemic levels, added that the job finding rate declined ‘very significantly,’ and said they don’t need to accelerate rate cuts.

USD/JPY Price Forecast: Technical outlook

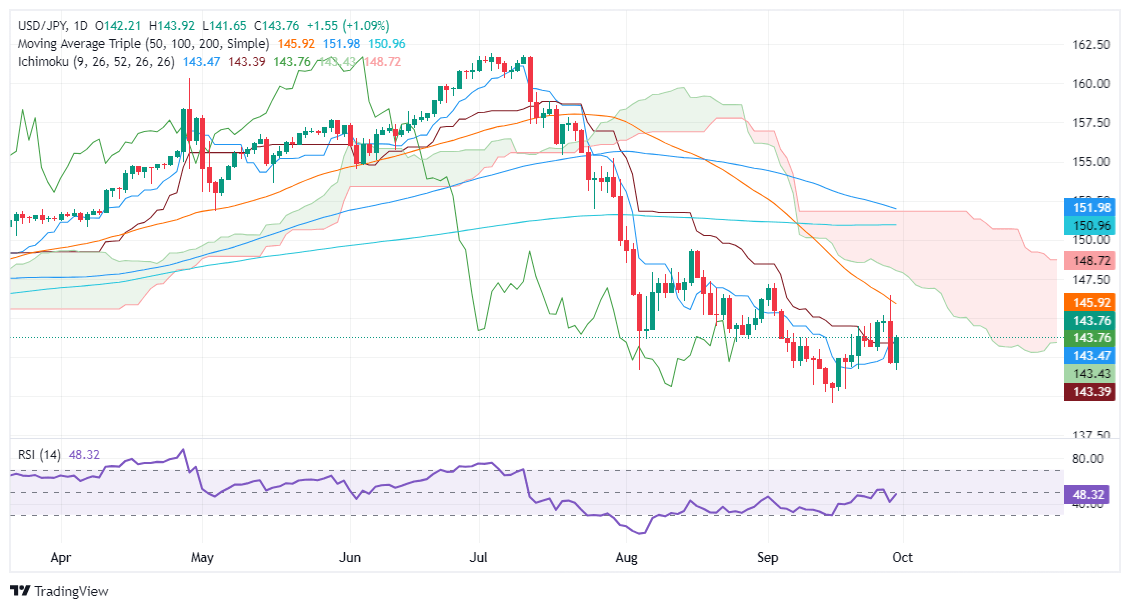

The USD/JPY remains downward biased despite registering solid gains and climbing above the Tenkan-Sen and Kijun-Sen, each at 143.46 and 143.39, respectively. Nevertheless, price action remains below the 200-day moving average (DMA) and beneath the Ichimoku Cloud (Kumo), hinting that sellers are in charge.

The Relative Strength Index (RSI) hints that buyers are gathering some steam but will need to clear key resistance levels overhead.

If USD/JPY breaks above 144.00, the next ceiling level will be 145.00, followed by the 50-day moving average (DMA) at 145.92. The next stop would be the bottom of the Kumo at around 148.00-148.20.

Conversely, if USD/JPY remains below 144.00, look for a pullback to the Tenkan-Sen at 143.46. Immediately after this level lies the Kijun-Sen at 143.39, followed by the 143.00 figure.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.27% | -0.01% | 1.02% | 0.10% | -0.17% | -0.26% | 0.58% | |

| EUR | -0.27% | -0.26% | 0.77% | -0.14% | -0.37% | -0.49% | 0.40% | |

| GBP | 0.00% | 0.26% | 1.15% | 0.11% | -0.11% | -0.23% | 0.66% | |

| JPY | -1.02% | -0.77% | -1.15% | -0.87% | -1.25% | -1.23% | -0.39% | |

| CAD | -0.10% | 0.14% | -0.11% | 0.87% | -0.22% | -0.34% | 0.54% | |

| AUD | 0.17% | 0.37% | 0.11% | 1.25% | 0.22% | -0.12% | 0.77% | |

| NZD | 0.26% | 0.49% | 0.23% | 1.23% | 0.34% | 0.12% | 0.87% | |

| CHF | -0.58% | -0.40% | -0.66% | 0.39% | -0.54% | -0.77% | -0.87% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.