USD/JPY Price Forecast: Hovers around 145.20 post-Fed minutes release

- USD/JPY steady as Fed minutes hint at easing, lowering US 10-year yields.

- Selling momentum persists; RSI indicates more downside potential.

- Below 145.00 targets 143.61, then 141.69; resistance at 146.00 could extend to 146.92, 149.39.

The USD/JPY trims some of its earlier gains after July’s Federal Reserve’s meeting minutes hinted the US central bank could ease policy as soon as September. Therefore, US Treasury bond yields, particularly the 10-year yield, slumped and weighed on the major due to its positive correlation. At the time of writing, the USD/JPY trades at 145.21, virtually unchanged.

USD/JPY Price Forecast: Technical outlook

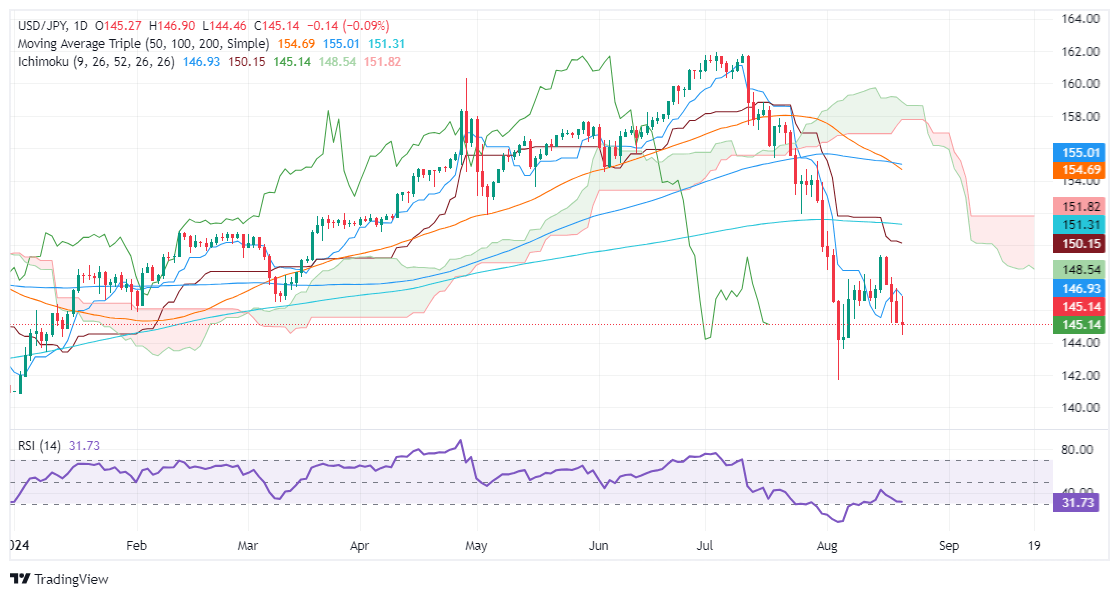

After falling to a seven-month low of 141.69, the USD/JPY recovered some ground and hit a two-week high of 149.39 before resuming its ongoing downtrend. Momentum backs sellers as depicted by the Relative Strength Index (RSI).

If USD/JPY drops below 145.00, the August 6 daily low of 143.61 will be exposed. Once cleared, the next support would be 141.69, followed by December’s 28 low of 140.25.

On the other hand, if prices climb above 146.00, this can pave the way for further upside. The next resistance would be the Tenkan-Sen at 146.92, followed by 149.39, ahead of the Kijun-Sen at 149.78.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.