USD/JPY Price Forecast: Break below trendline lends chart a more bearish aspect

- USD/JPY is rapidly selling off and is now probably in a downtrend on a short and medium-term basis.

- The pair will probably continue declining to targets in the lower 150s.

- RSI is oversold, raising the risk of a correction or consolidation forming.

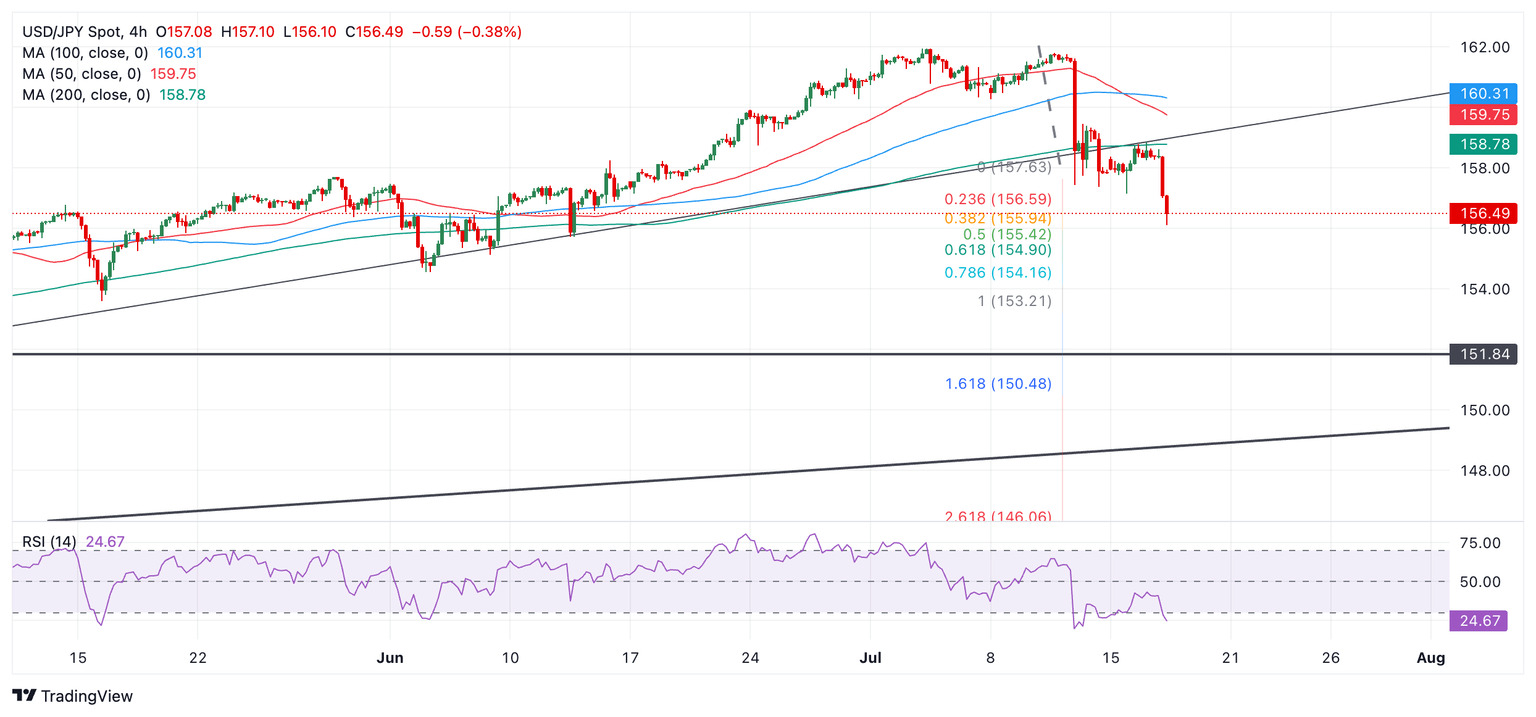

USD/JPY is declining steeply from its early July highs. After peaking at 161.95 on July 3 it has fallen over five Japanese Yen to the 156.50s on July 17.

The break below the major trendline at 158.45 on July 13 was a gamechanger for the pair and taken together with the more recent break below the 157.15 July 15 low, has given the chart a much more bearish aspect.

The short-term trend is bearish and the intermediate term trend is now also probably negative too. Given the old adage that “the trend is your friend” the odds favor a continuation lower over those timeframes.

USD/JPY Daily Chart

How much lower could USD/JPY go? The next immediate target is at 154.90, which is the 61.8% Fibonacci extension of the down move prior to the trendline break extrapolated lower. This is followed by 153.21, the 100% extrapolation of the same.

A more bearish scenario could even envisage price falling to 151.84 and a key support level (October 2021 high).

The Relative Strength Index (RSI) is in oversold territory indicating a rising chance of a pullback or consolidation delaying the pair’s descent.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.