USD/JPY Price Analysis: Subdued at around 159.60 amid intervention threats

- USD/JPY remains flat as US Treasury yields tumble.

- Technical outlook shows upward bias with bullish RSI, but risks persist due to potential Japanese intervention.

- Key resistance levels: psychological 160.00 mark, YTD high at 160.32, further gains at 160.50 and 161.00.

- Key support levels: day's low at 158.75, Tenkan-Sen at 157.82, Senkou Span A at 157.53, and Kijun-Sen at 157.24.

The USD/JPY is flat late in the North American session as US Treasury yields fell. Intervention threats by Japanese authorities refrained traders from pushing the exchange rate above 160.00. At the time of writing, the pair trades at 159.62, unchanged.

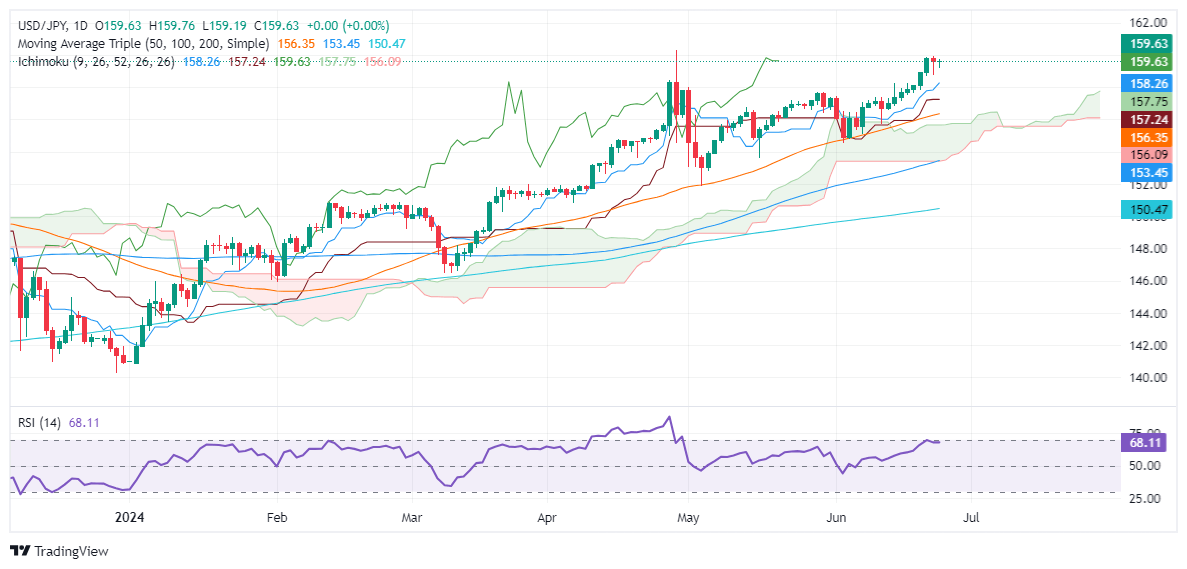

USD/JPY Price Analysis: Technical outlook

The USD/JPY is upward biased after climbing above the 159.00 figure, spurring fears that Japanese authorities or the Bank of Japan (BoJ) might intervene in the FX markets.

Momentum favors buyers, with the Relative Strength Index (RSI) remaining bullish, but downward risks persist. If USD/JPY clears the psychological 160.00 mark, the next resistance level would be the year-to-date (YTD) high of 160.32. Further gains are anticipated above 160.50 and at 161.00.

Conversely, if USD/JPY drops below the day's low of 158.75, it could pave the way for testing key support levels. The next support would be the Tenkan-Sen at 157.82, followed by the Senkou Span A at 157.53, and then the Kijun-Sen at 157.24.

USD/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.