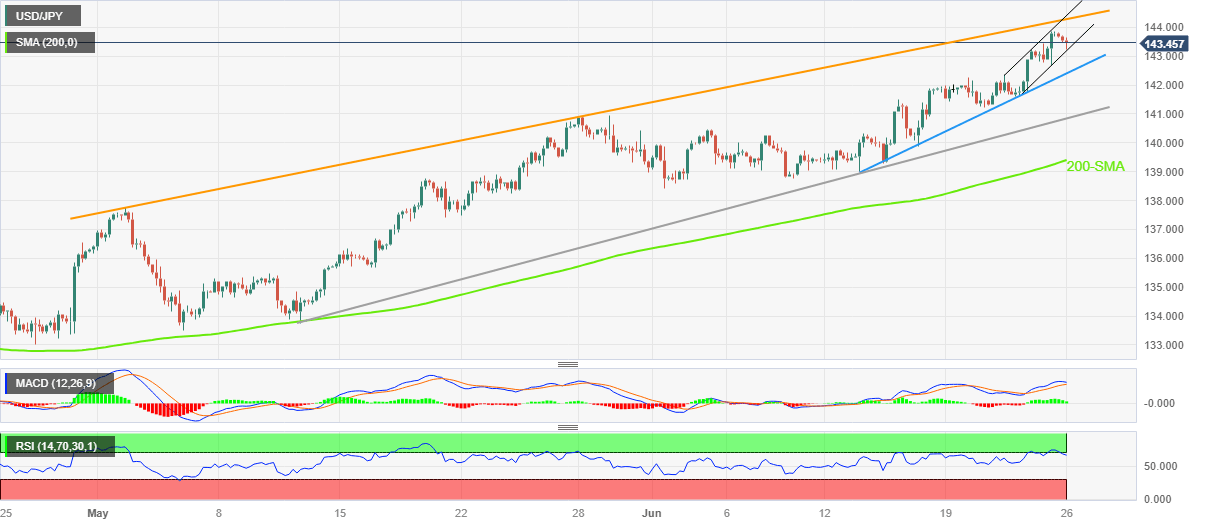

USD/JPY Price Analysis: Mildly bid within immediate bullish channel around 143.50

- USD/JPY fades bounce off intraday low inside three-day-old rising trend channel.

- Overbought RSI prods Yen pair buyers at multi-day top.

- Bullish MACD signals, key technical supports keep pair buyers hopeful.

USD/JPY rebounds from intraday low but fails to gain upside momentum around 143.50 during early Monday. In doing so, the Yen pair prints the first daily loss in three while retreating from the highest levels since November 2022.

That said, the risk-barometer pair’s pullback from the Year-To-Date (YTD) high could be linked to overbought RSI conditions. However, an upward-sloping trend channel from the last Wednesday joins bullish MACD signals to keep the USD/JPY buyers hopeful.

Even if the pair sellers defy the bullish channel pattern by breaking the 143.20 immediate support, a fortnight-long ascending trend line, close to 142.40, acts as the additional downside filter.

It’s worth noting that an upward-sloping support line from early May and the 200-SMA, respectively near 140.80 and 139.40 are the extra checks for the USD/JPY bears before taking control.

On the flip side, an eight-week-old rising trend line, near 144.30 at the latest, restricts the immediate upside of the USD/JPY pair.

Following that, the aforementioned ascending channel’s top line of near 144.45 could act as the last defense of the USD/JPY bears.

In a case where the USD/JPY remains firmer past 144.45, the pair’s run-up towards the September 2022 high near 145.90 can’t be ruled out.

Overall, USD/JPY remains on the buyer’s radar despite the latest retreat.

USD/JPY: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.