USD/JPY Price Analysis: How far can this rally go?

- USD/JPY bears are moving in and the daily W-formation is compelling.

- The bulls, however, may only be a correction away.

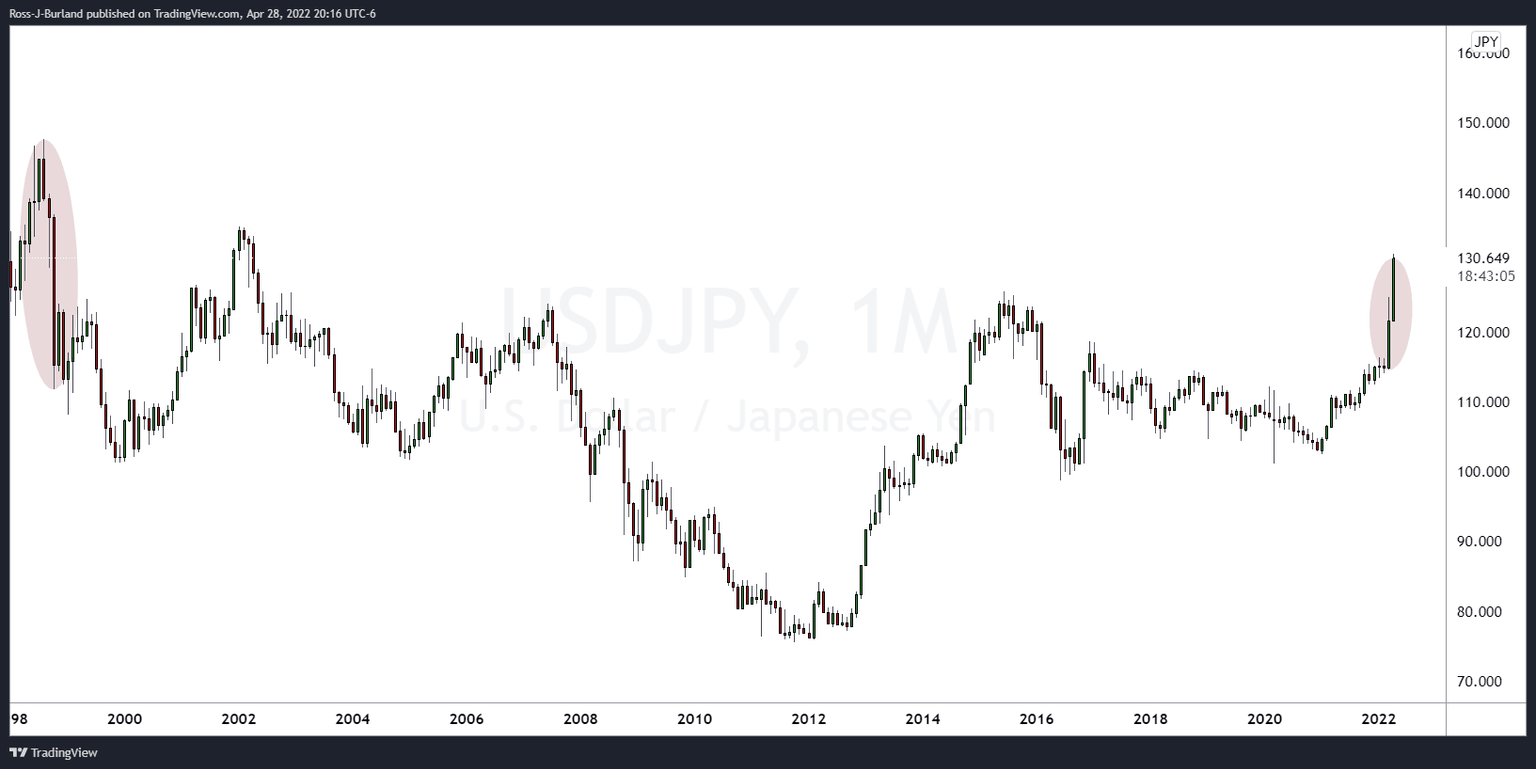

USD/JPY is likely due for a correction, but that is not to say that the monthly rally can't carry on in due course. Casting eyes back over the monthly charts, albeit well into the past, in 1998, the yen rallied for three consecutive months and tallied gains of some 24% from when USD/JPY fell from 147.67 to 111.88:

(USD/JPY monthly chart)

For the meanwhile, the DXY chart could be regarded as moving into a phase of meanwhile distribution, which is common ahead of major events such as the Federal reserve and Nonfarm Payrolls at the end of the month:

(DXY H1 chart)

This leaves scope for a meanwhile correction in USD/JPY:

The daily chart has painted a W-formation which is a reversion pattern and the price would be expected to revert towards the neckline, near the 50% mean reversion level around 129 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.