USD/JPY Price Analysis: Drops from around 24-year highs, back below 137.00

- The Japanese yen strengthened on verbal intervention by the Japanese Finance Minister Suzuki.

- On Tuesday, the USD/JPY tumbled towards a daily low of around 136.50 before settling near the June 21 highs.

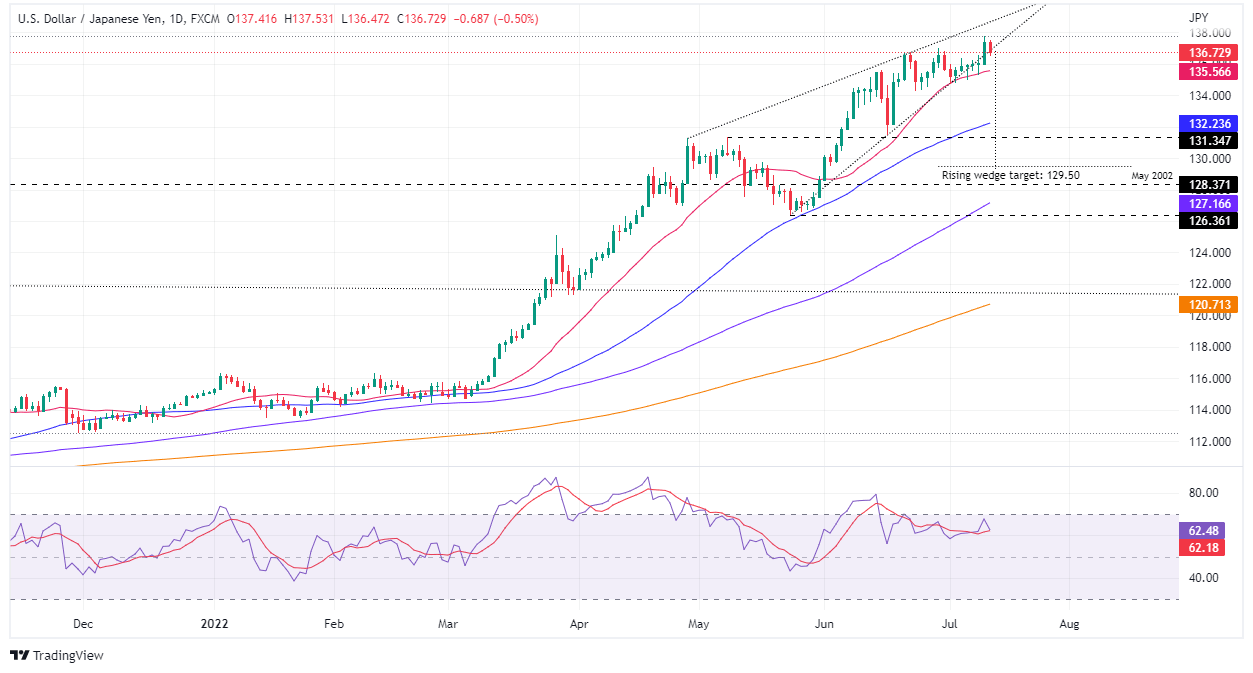

- USD/JPY Price Analysis: The major remains upward biased, but a rising wedge has formed, which targets a fall towards 129.50.

The USD/JPY retreats from 24-year highs around 137.75, falling more than 100-pips during the North American session, due to falling US bond yields and talks between the US Treasury Secretary Janet Yellen and Japan’s Finance Minister Suzuki, in which he told her about the weakening of the yen and agreed to continue consulting in foreign exchange.

At the time of writing, the USD/JPY is trading at 136.73, down by more than half percent, after reaching a daily high of around 137.53, to stumble towards fresh daily lows below 136.50 before settling around current price levels.

USD/JPY Daily chart

The USD/JPY daily chart illustrates the pair as upward biased, though forming a rising wedge, meaning selling pressure might be around the corner, to step in on the pair and drag it lower. Also, with the Relative Strength Index (RSI) stepping out of overbought conditions and about to cross under the RSI’s 7-day SMA, that would open the door for further downside.

If the USD/JPY break below the rising wedge, its first support would be the 20-day EMA at 135.56. Once cleared, the next demand zone to test would be the July 1 low at 134.74, followed by the 50-day EMA at 132.23, on its way, towards the measured target, using the top-bottom trendlines that form the rising wedge at around 129.50.

USD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.