USD/JPY Price Analysis: Bulls seeking breakout post correction

- USD/JPY is on the verge of an upside breakout, but there are hurdles.

- Bulls need to get over the hourly resistance, but a deeper correction could be on the cards.

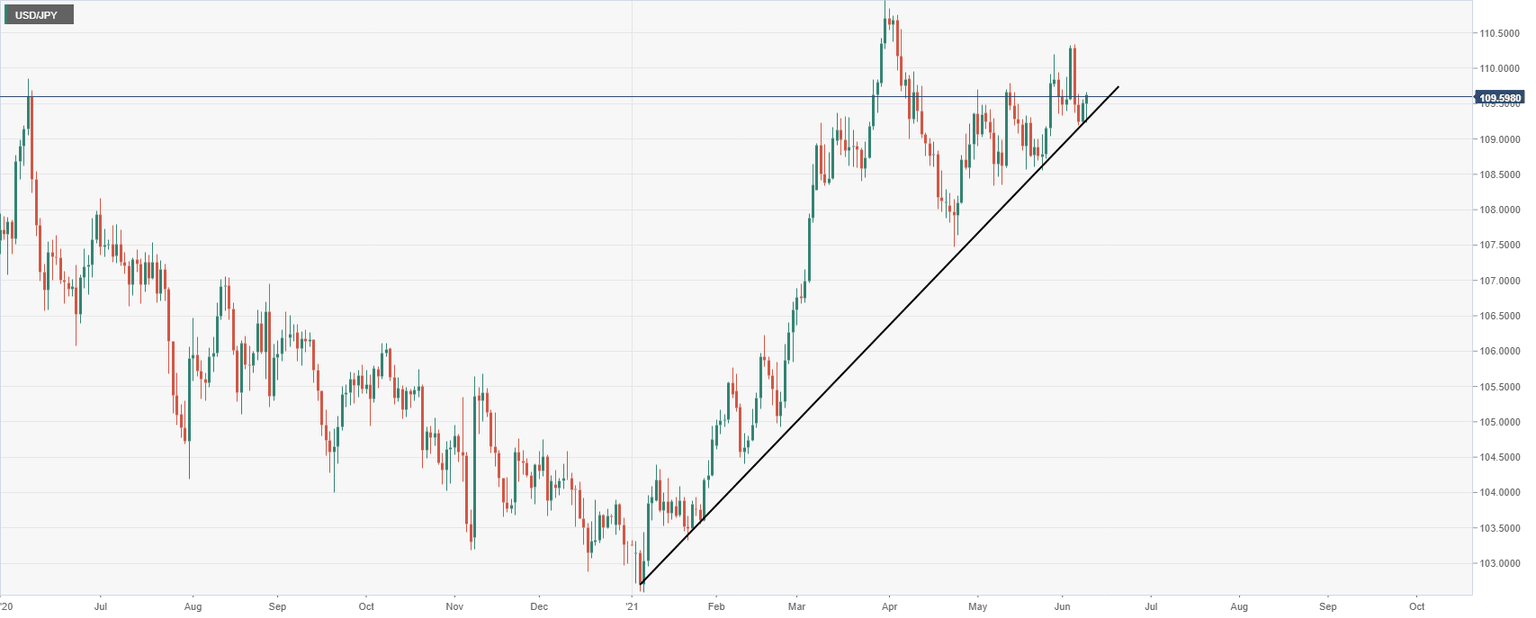

USD/JPY has been on course for higher highs in recent trade, moving higher and supported by the dynamic supporting trend line, the 50-day EMA and now the 21-day EMA.

The following illustrates the bullish bias with a cautionary note from the lower time frames.

Daily chart

Bulls are riding the dynamic trendline support.

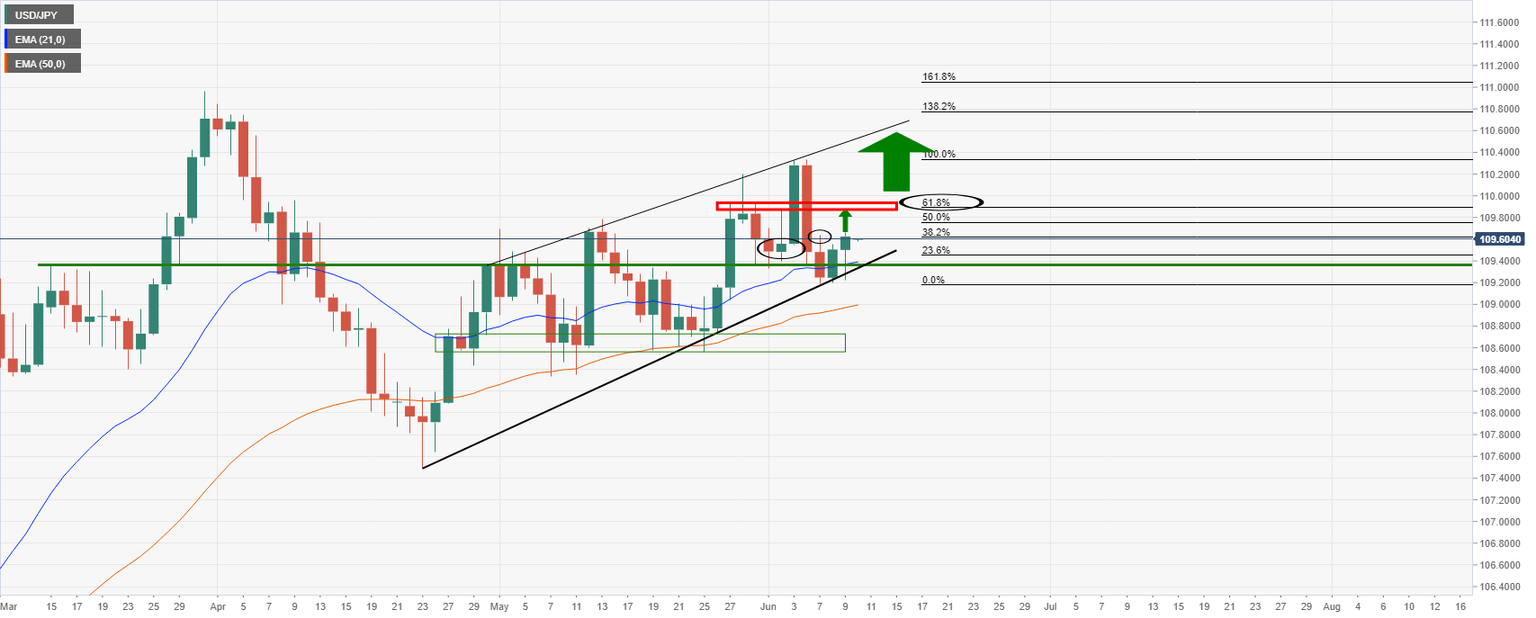

Daily chart

The price has been supported by the 50-day EMA and the 21-day EMA, recently penetrating old resistance and likely en route for a test of the 61.8% Fibo.

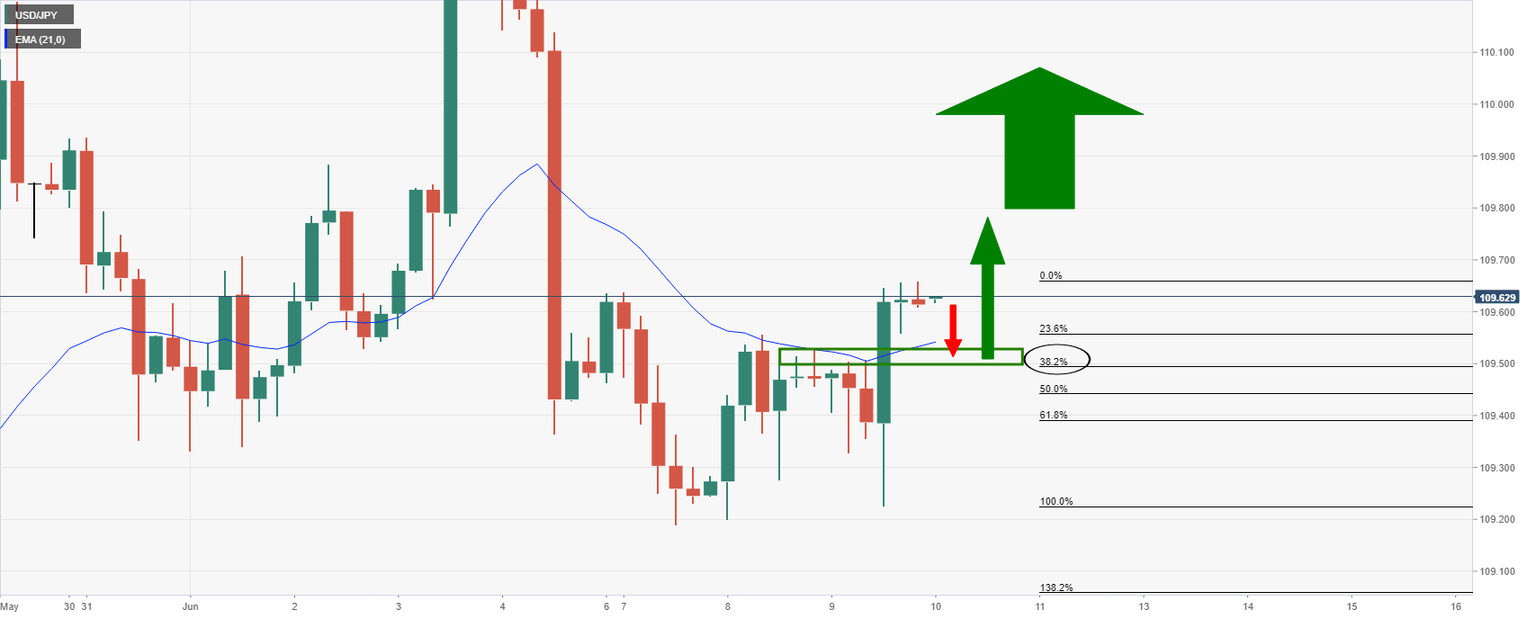

4-hour chart

With that being said, it has been stalling ahead of key data events on Thursday.

A correction could be in order to test the 38.2% Fibonacci retracement.

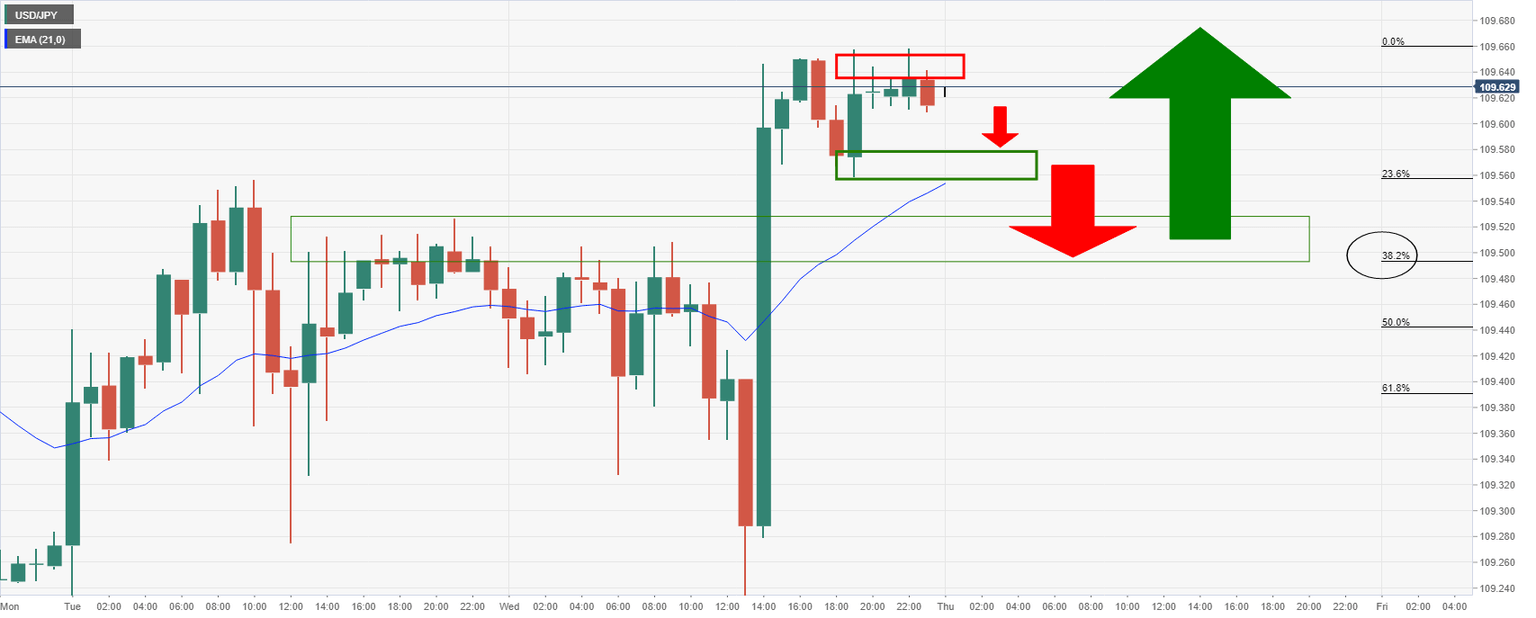

Hourly chart

The hourly resistance doesn't do the bulls much of a favour and this could lead to failures at immediate hourly support which opens risk to the 4-hour support prior to an upside continuation on the daily chart.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.