USD/JPY Price Analysis: Bears poke 10-week-old support line near 130.50

- USD/JPY prints three-day losing streak to refresh multi-day low, bounces off daily low at the latest.

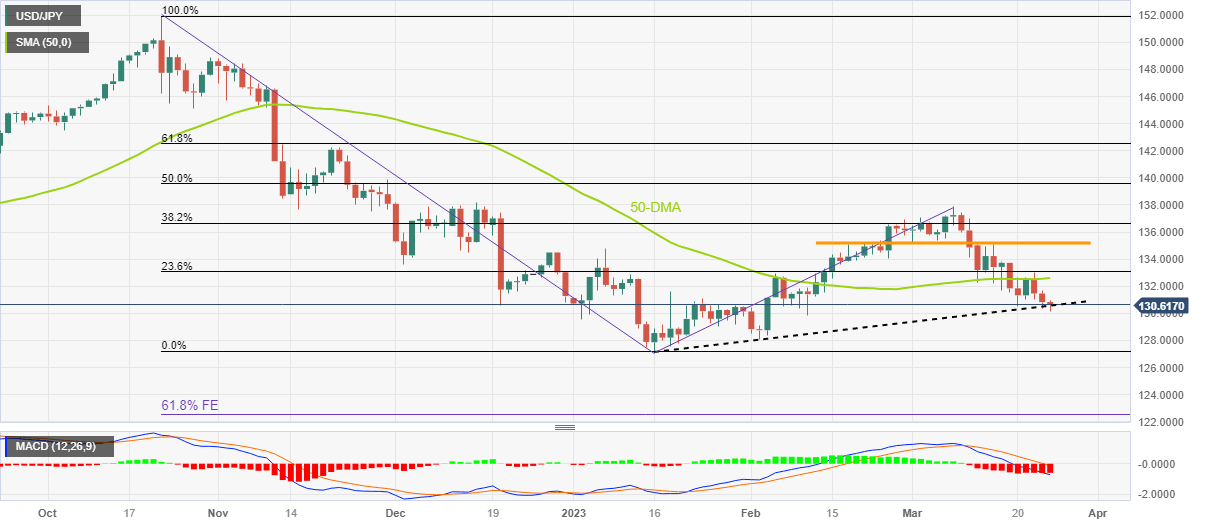

- Sustained trading below 50-DMA, bearish MACD signals favor sellers.

- Yen pair’s recovery remains elusive below five-week-long horizontal resistance.

USD/JPY licks its wounds near 130.60, after refreshing a 1.5-month low, during a three-day downtrend on early Friday. In doing so, the Yen pair sellers attack the support line stretched from early January while extending the mid-week pullback from the 50-DMA.

In addition to the pair’s inability to cross the 50-DMA, around 132.60 by the press time, the bearish MACD signals also weigh on the quote and suggest the downside break of the immediate support line, close to 130.50 at the latest.

Following that, the 130.00 round figure and multiple levels marked in February near 129.30, as well as near 128.00, could test the USD/JPY bears before directing them to the yearly low of 127.21.

It’s worth noting, however, that the Yen pair’s sustained weakness past 127.21, could make it vulnerable to testing the 61.8% Fibonacci Expansion (FE) of its moves between October 2022 and March 2023, near 122.50.

Alternatively, USD/JPY recovery can initially aim for the 50-DMA hurdle of 132.60. However, a horizontal area comprising multiple tops marked since February 17, close to 135.20, appears a tough nut to crack for the bulls afterward.

In a case where the Yen pair remains firmer past 135.20, the odds of witnessing a fresh monthly high, currently around 137.90, can’t be ruled out.

USD/JPY: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.