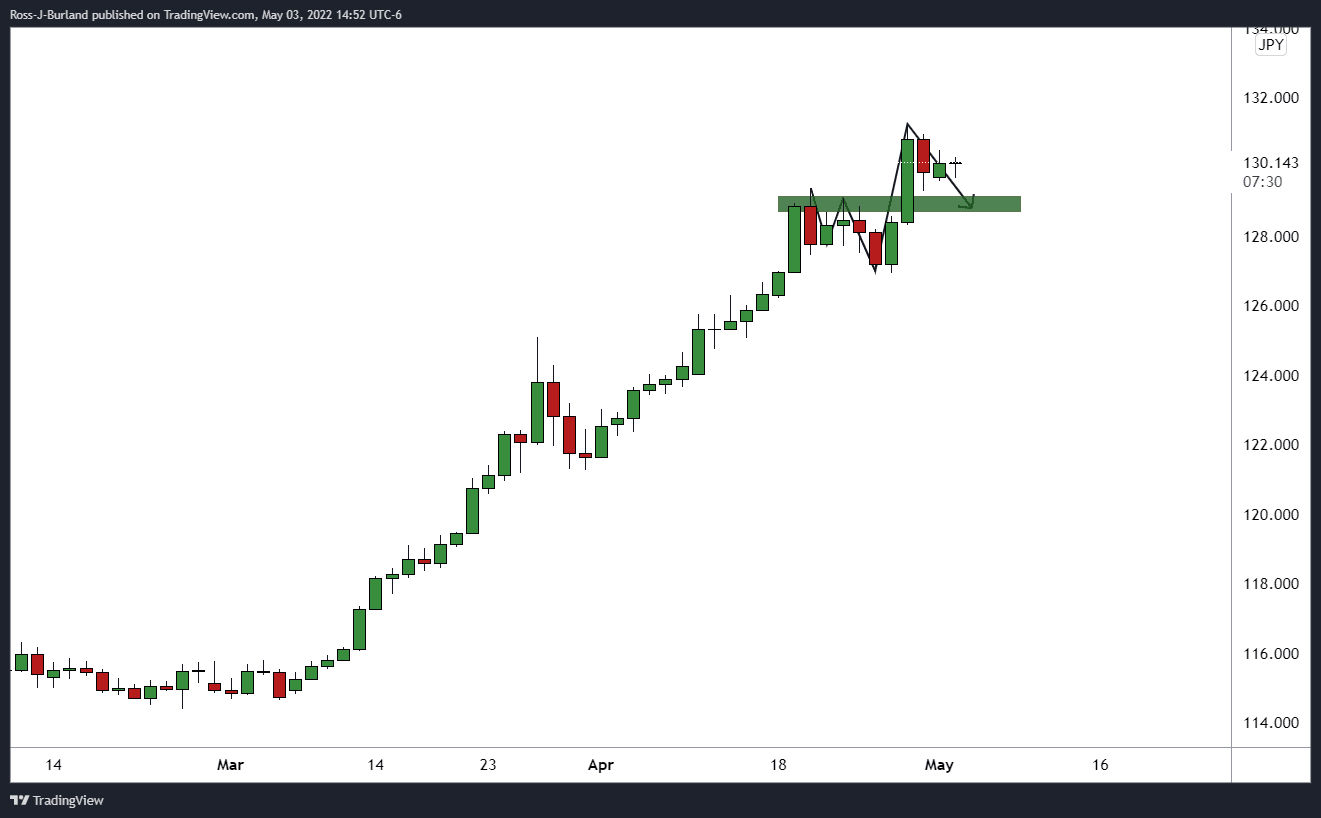

USD/JPY Price Analysis: Bears eye a 61.8% golden ratio

- USD/JPY bears are seeking a deeper correction.

- The 50% mean reversion level is holding up, guarding a 61.8% retracement.

USD/JPY ended the day flat on Wall Street around as markets moved into consolidation ahead of the Federal Reserve. At the time of writing, USD/JPY is trading at 130.16 and has traded between 129.69 and 130.29. The pair is correcting a bullish impulse in the daily charts that was made when the US dollar rallied to 20-year highs last week.

The following illustrates the price in the daily chart and prospects of a deeper retracement:

USD/JPY daily chart

The W-formation is a reversion pattern and so far, the price has corrected into a 50% mean reversion area which is holding up as support. A break of here would be expected to see the price challenge the old highs and presumed support near a 61.8% golden ratio of around 128.60.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.