USD/JPY firms as trade tensions and Fed caution weigh on Dollar

- USD/JPY extends decline, trading near the lower end of the range as safe-haven flows support the Yen ahead of the Fed decision.

- Trade frictions between the US and Japan, along with softening US growth data and geopolitical risks, dampen risk sentiment.

- Technical signals turn bearish with the pair capped below key moving averages, and momentum indicators suggesting further downside.

USD/JPY is trading weaker on Tuesday, hovering in the 142.00 area as safe-haven demand strengthens the Japanese Yen. Risk aversion has intensified as global investors respond to elevated geopolitical uncertainty, including tensions in the Middle East, renewed trade frictions, and shifting global central bank dynamics. Market participants are awaiting the outcome of Wednesday’s Federal Reserve decision, with a particular focus on the tone of Chair Jerome Powell’s guidance.

In Washington, US President Donald Trump held a joint press conference with Canadian Prime Minister Mark Carney, downplaying the need to renegotiate USMCA and instead focusing on broader trade priorities. Trump’s comments about China’s economic struggles and his administration’s active negotiations with 17 trading partners added to market unease. Meanwhile, Treasury Secretary Scott Bessent confirmed that the US had formally rejected Japan’s request for tariff relief, maintaining the 10% and 14% levies on Japanese exports. Japan’s efforts to push for a comprehensive trade deal remain stalled, heightening uncertainty for bilateral relations.

US economic data continue to offer a mixed picture. The March trade deficit widened significantly, likely contributing to a downward revision in Q1 GDP figures. Although the April ISM services PMI rose to 51.6 from 50.8, internal components such as activity and employment disappointed. The Atlanta Fed’s GDPNow model now forecasts Q2 growth at 1.1%, a sharp drop from earlier projections. Meanwhile, the Fed is expected to hold interest rates steady on Wednesday, but the market will closely watch Powell’s press conference for clues on future rate path. Traders currently price in one rate cut by July and a second by year-end.

Japanese data remain sparse, but the country’s position in US trade discussions is under scrutiny. With no breakthrough in tariff talks, Japanese exporters face headwinds, especially in autos and metals. Additionally, a scheduled visit by US agricultural officials to Tokyo underscores the interconnected nature of trade diplomacy, as Washington seeks concessions across sectors.

Technical Analysis

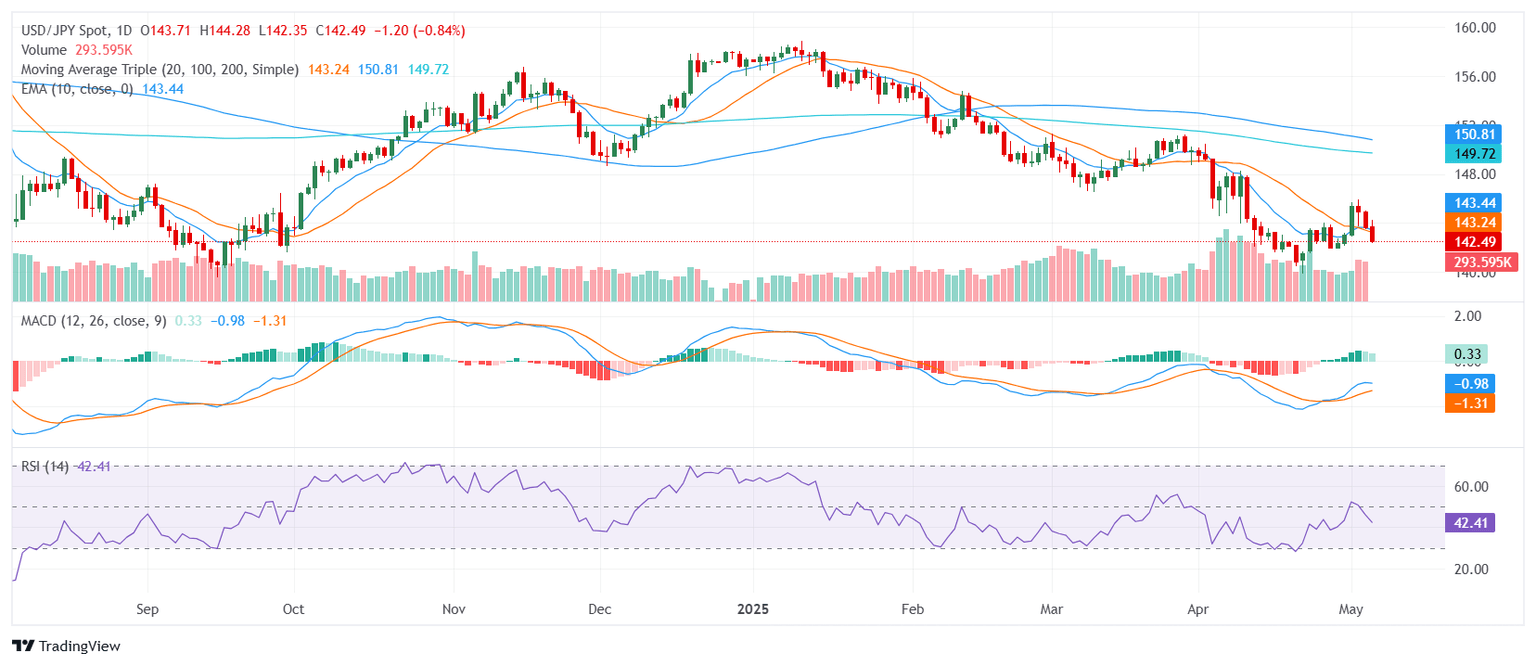

From a technical perspective, USD/JPY is flashing bearish signals. The pair is currently trading near the bottom of its daily range (142.35 – 144.27), down −0.88% on the session. The Relative Strength Index (RSI) at 42.334 remains neutral, while the MACD gives a mild buy signal, creating short-term noise. However, the Awesome Oscillator at −1.680 is flat, and the ADX (14) at 28.468 confirms rising selling pressure.

Key moving averages further reinforce the bearish outlook. The 20-day SMA at 143.20, 100-day at 150.73, and 200-day at 149.67 all point lower. Shorter-term trend lines, including the 10-day EMA at 143.41 and SMA at 143.33, now act as overhead resistance. A sustained move below 142.00 could open the door to further losses, while only a break above 144.00 would ease current downside momentum.

With geopolitical tensions, mixed US macro data, and unresolved US-Japan trade disputes weighing on sentiment, USD/JPY remains vulnerable in the near term. The Fed’s communication on Wednesday will be a key driver for whether this downtrend deepens or stabilizes.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.