USD/JPY: Correction from six-week highs stalls near 132.50, US data eyed

- USD/JPY is in the red for the first time this week, back below the 133.00 level.

- US Dollar benefits from risk aversion but US Treasury yields remain a drag.

- Bearish 50DMA support is in sight amid the pullback from multi-week highs.

USD/JPY is on a corrective downside journey so far this Wednesday, witnessing losses for the first time this week. The pair is retreating from fresh six-week highs of 133.31 reached a day before, trading under 133.00 amid broad risk aversion.

Hotter-than-expected US Consumer Price Index (CPI) data combined with hawkish commentary from US Federal Reserve (Fed) officials have spooked investors, negatively impacting global stocks. The rush to safety in the US bond market is sending the US Treasury bond yields lower, in turn, weighing down on the USD/JPY pair.

Further, expectations that the new Bank of Japan (BoJ) Governor Kazuo Ueda could likely abandon the central bank’s yield curve policy are lending support to the Japanese Yen.

However, the renewed demand for the US Dollar, amid dominating risk-off flows, is fuelling the latest uptick in the spot. All eyes now turn toward the US Retail Sales data due later in the NA session for fresh trading impetus.

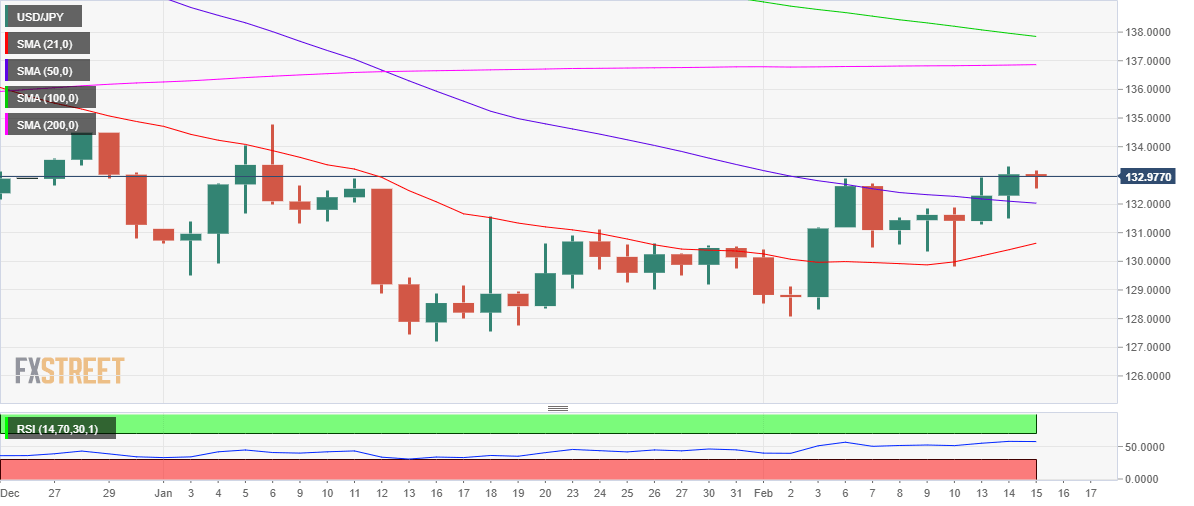

From a short-term technical perspective, USD/JPY is reattempting the 133.00 level, having found support near the 132.50 psychological level.

The 14-day Relative Strength Index (RSI) is edging higher above the midline, suggesting that the recovery momentum remains well in place.

Buyers need to take out the six-week high at 133.31 to extend the recent uptrend toward the static resistance at 133.50.

On the flip side, a sustained move below the 132.50 demand area will put the 50-Daily Moving Average (DMA) support at 132.03 under threat.

USD/JPY: Daily chart

USD/JPY: Additional technical levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.