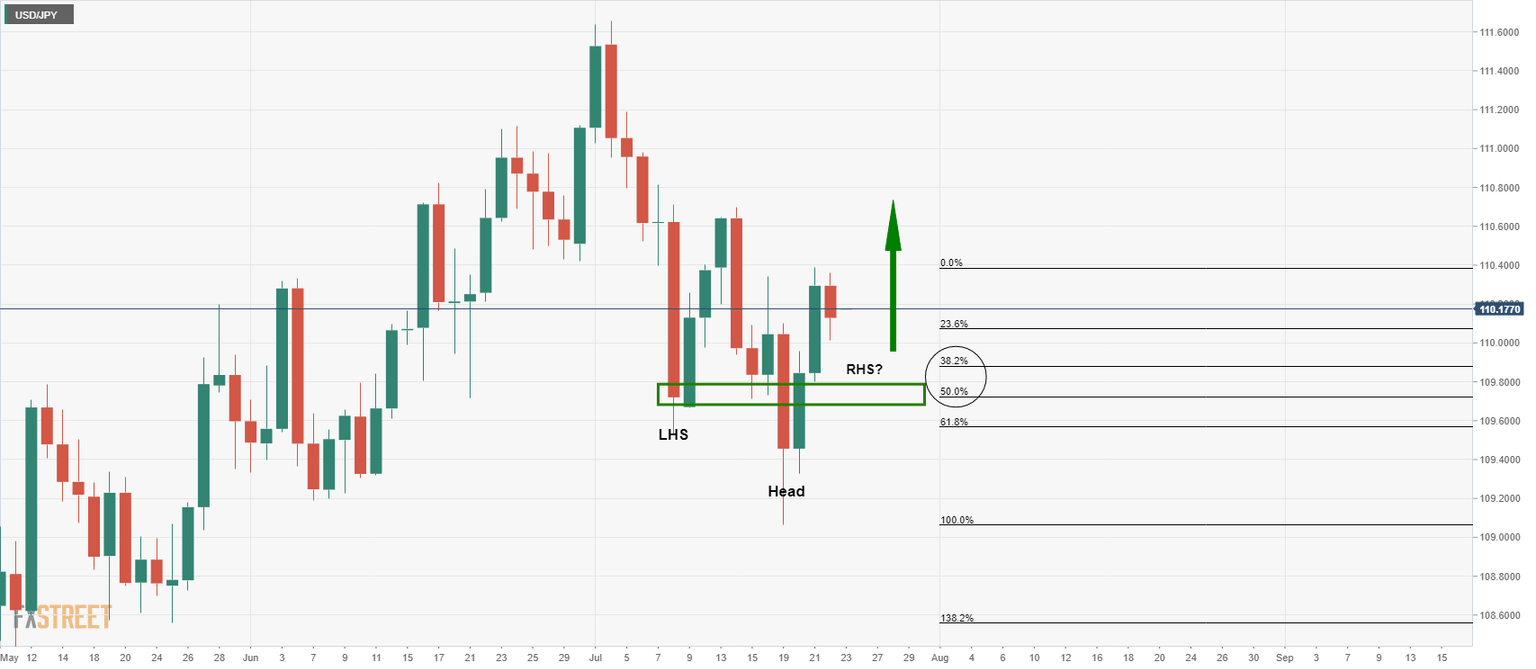

USD/JPY correcting with prospects of upside continuation

- USD/JPY bulls awaiting for bullish structure and prospect of a daily upside continuation.

- Reverse head & shoulders could be in the making.

USD/JPY is flat on the day so far at 110.16 sticking to a 110.07 and 110.16 range. The US dollar was mixed against G10 FX following the European Central Bank

Forward guidance was more dovish than previously: "the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target."

Meanwhile, local data in the US weekly jobless claims were higher than expected. Initial claims rose 419k (est. 350k), and continuing claims were 3.236m (est. 3.100m).

As for yields, US bond yields fell in a Europe led bond rally, following the ECB’s dovish outcome.

The 2-year government bond yields fell 2bps from 0.22% to 0.20% and 10-year bond yields fell from 1.30% to 1.28%.

USD/JPY technical analysis

There are prospects of a deeper correction to at least the 38.2% Fibonacci if not the 505 mean reversion.

On a test of the area, bulls could commit which would result in a right-hand shoulder of a reverse head & shoulders.

This would be a bullish development and raise the probability of an onward bullish impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.