USD/JPY climbs as resilient Retail Sales beats estimates with Fed comments in focus

- USD/JPY rebounds as Fed-BoJ divergence continues to weigh on the safe-haven Yen.

- US Retail Sales smash estimates, rising 0.6% vs 0.1% forecast, reducing the prospects of a Fed rate cut in September.

- USD/JPY rise toward the 149.00 psychological level, trading near 148.50 at the time of writing.

The US Dollar (USD) is gaining renewed momentum against the Japanese Yen (JPY), with central bank divergence continuing to serve as a key driver for the USD/JPY pair. As the pair approaches the psychological resistance level at 149.00, expectations that the Federal Reserve (Fed) will maintain higher interest rates are lending support to the Greenback on Thursday.

At the time of writing, USD/JPY is trading 0.47% higher on the day, positioning the pair to recover after a 0.72% decline in the previous session. US Retail Sales data released on Thursday and remarks from several Fed officials may provide further direction for price action.

Retail Sales figures for June beat estimates, rising 0.6% in June, above analyst estimates of a 0.1% rise and rebounding sharply after a 0.9% contraction in May. Given that consumer spending accounts for a significant share of US Gross Domestic Product (GDP), this data offers valuable insight into the strength of the economy, which influences interest rate expectations.

In addition, speeches from Fed members scheduled throughout the day may provide greater clarity on the central bank’s policy outlook. With inflation data still indicating elevated price pressures, several policymakers have voiced concern that rising tariffs could further complicate the Fed’s efforts to return inflation to its 2% target.

While the Fed maintains its policy rate within the 4.25%–4.50% range, the Bank of Japan (BoJ) continues to keep interest rates at 0.5%, citing the potential economic strain of tightening policy too soon. This contrast in monetary policy and yield differentials remains a key factor supporting continued strength in USD/JPY.

According to the CME FedWatch Tool, markets are currently pricing in a 54.3% probability of a Fed rate cut in September, with a 46.2% probability that rates will remain unchanged until October.

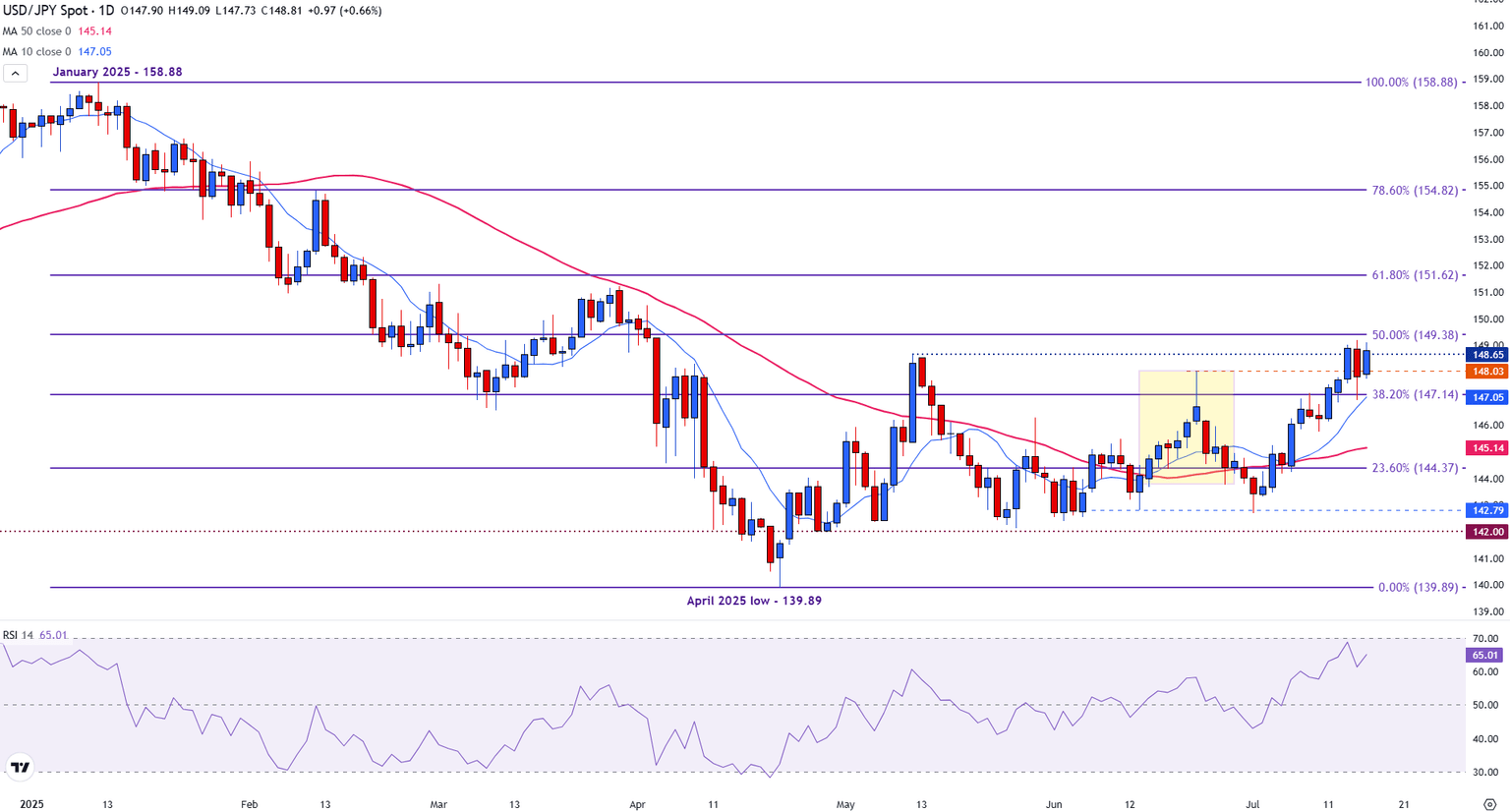

Technical analysis: USD/JPY recovers above 148.50

USD/JPY is approaching a critical technical juncture, with prices nearing the 149.00 psychological level resistance level.

The 50% Fibonacci retracement level of the January-April decline serves as additional resistance, a break of which could open the door for the 150.00 mark, a level that has previously served as battleground for bulls and bears

A decisive break above this level could trigger fresh bullish momentum, paving the way toward the 61.8% Fib level at 151.62, and potentially extending the rally toward 154.82, the 78.6% retracement zone that aligns with broader upside targets.

With the 38.2% Fibo level providing support at 147.14, further downside may find USD/JPY testing the 50-day Simple Moving Average (SMA) at 145.14 and the 23.6% retracement level at 144.37.

Technically, the trend remains constructive, with the 10-day SMA (147.04) holding above the 50-day SMA, reinforcing short-term bullish control. Meanwhile, the Relative Strength Index (RSI) at 64 is edging closer to overbought territory but still leaves room for further gains.

These levels are crucial, as a breakout or rejection at resistance will likely define the next phase of direction for USD/JPY.

USD/JPY daily chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.