USD/JPY bulls claim 110 ahead of the Fed

- USD/JPY take son the 110 area again ahead of the FOMC this week.

- US dollar is in focus as US yields climbed.

As per the start of the week's analysis, USD/JPY Price Analysis: Bulls targeting 110.00, the bulls have finally met the target ahead of the Federal Open Market Committee on Wednesday.

Prior analysis

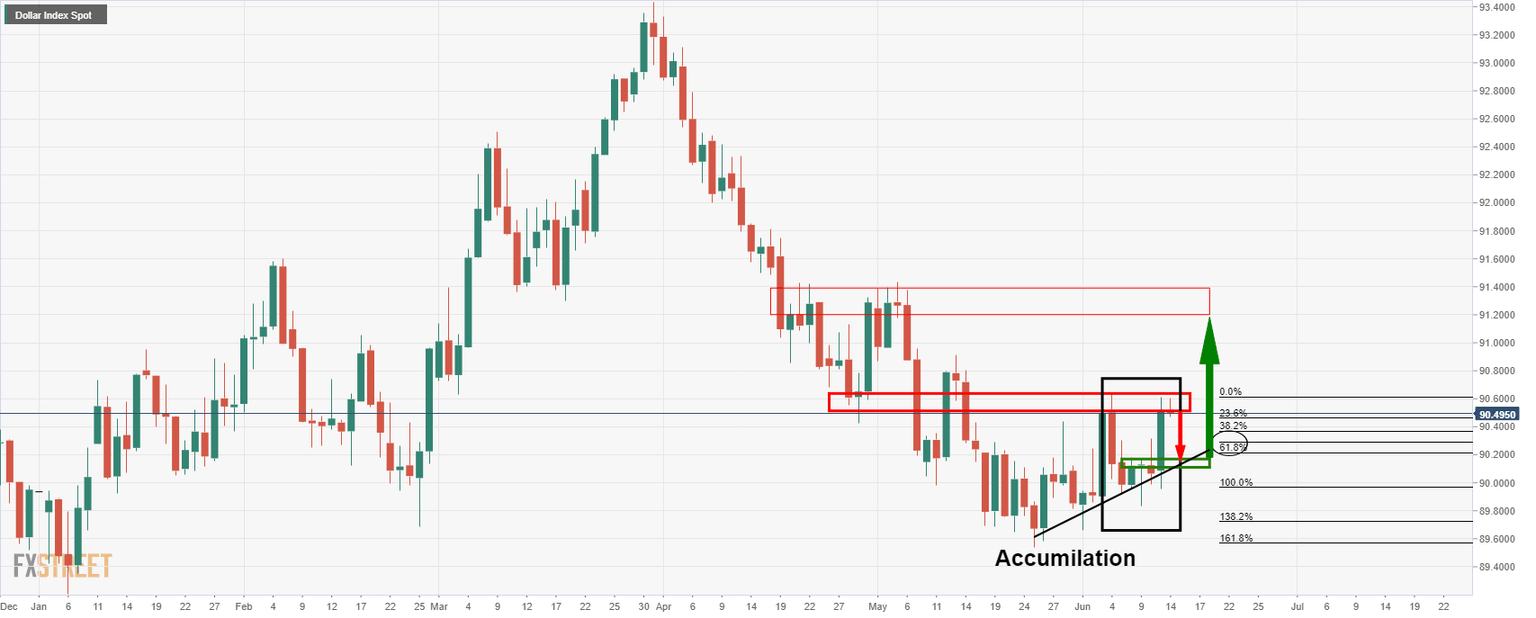

''USD/JPY is on the way to the 110 area as the US dollar continues to firm following Friday's bullish performance.

The -61.8% Fibonacci of the hourly correction comes in at 109.99.''

Hourly chart

Live market

The markets have been in a volatility lull for many weeks and short of the US dollar.

With the anticipation of the Fed this week, short covering in the days counting down to the event is a probable cause for the recent strength in the greenback which is in a phase of accumulation.

US dollar in focus ahead of the FOMC

Meanwhile, US yields are getting some love on Monday, with the ten-year rising 2.9% from a low of 1.4480% to a high of 1.5010% which is helping to boost USD/JPY higher in a low volatility marketplace looking for carry.

FOMC upside risks for the US dollar are anchored

The Fed meets for its 2-day June meeting tomorrow, with the policy decision and updated projections due on Wednesday.

There is little chance of there being new taper hints considering the members believe that the current inflation we are witnessing reflects the historically exceptional circumstances and that inflation future prospects are transitory.

With that being said, the magnitude of price rises in both April and May has been unsettling, so there is a slight chance of a hawkish outcome that could be marginally positive for the US dollar.

The risk is that this pushes inflation expectations higher, ultimately feeding through to a more sustained rise in inflation over the medium term.

''We expect that this week’s FOMC meeting is likely to bring upward revisions for PCE inflation in 2021,'' analysts at Rabobank said.

''As long as further out inflation forecasts remain anchored the market should absorb this well.''

''As Philip Marey notes “, it takes only two more participants (in the FOMC) to shift toward a hike in 2023, to make it a split 9-9 committee on whether to hike or not in 2023”. This is too far away to create too many waves in the market, but such a shift would be marginally USD positive,'' the analysts added further.

On the other hand, ABN Amro wrote in a note, ''the most likely course is that inflation decelerates over the coming months, settling back at more normal levels later this year. It is even possible we could get one or two weak readings in the months ahead, as some price rises look unsustainable and vulnerable to payback (particularly in used cars, a category driving 1/3 of the overshoot in April/May).''

''As such, although we expect a significant upward revision to the Fed’s current 2.4% forecast for PCE inflation in 2021 – perhaps a rise of more than a percentage point – we expect the FOMC statement to continue to describe the current inflation overshoot as transitory, and Chair Powell is likely to mount a vigorous defence of this thinking in the press conference.''

''At the same time, while Chair Powell might acknowledge that the Committee is now ‘talking about talking about' a tapering of its asset purchases, we do not expect any concrete hints on this at the press conference. We continue to think a formal taper announcement could come by the September meeting – perhaps telegraphed at the Jackson Hole Symposium. This would pave the way for tapering to start in Q4,'' Bill Diviney at ABN Amro said.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.