USD/JPY back into 148.40 as Greenback takes a breather

- The USD/JPY is looking for relief, dropping into 148.40.

- Broad-market risk appetite is cautiously stepping forward, limiting US Dollar gains on data beats.

- The Yen has been trading gently after Tuesday's mystery chart surge.

The USD/JPY kicked off Thursday trading reaching a high of 149.12 before settling back into the day's low near 148.40.

US Initial Jobless Claims came in better than expected, showing 207 thousand new unemployment benefits seekers, below the market forecast of 210K.

Challenger Job Cuts also improved, with 47.457 thousand announced job cuts compared to the previous 75.151K.

Late Thursday will see Japanese Labor Cash Earnings figures, where the early Tokyo Friday markets expects monthly wage figures to tick up slightly from 0.2% to 0.3%.

It's another US Non-Farm Payroll (NFP) Friday just around the corner, and markets are expecting US labor starts to decrease slightly from 187K to 170K. A meet-or-beat scenario could easily spark a US Dollar (USD) resurgence as broader markets continue to fear an overly strong US economy pushing the Federal Reserve (Fed) closer to more rate hikes in the future.

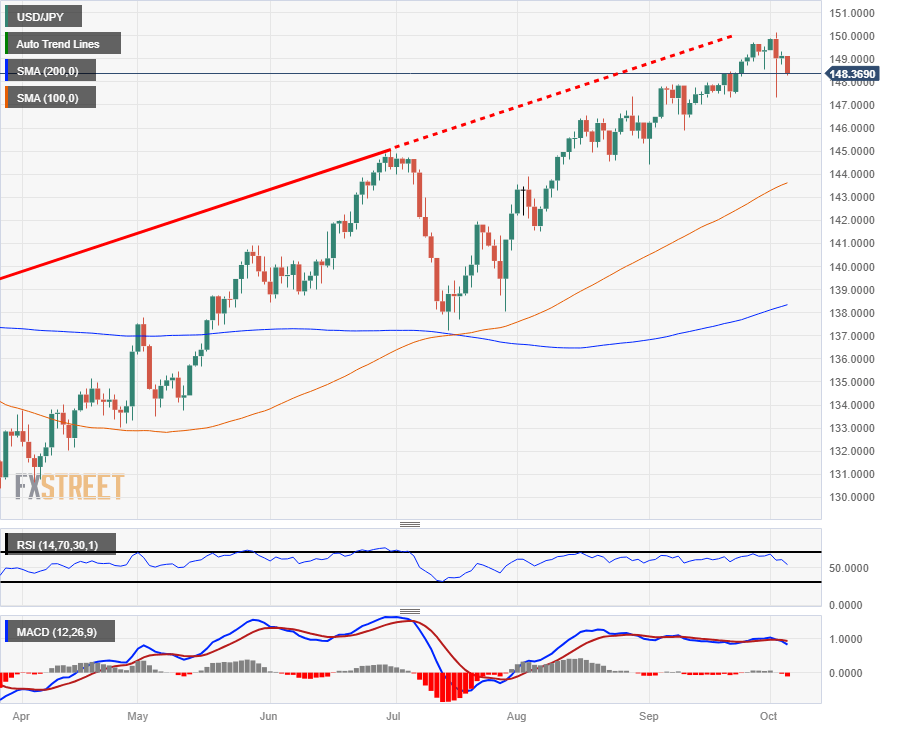

USD/JPY technical outlook

Despite Thursday's chart softening, the USD/JPY remains firmly entrenched deep in bullish territory, with the pair up over 8% from the last bottom near 137.25 back in July.

The long-term bullish US Dollar trend remains firmly intact, with the 100-day Simple Moving Average (SMA) far below current price action, pushing towards the topside near the 144.00 psychological level.

The year's highs are close by at 150.16, and a break above this level will see the USD/JPY set to challenge 2022's peaks near 151.94.

USD/JPY daily chart

USD/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.