USD/INR climbs as traders await US PCE data

- Indian Rupee softens in Friday’s early European session.

- The month-end importer USD bids and likely position unwinding weigh on the INR.

- The US August PCE Price Index data will take center stage on Friday.

The Indian Rupee (INR) loses momentum on Friday amid the renewed US Dollar (USD) demand from importers related to month-end payments and the likely unwinding of long positions. Nonetheless, a fall in crude oil prices and a robust trend in Indian equities might help limit the INR’s losses.

Investors will closely monitor the release of the US August Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation indicator, on Friday. The headline PCE is forecast to show an increase of 2.3% YoY in August, while the core PCE is estimated to show a rise of 2.7% YoY in the same report. Also, the Michigan Consumer Sentiment Index for September will be released later in the day.

Daily Digest Market Movers: Indian Rupee declines due to USD demand related to month-end payments

- "Over the week, the (dollar-rupee) pair has opened lower, only to rebound as importers rush to meet month-end dollar demand, causing USD/INR to close higher," said Amit Pabari, managing director at FX advisory firm CR Forex.

- The US weekly Initial Jobless Claims for the week ending September 21 rose to 218K, up from the previous week's 222K (revised from 219K). The figure came in below initial consensus of 225K.The US weekly Initial Jobless Claims for the week ending September 21 rose to 218K, up from the previous week's 222K (revised from 219K). The figure came in below initial consensus of 225K.

- India’s Sensex climbed 666.25 points to settle at an all-time high of 85,836.12, while Nifty rose 211.90 points to hit a record of 26,216.05.

- US Durable Goods Orders were flat in August, compared to a rise of 9.9% in July, according to the US Census Bureau. This figure came in better than the estimation of a decline of 2.6%.

- The US Gross Domestic Product (GDP) increased at an annual rate of 3.0% in the second quarter (Q2), as previously estimated, the US Bureau of Economic Analysis (BEA) showed Thursday.

- Fed Governor Lisa Cook stated on Thursday that she endorsed the 50 bps interest rate cut last week as a way to address increased "downside risks" to employment, per Reuters.

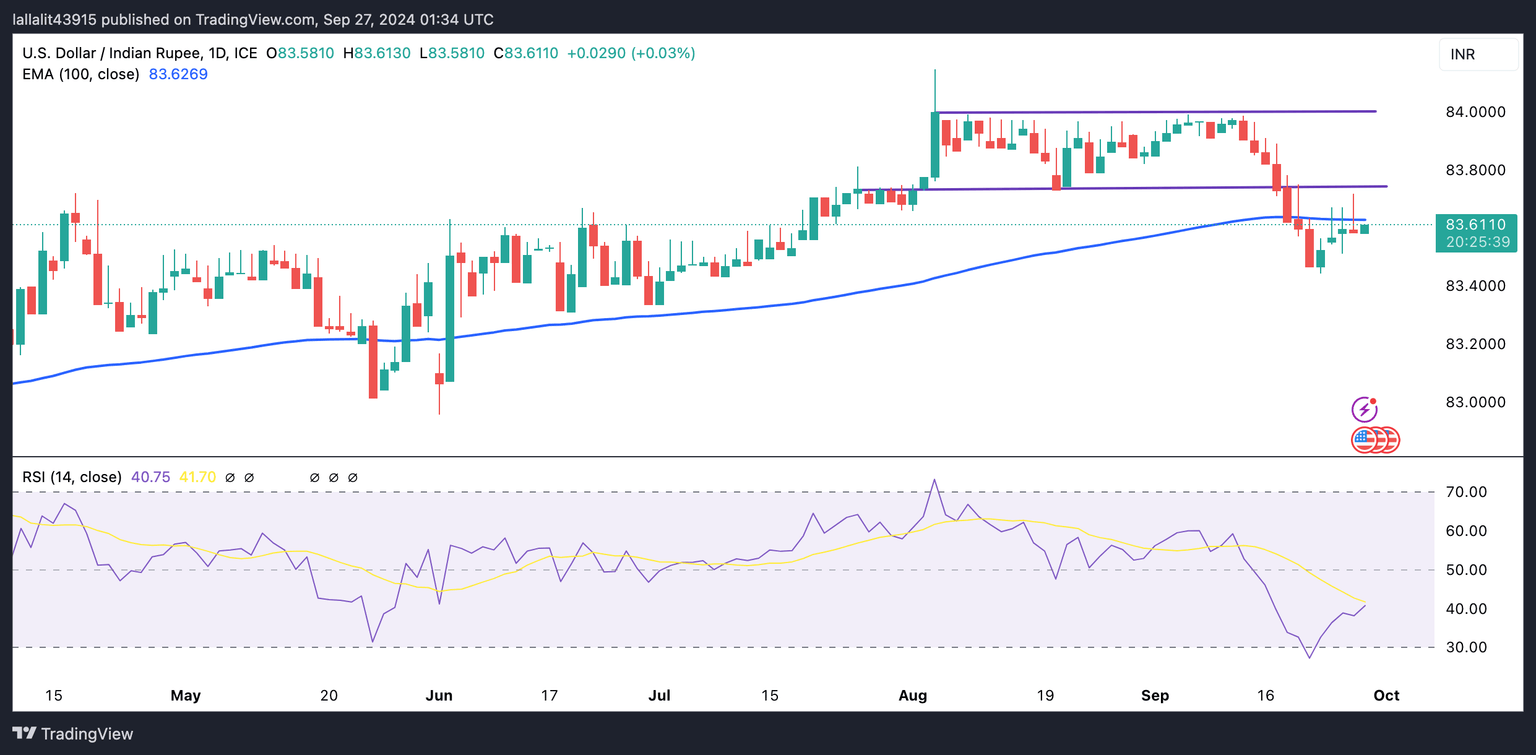

Technical Analysis: USD/INR’s bearish stance remains intact

The Indian Rupee weakens on the day. Technically, the USD/INR pair maintains a negative view on the daily chart as the price remains capped under the key 100-day Exponential Moving Average (EMA). The downward momentum is reinforced by the 14-day Relative Strength Index (RSI), which is located below the midline near 39.30, suggesting that further downside cannot be ruled out.

The low of September 23 acts as an initial support level for USD/INR. Sustained trading below this level could lead the pair to drop to 83.00, representing the psychological level and the low of May 24.

On the upside, a decisive break above the 100-day EMA at 83.62 could set the pair up for a retest of the support-turned-resistance level at 83.75. The additional upside filter to watch is the 84.00 round mark.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.