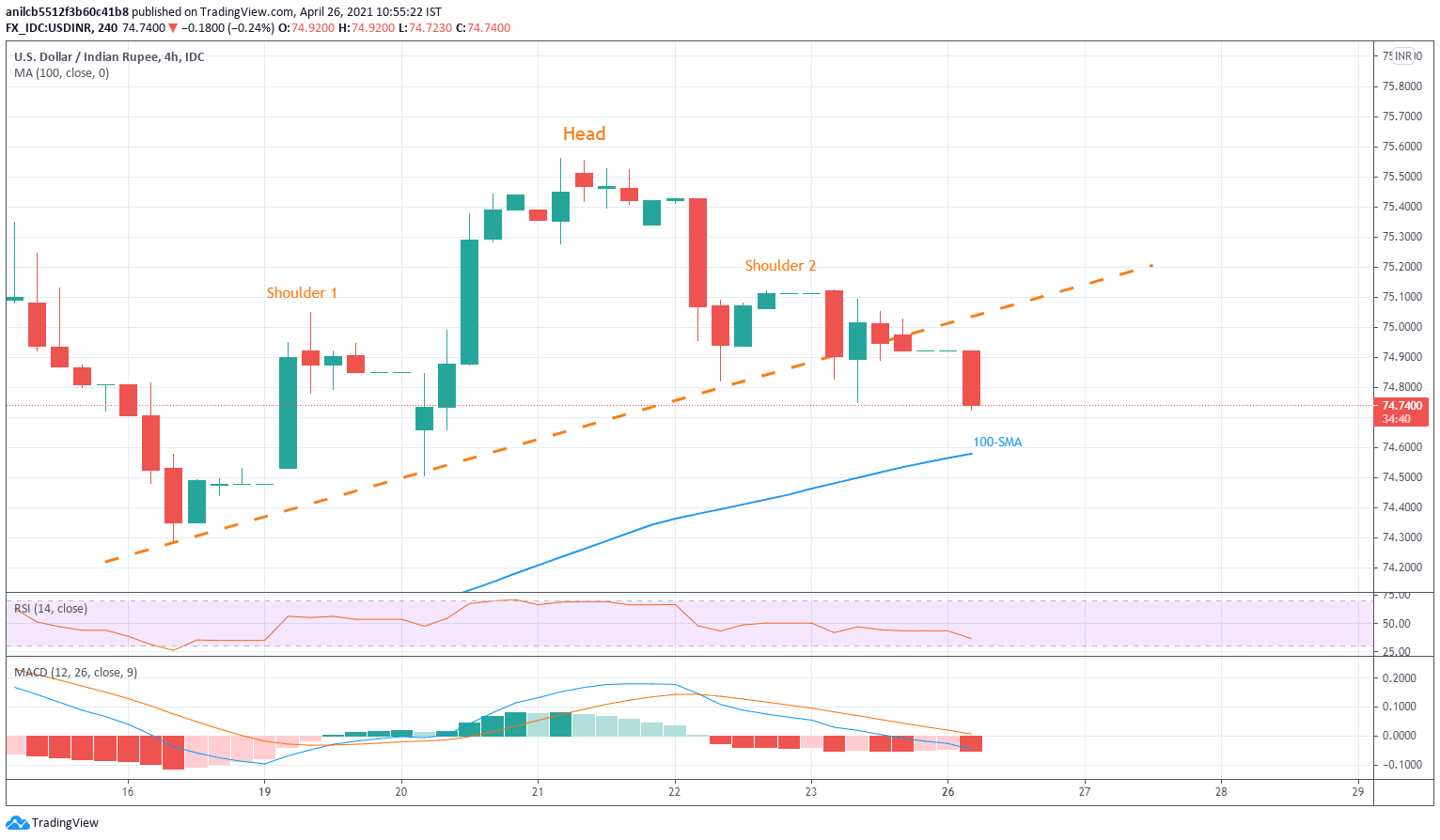

USD/INR Price News: Indian rupee stays positive below 75.00 on short-term H&S

- USD/INR stays offered after confirming a bearish chart pattern.

- 100-SMA can offer intermediate halt during the drop towards 73.90.

- Bearish MACD, downward sloping RSI favor sellers, bulls need to cross 75.10 for fresh entries.

USD/INR holds lower ground near 74.80, down 0.05% intraday, amid an initial Indian session on Monday. The pair recently confirmed a bearish chart pattern, head-and-shoulders (H&S) on the four-hour play.

Not only the H&S confirmation but downbeat MACD and declining RSI line, not oversold, also back USD/INR sellers.

Although 72.30 comes out as the theoretical target of the H&S, 100-SMA near 74.57 and the mid-April low around 74.30 can test the USD/INR bears.

Meanwhile, a corrective pullback beyond the neckline figure of 75.05 should cross the shoulder 2, around 75.10, before recalling the USD/INR buyers.

Following that, 75.50 and the monthly top surrounding 75.56 will be the key levels to watch.

USD/INR four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.