USD/INR Price News: Indian rupee stays firmer below 73.00

- USD/INR keeps bounce off intraday low while trimming Monday’s gains.

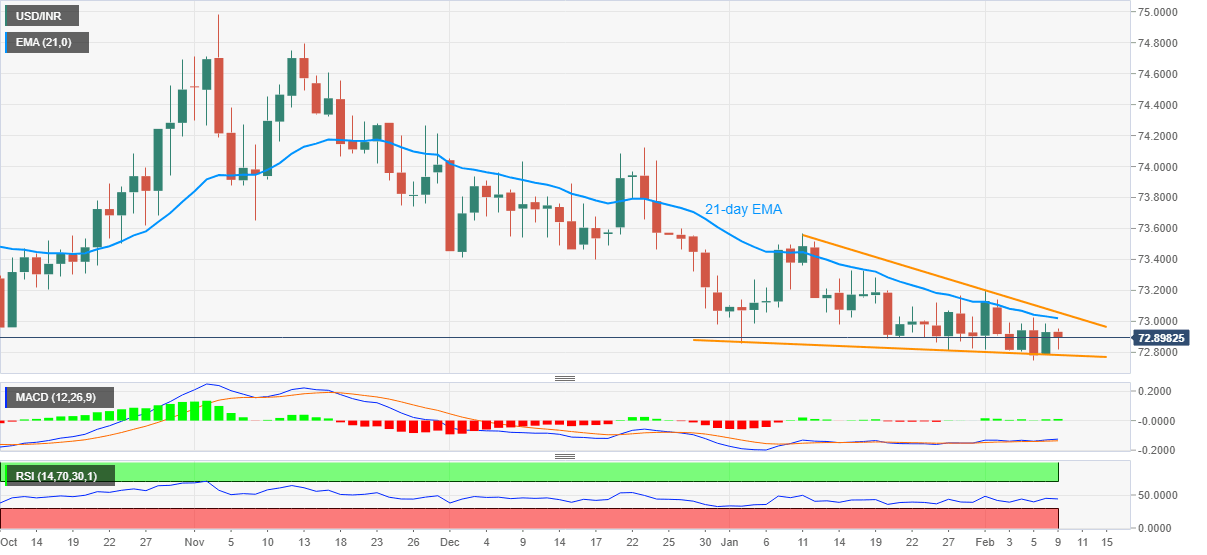

- One-month-old falling wedge formation restricts the pair’s immediate moves.

USD/INR rises to 72.89, down 0.10%, during the initial hour of the Indian trading session on Tuesday. In doing so, the quote remains below 21-day EMA and inside short-term bullish chart pattern.

Considering the recently sluggish moves below 73.00, USD/INR bears seem tiring. As a result, buyers can take entry with the full form on confirmation of the bullish play at hand.

However, the 21-day EMA level of 73.00 guards the quote’s immediate upside ahead of the stated formation’s resistance line near 73.05.

In a case where the quote successfully crosses 73.05 on a daily closing basis, USD/INR run-up towards the January 2021 peak surrounding 73.55 will be in the spotlight.

On the flip side, the pair’s weakness below the nearby support line, at 72.78 now, needs confirmation of further downside with a daily close below 72.75 before directing USD/INR bears to the early 2020 highs near 72.20.

USD/INR daily chart

Trend: Recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.