USD/INR Price News: Golden cross teases Indian rupee bears above 79.50, Fed Minutes eyed

- USD/INR struggles to extend recent pullback amid off in Indian currency, bond markets.

- Growth fears surrounding China, US keep buyers hopeful amid a sluggish session.

- Hawkish hopes from Fed minutes put a floor under the prices.

- Second-tier US data, risk catalysts can entertain intraday traders.

USD/INR picks up bids to pare recent losses around 79.58 during the mid-Asian session on Tuesday. In doing so, the Indian rupee (INR) pair justifies the market’s risk-off mood amid sluggish trading hours, while also respecting the bullish chart pattern.

That said, economic slowdown fears concerning China and the US appear to be the major challenge for the USD/INR bears. Also putting a floor under the USD/INR prices is the market’s anxiety ahead of Federal Open Market Committee (FOMC) meeting minutes.

The growth fears recently gained momentum after China released downbeat Retail Sales and Industrial Production data for July on Monday. On the same were data suggesting a lack of credit demand for China’s easy loan funds and the surprise rate cut from the People’s Bank of China (PBOC).

The pessimism also escalated as stronger as China President Xi Jinping showed readiness to take more measures after the previous day’s downbeat statistics. Xinhua News Agency quoted China President Xi saying that they will “use new development ideas in economic growth”. The comments rolled out after downbeat prints of Retail Sales, Industrial Production and Loan Growth for July.

It should be noted, though, that the fears about the US-China tussles grow and challenges the USD/INR sellers as Xinhua reported that China imposes sanctions on a number of Taiwan separatists. Previously, the visit of multiple US lawmakers to Taiwan irritated Beijing, which in turn led to fierce military drills near the Taiwan border and an escalation of the geopolitical risks.

On Monday, US NY Empire State Manufacturing Index for August dropped to -31.3 from 11.1 in July and 8.5 in market forecasts. Further, the US August NAHB homebuilder confidence index also fell to 49 versus 55, its lowest level since the initial months of 2020. Although the recent US data joins the previous week’s softer inflation figures, the Fed policymakers remain hawkish, which in turn keeps the USD/CNH buyers hopeful.

Against this backdrop, the US 10-year Treasury yields snap a two-day downtrend around 2.79% while the S&P 500 Futures decline 0.10% intraday at the latest.

Given the off in Indian currency and bond markets, USD/INR pair traders will keep their eyes on the US Building Permits, Housing Starts and Industrial Production numbers for July for fresh impulse. However, Fed Minutes will be crucial amid indecision over the US central bank’s next move.

Technical analysis

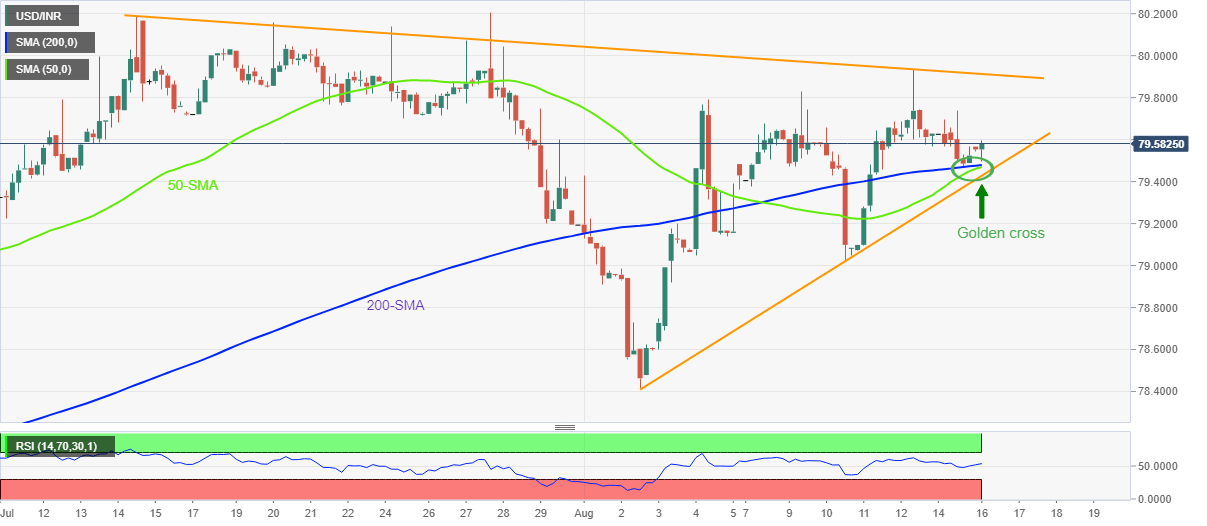

USD/INR keeps the previous day’s bounce off the 200-SMA after posting a two-day downtrend. The recovery moves also gain support from the firmer RSI (14) line and an impending “golden cross”.

That said, a sustained piercing of the 50-SMA to the 200-SMA appears necessary to confirm the bullish moving average crossover.

In that case, a run-up towards the monthly resistance line near 79.90 becomes imminent. Following that, the 80.00 threshold and the recent record top near 80.20 will be in focus.

Alternatively, a downside break of the two-week-old support line, at 79.40 by the press time, could defy the bullish hopes by directing the USD/INR bears towards the 79.00 round figure.

USD/INR: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.