USD/INR Price Forecast: The support area at 85.25 is coming into focus

- The US Dollar is extending its reversal from $86.00 for the fourth day in a row.

- The tepid reaction to the US-China deal and investors' caution ahead of the US CPI are supporting the Rupee.

- USD/INR is approaching a key support area at 85.25-85.35.

The Indian Rupee is trading higher for the fifth consecutive day on Wednesday. The US Dollar-supportive impact from the US-China deal has been short-lived, and the pair resumed its downward trend ahead of the US CPI release, nearing the support area at 85.25-85.35.

US and China agreed on a framework to de-escalate their trade rift and return to the Geneva meeting consensus, that is, fewer restrictions for rare earths’ trade and lower tariffs. The lack of details about the agreement, however, has triggered a sceptical market reaction.

The Dollar ticked up after the news before losing ground during the US Session, with investors cautious ahead of the release of US CPI data and a key auction of US Treasury bonds due later today.

Technical analysis: USD/INR bears remain in control

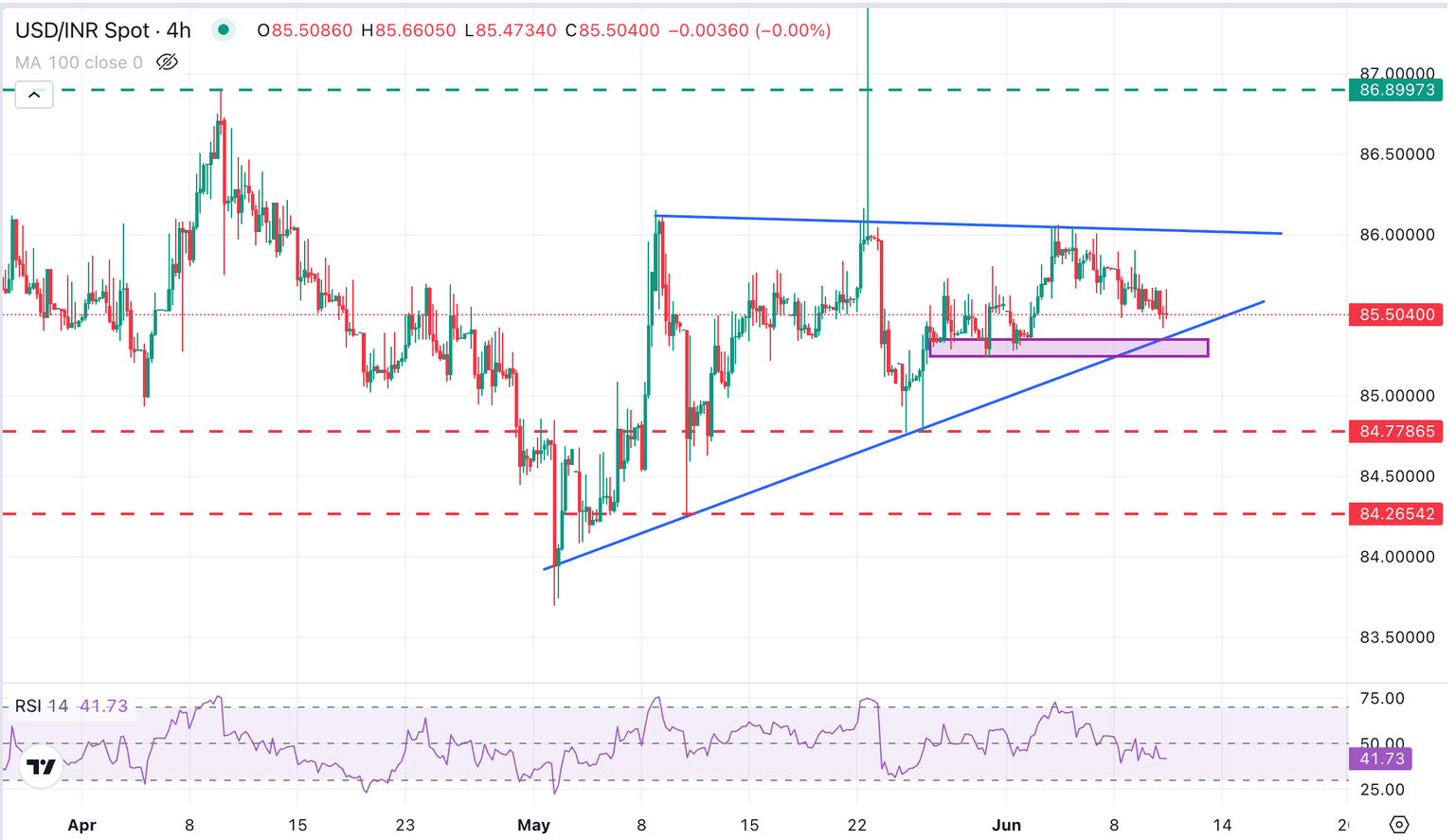

The USD/INR keeps correcting lower from the 86.00 peak hit last week, likely to extend losses towards the key 85.25-85.35 area, where the lows of May 28 and 30 and June 2 meet the ascending trendline support from early May lows.

The pair is moving in an ascending triangle pattern, which is a bullish formation, but technical indicators are pointing lower, and the confirmation below the mentioned levels would increase negative pressure towards 84.77 (May 26 and 27 lows), ahead of the 12 May low, at 84.25.

On the upside, a break above $86.00 to mark a trend shift and set its focus towards the April 9 high, at 86.90.

USD/INR 4-Hour Chart

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.