USD/INR Price Analysis: Indian rupee buyers need validation from 79.70

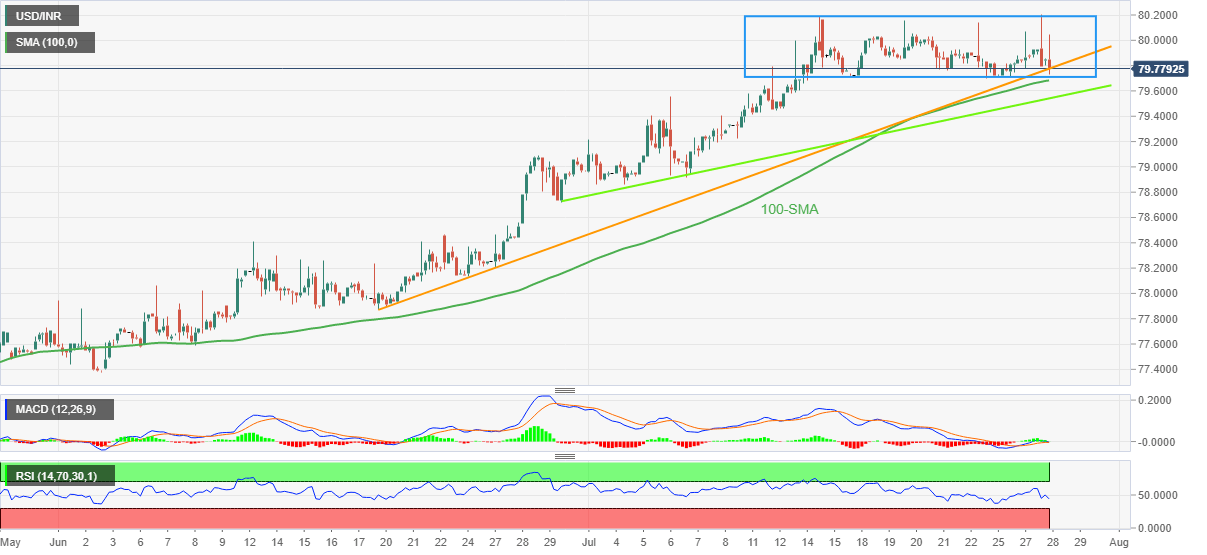

- USD/INR remains pressured inside two-week-old trading range, pokes short-term support line of late.

- 100-SMA, one-month-old ascending trend line adds strength to the downside filters.

- Bulls should wait for a daily close beyond 80.20 to retake control.

- RSI, MACD signals hint that buyers are running out of steam.

USD/INR extends the post-Fed losses as the bears attack a five-week-old rising trend line support near 79.80 during the initial hour of the Indian trading session on Thursday. Even so, the pair remains inside a fortnight-long trading range between 80.20 and 79.70.

Considering the latest weakness in the RSI, as well as an impending bear cross on the MACD< USD/INR is likely to break the 79.70 support.

Following that, an upward sloping trend line from June 29, at 79.55, will be in focus.

In a case where USD/INR prices drop below 79.55, the odds of witnessing the quote’s south-run towards 79.00 and then to the June 29 swing low near 78.80 will be in focus.

Meanwhile, recovery moves may initially aim for the 80.00 threshold before challenging the aforementioned range’s resistance, at 80.20.

In a case where the USD/INR buyers manage to keep reins past 80.20, the 81.00 round figure could flash on their radars.

USD/INR: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.