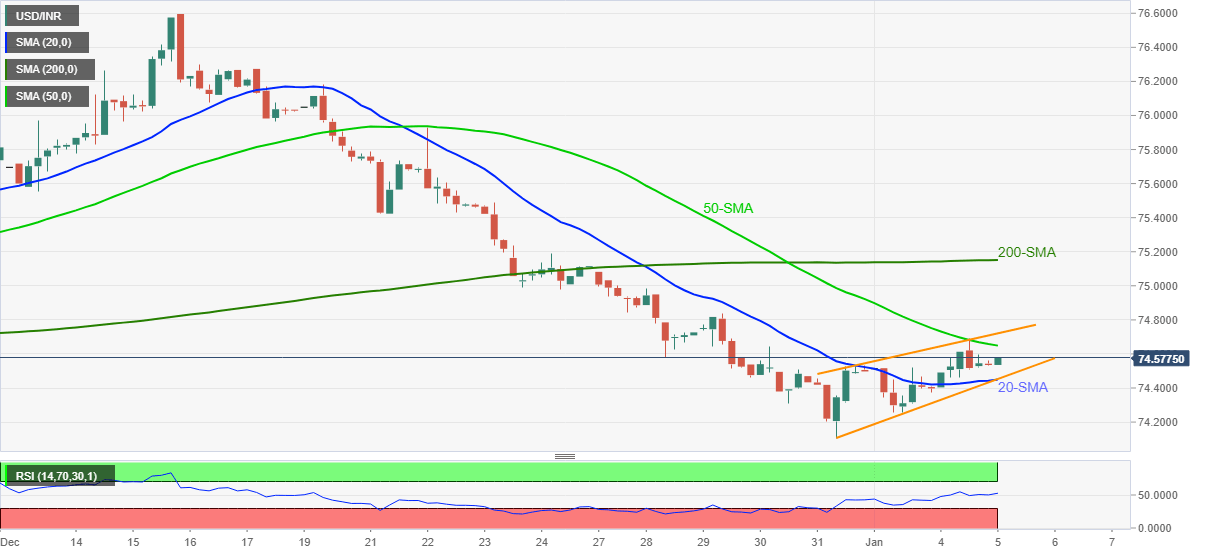

USD/INR Price Analysis: Bear flag keeps Indian rupee buyers hopeful, 74.45 eyed

- USD/INR defends corrective latest pullback around seven-week low.

- Bearish chart pattern needs validation from 20-SMA, buyers need to conquer 200-SMA for conviction.

USD/INR seesaws around 74.55-60 during Wednesday’s Asian session, after rising the most in three weeks the previous day. In doing so, the Indian rupee (INR) pair holds onto the recovery moves from the lowest levels since mid-November, flashed on Friday.

Even so, a bearish chart pattern called flag challenges USD/INR buyers on the four-hour (4H) play.

The quote’s latest rebound, however, takes clues from ascending RSI line and hints at another attempt to cross the 50-SMA level of 74.65.

Following that, the flag’s upper line, around 74.75, will precede the 75.00 threshold to challenge the USD/INR bulls. Also acting as the key upside hurdle is the 200-SMA level of 75.15.

On the flip side, 20-SMA adds strength to the bearish formation’s support line near 74.65, a break of which will theoretically confirm the south-run towards the last year’s bottom surrounding 72.20-15.

During the anticipated fall, lows marked in November and September 2021, respectively around 73.85 and 72.90, may offer a breather space to the USD/INR bears.

USD/INR: Four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.