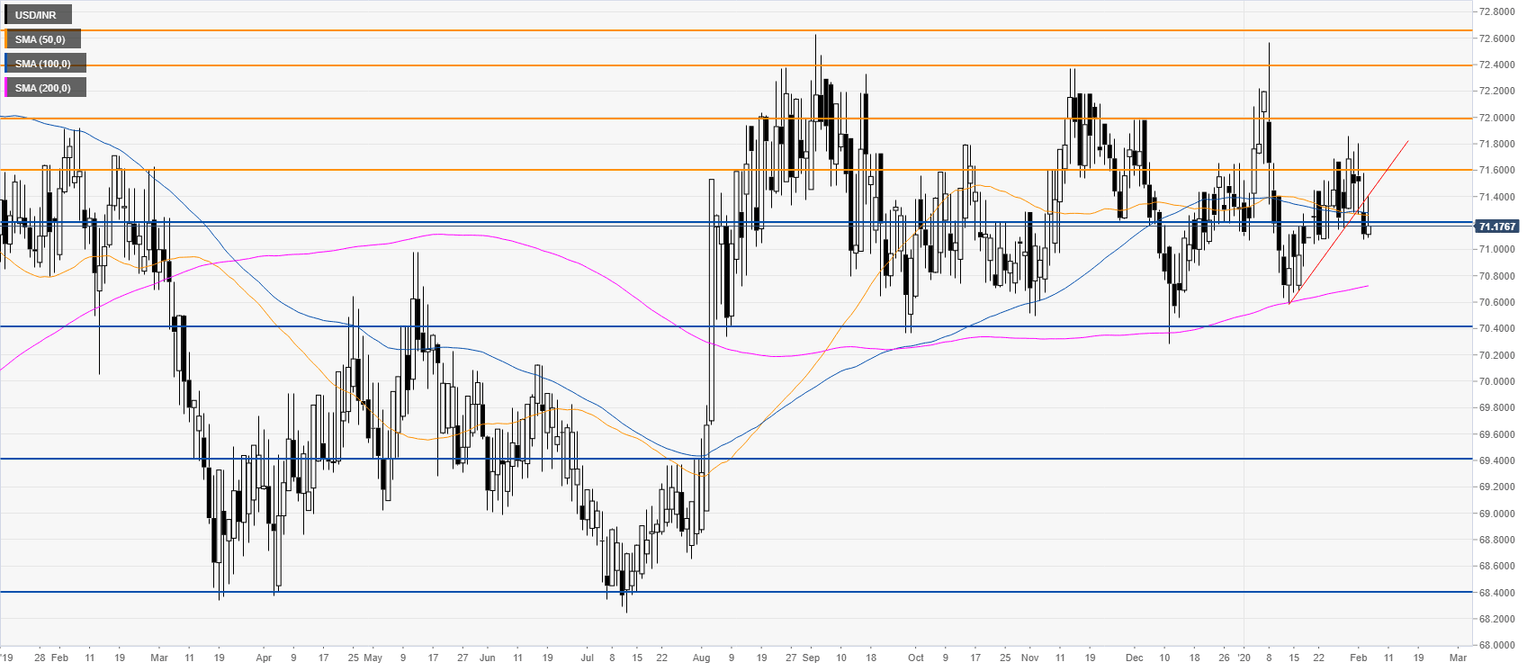

USD/INR New York Price Forecast: Greenback vulnerable below 71.20 vs. rupee

- USD/INR broke below the bear flag pattern and the 71.20 support level.

- Downside target can be located near the 70.40 level.

USD/INR weekly chart

USD/INR daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst