USD/INR rallies further due to consistent FIIs outflow from Indian stock market

- The Indian Rupee slides further against the US Dollar, with USD/INR refreshing all-time highs around 91.10.

- India’s retail CPI rose at a faster pace of 0.7% in November, but is still below the RBI’s tolerance band of 2%-6%.

- Investors await US NFP data for fresh cues on the Fed’s monetary policy outlook.

The Indian Rupee (INR) starts the week on a bearish note against the US Dollar (USD), extending its losing streak for the third trading day. The USD/INR pair refreshes its all-time high near 91.10 as the continuous outflow of foreign funds from the Indian stock market amid the absence of any trade deal announcement between the United States (US) and India is consistently hurting the Indian Rupee.

The US and India have not yet reached a consensus, even as US Trade Representative Jamieson Greer stated last week that the latest offer by New Delhi is the "best ever" Washington has seen.

So far in December, Foreign Institutional Investors (FIIs) have remained net sellers in all trading days, and have offloaded stake worth Rs. 19,605.51 crore.

On the domestic front, India's Wholesale Price Index (WPI) Inflation data for November has come in better than projected. The data showed that inflation at the producer level deflated at a moderate pace of 0.32% year-on-year, compared to estimates of 0.6% and a 1.21% decline in October.

Lat week, India’s retail Consumer Price Index (CPI) came in higher at 0.71% on an annualized basis, as expected, from 0.25% in October. However, it remains well below the Reserve Bank of India’s (RBI) tolerance band of 2%-6%, keeping the door open for further interest rate cuts.

Earlier this month, the RBI also reduced its Repo Rate by 25 basis points (bps) to 5.25% and kept a neutral stance on the monetary policy outlook.

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.01% | -0.02% | -0.50% | -0.04% | 0.00% | 0.13% | -0.01% | |

| EUR | -0.01% | -0.04% | -0.53% | -0.05% | -0.00% | 0.15% | -0.02% | |

| GBP | 0.02% | 0.04% | -0.48% | -0.02% | 0.03% | 0.16% | 0.01% | |

| JPY | 0.50% | 0.53% | 0.48% | 0.45% | 0.50% | 0.66% | 0.49% | |

| CAD | 0.04% | 0.05% | 0.02% | -0.45% | 0.05% | 0.19% | 0.03% | |

| AUD | -0.01% | 0.00% | -0.03% | -0.50% | -0.05% | 0.14% | -0.05% | |

| INR | -0.13% | -0.15% | -0.16% | -0.66% | -0.19% | -0.14% | -0.17% | |

| CHF | 0.00% | 0.02% | -0.01% | -0.49% | -0.03% | 0.05% | 0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Daily digest market movers: Investors await US NFP data for November

- The Indian Rupee continues to underperform the US Dollar, even as the latter remains on tenterhooks amid expectations that the Federal Reserve (Fed) will deliver more interest rate cuts next year than what it had signaled in the monetary policy announcement on Wednesday.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, struggles near its eight-week low of 98.13 posted on Thursday.

- According to the CME FedWatch tool, there is a 64.3% chance that the Fed will cut interest rates at least two times by the end of 2026. While the Fed’s dot plot showed that policymakers see the Federal Funds Rate falling to 3.4% by 2026, indicating one more interest rate cut from current levels of 3.50%-3.75%.

- Fed dovish bets for the next year are backed by firm hopes of Chairman Jerome Powell’s replacement with a US President Donald Trump’s candidate, whose decisions will be biased by Trump’s economic agenda.

- US President Trump has criticized Fed Chair Powell several times for holding interest rates at higher levels since his return to the White House. Trump stated last week that he is happy with the Fed easing monetary conditions, but wants more from them.

- Meanwhile, a report from The Wall Street Journal (WSJ) showed on Friday that US President Trump is leaning towards either former National Economic Council Director Kevin Hassett or Fed Governor Kevin Warsh to replace Chairman Powell this year. "I think you have Kevin and Kevin. They’re both - I think the two Kevins are great," Trump said.

- On the domestic front, investors will pay close attention to the US Nonfarm Payrolls (NFP) data for November, which will be released on Tuesday. Investors will pay close attention to the US NFP data as its impact will be significant on market expectations for the Fed’s monetary policy outlook, knowing that weak labor market conditions majorly drove a 75 bps reduction in interest rates this year.

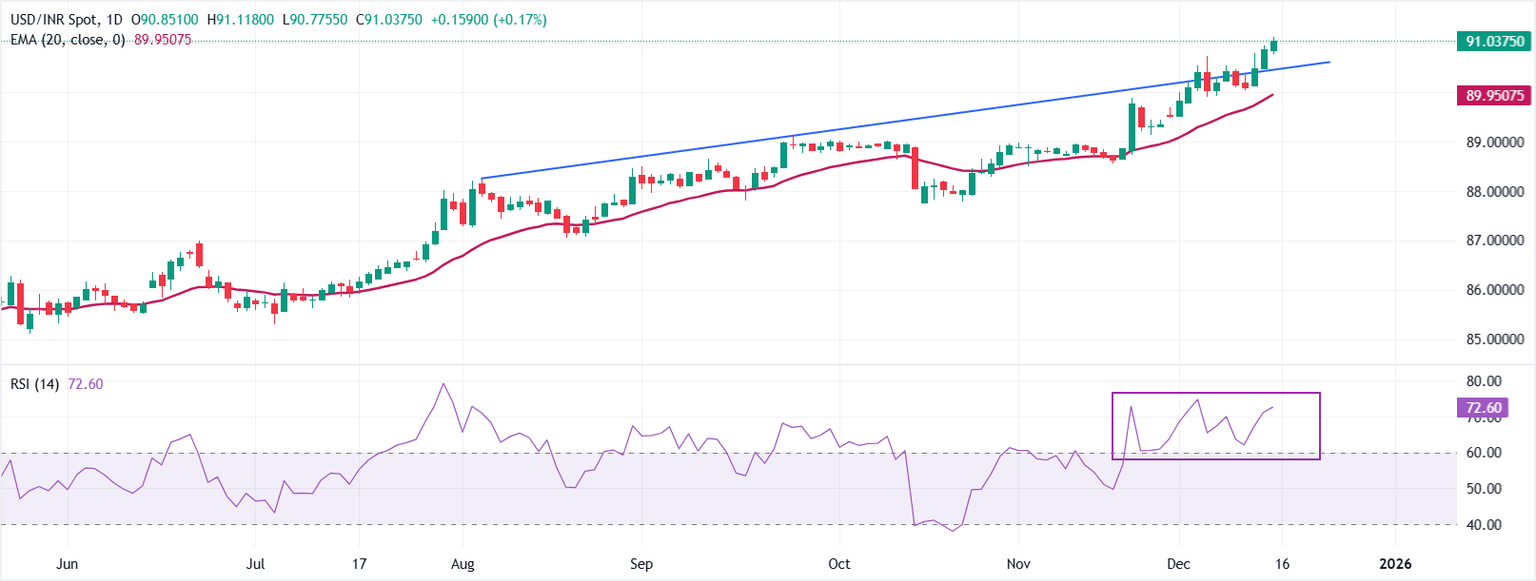

Technical Analysis: USD/INR rises above 91.00

USD/INR trades higher around 90.94 on Monday. The 20-Exponential Moving Average (EMA) at 89.9414 rises and price holds above it, keeping the short-term trend pointed higher. The rising trend line from 88.64 underpins the bullish bias.

The 14-day Relative Strength Index (RSI) at 71.70 sits in overbought territory, which could cap near-term gains as momentum stretches.

The upward-sloping average should act as first support on dips, while a daily close below it would signal a deeper correction towards the round-level figure of 90.00. While a sustained strength above the current level would extend the advance towards 92.00.

(The technical analysis of this story was written with the help of an AI tool)

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.