USD Index Price Analysis: There is a minor support at 102.58

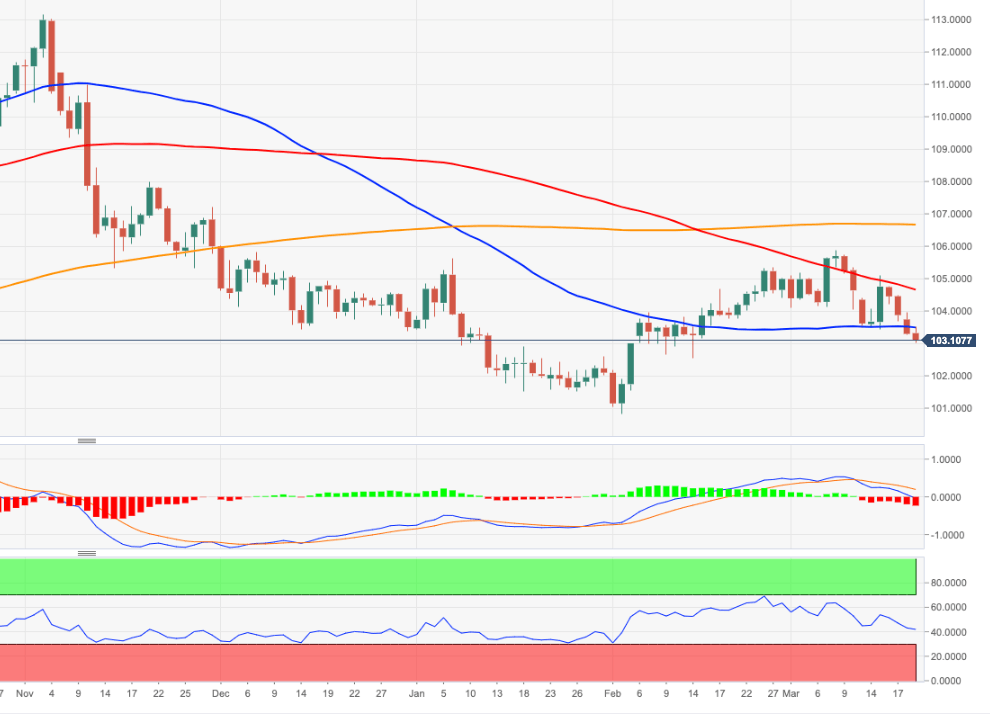

- DXY remains well on the defensive and threatens 103.00.

- Further losses could see the weekly low at 102.58 revisited.

DXY adds to the ongoing decline and puts the 103.00 region to the test on Tuesday.

The bearish mood appears unabated for the time being. Against that, there is a minor support at the weekly low at 102.58 (February 14), while the loss of this region could spark a deeper pullback to the 2023 low near 101.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.62, the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.