USD Index Price Analysis: The hunt for 104.70

- DXY reverses the initial pessimism and advances to daily highs.

- Extra recovery continues to target the 104.70 region.

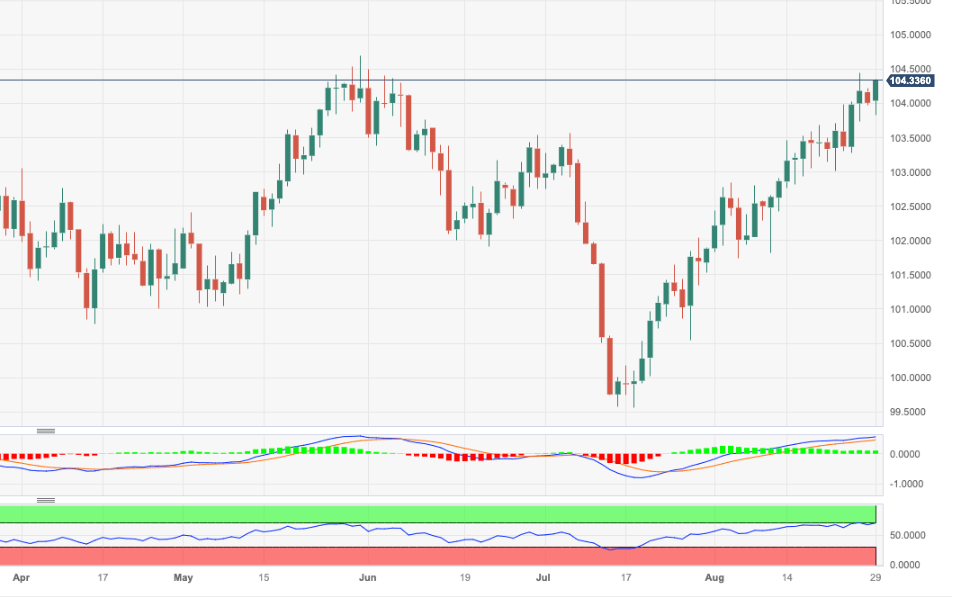

DXY quickly leaves behind Monday’s decline and resumes the uptrend to retest the 104.30/40 band on Tuesday.

Immediately to the upside turns up the August top at 104.44 (August 25), while the surpass of this level should open the door to a rapid test of the May high of 104.69 (May 31) prior to the 2023 peak of 105.88 (March 8).

While above the key 200-day SMA, today at 103.09, the outlook for the index is expected to shift to a more constructive one.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.