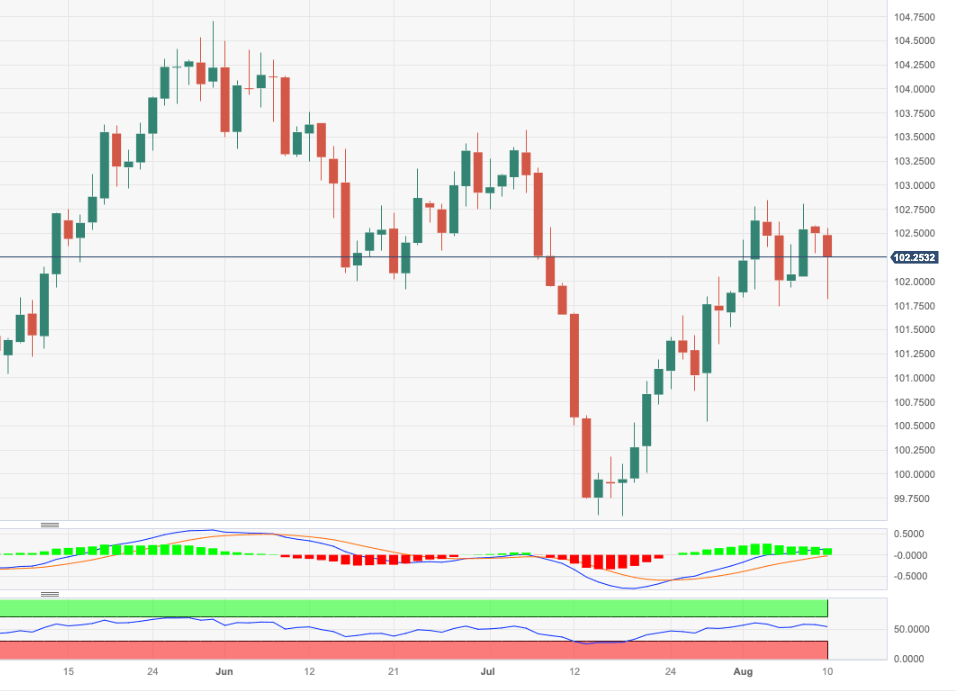

USD Index Price Analysis: The 102.80 region caps the upside so far

- DXY breaches the 102.00 support in the wake of US CPI.

- Bullish attempts remain limited by the 102.80 region, or monthly highs.

DXY comes under intense selling pressure and breaks below the 102.00 support to rebound soon afterwards on Thursday.

The index appears to have embarked on a consolidative phase for the time being. Next on the upside emerges the so far monthly top of 102.84 (August 3), while the breakout of this level exposes a probable move to the key 200-day SMA at 103.37 prior to the July high of 103.57 (July 3).

Looking at the broader picture, while below the 200-day SMA the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.