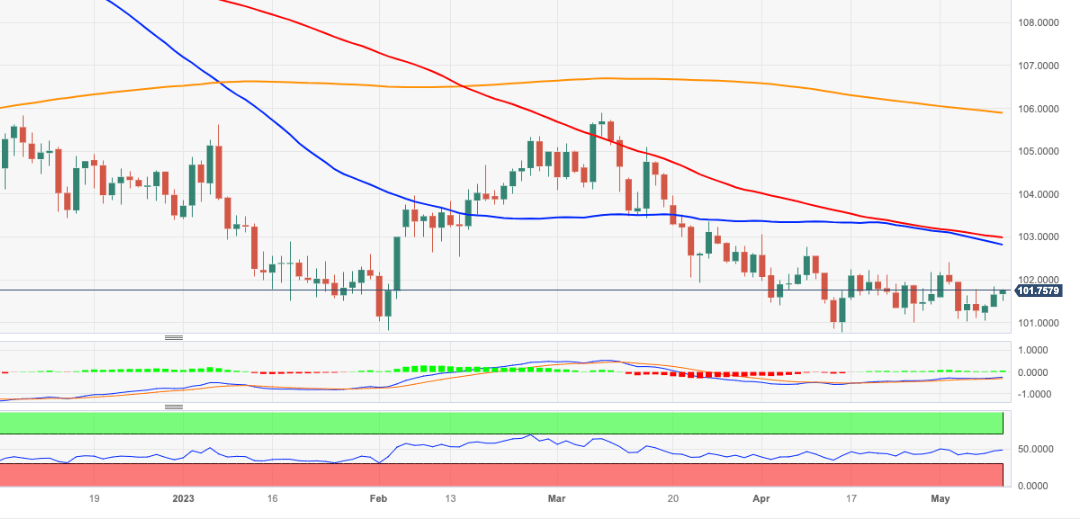

USD Index Price Analysis: Strong support remains around 101.00

- DXY extends the weekly move higher and retests 101.80.

- The index appears well supported by the 101.00 region so far.

DXY picks up further pace and challenges once again the 101.80 region on, or weekly peaks, on Wednesday.

A more serious bullish attempt should clear the monthly high at 102.40 (May 2) to mitigate the downside pressure and allow for a potential advance to the provisional 55- and 100-day SMAs at 102.81 and 102.98, respectively.

On the downside, there is a formidable contention around the 101.00 neighbourhood for the time being.

Looking at the broader picture, while below the 200-day SMA, today at 105.89, the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.