USD Index Price Analysis: Immediate hurdle comes at 102.84

- DXY regains upside traction following two daily pullbacks in a row.

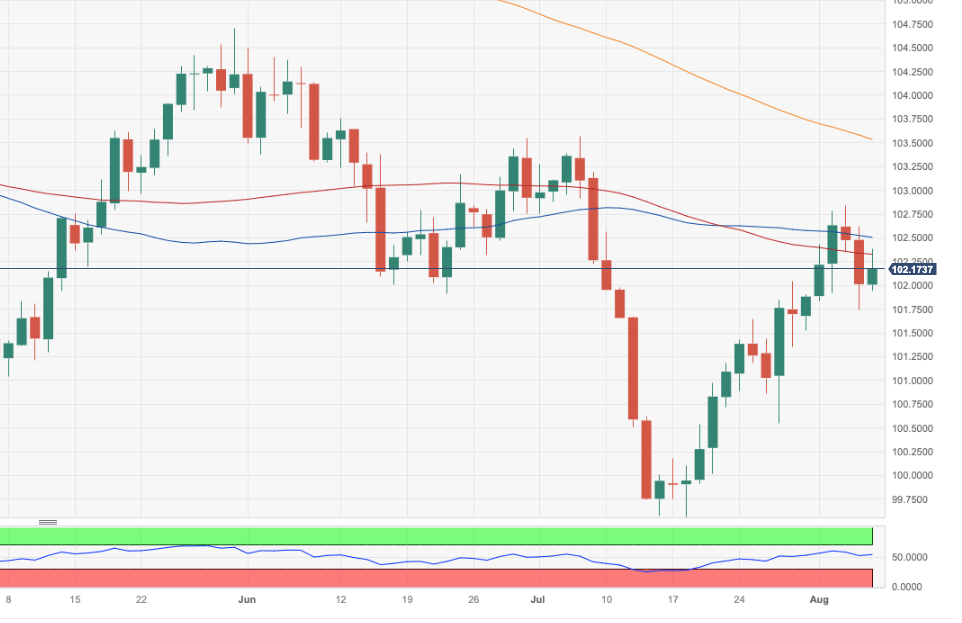

- There is an initial hurdle at the monthly high of 102.84.

DXY regains composure and reclaims the area beyond the key 102.00 hurdle at the beginning of the week.

The index manages to leave behind part of the selling pressure seen in the latter part of the week and retakes the 102.00 yardstick and beyond on Monday. The index needs to rapidly clear the so far monthly top of 102.84 (August 3) to allow for a potential move to the July top of 103.57 (July 3), which appears underpinned by the proximity of the key 200-day SMA.

Looking at the broader picture, while below the 200-day SMA (103.52) the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.