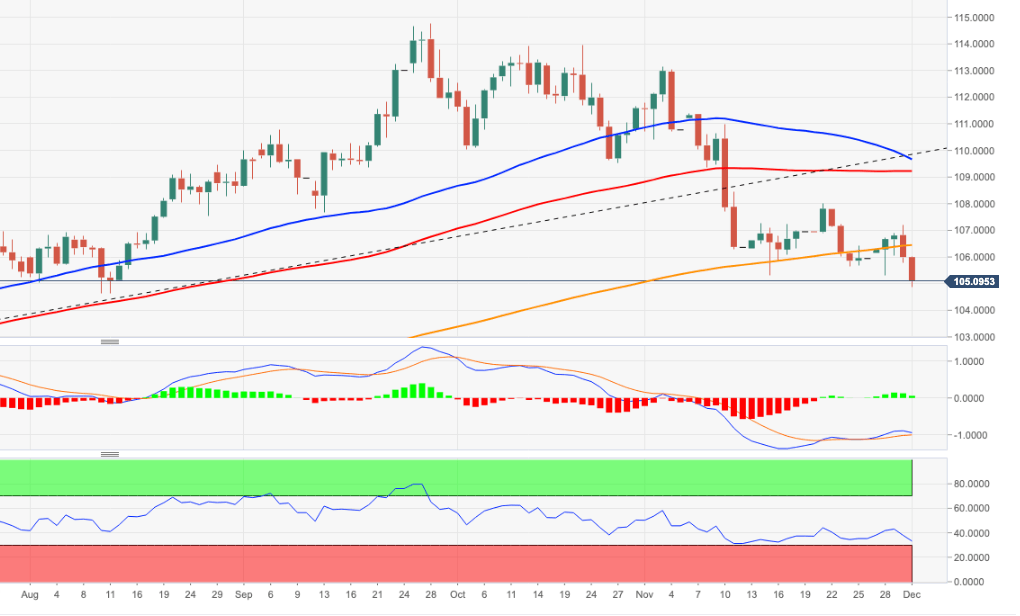

USD Index Price Analysis: Extra losses could test 104.63

- The index remains well on the defensive and breaks below 105.00.

- The continuation of the downside could drop to the August low.

DXY extends the leg lower to the area below the 105.00 level for the first time since mid-August.

The continuation of the selling pressure could motivate the dollar to shed further ground and challenge the August low at 104.63 (August 10) in the short-term horizon.

Below the 200-day SMA at 105.51, the dollar’s outlook should remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.