USD Index Price Analysis: Beware of the technical correction

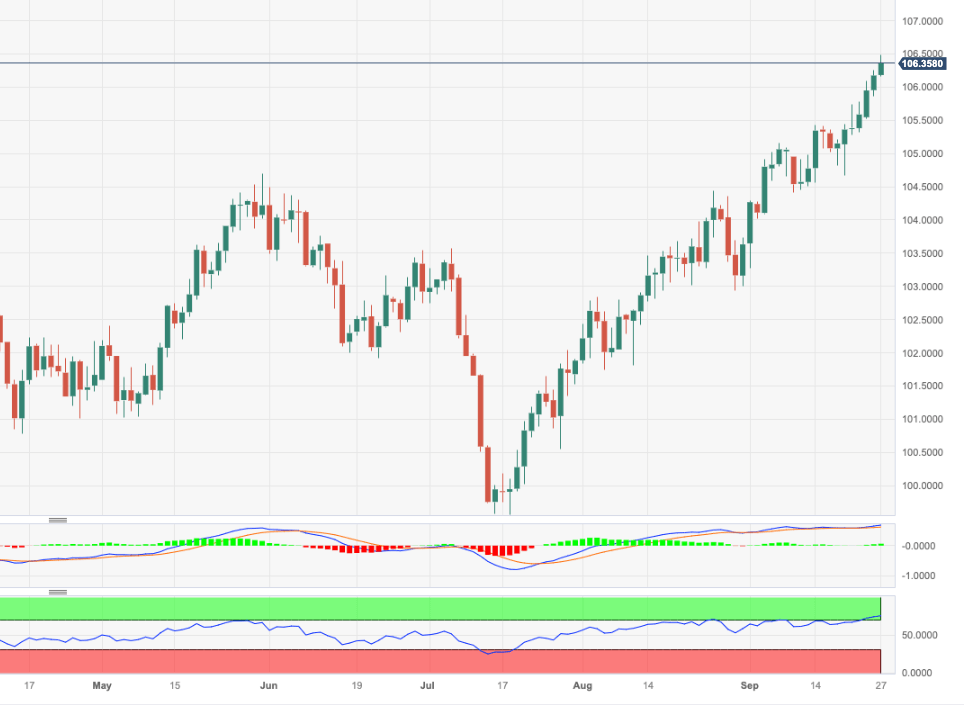

- DXY rises to new 2023 highs near 106.50 on Wednesday.

- Current overbought conditions could spark a knee-jerk.

DXY accelerates its upside and reaches new YTD peaks near 106.50 on Wednesday.

Considering the ongoing price action, extra gains appear likely for the time being. Further up now comes the weekly high at 107.19 (November 30, 2022) prior to another weekly peak at 107.99 (November 21 2022).

However, the current overbought conditions of the index could favour some near-term corrective move.

In the meantime, while above the key 200-day SMA, today at 103.07, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.