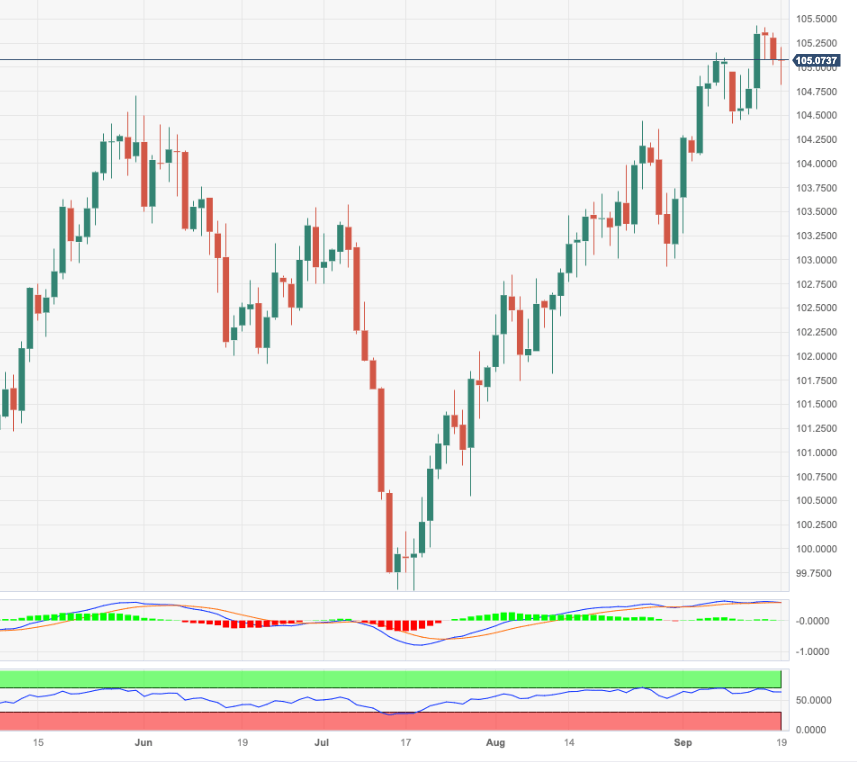

USD Index Price Analysis: A drop to 104.40 emerges on the horizon

- DXY extends the weekly retracement below 105.00.

- Further south comes the weekly low near 104.40.

DXY has been shedding ground for the last three sessions and has opened the door to extra losses in the near term.

In case the corrective decline picks up further pace, the index could extend the drop to, initially, the weekly low of 104.42 (September 11). A sustained pullback below the latter could prompt the index to embark on a potential test of the critical 200-day SMA, today at 103.03.

While above the key 200-day SMA, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.