USD Index faces extra selling pressure near 102.20 ahead of CPI

- The index comes under pressure near 102.20.

- US yields advance marginally across the curve so far.

- US inflation is expected to rise 3.3% YoY in July.

The greenback adds to Wednesday’s pullback and revisits the 102.20 region when tracked by the USD Index (DXY) on Thursday.

USD Index looks at US data

The index loses ground for the second session in a row and navigates in the low-102.00s on Thursday amidst rising expectation ahead of the release of US inflation figures for the month of July.

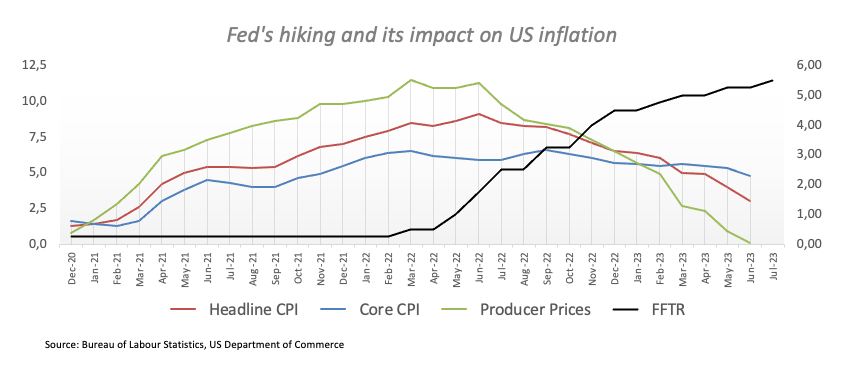

According to market consensus, US consumer prices are seen rising 3.3% in the year to July, a tad above June’s readings and the first uptick since June 2022.

In the meantime, US yields appear slightly bid following the recent weakness against the backdrop of steady bets that the Federal Reserve could have ended its tightening campaign with July’s interest rate hike.

Other than the release of inflation figures, weekly Jobless Claims are due and Philly Fed P. Harker (voter, hawk) and Atlanta Fed R. Bostic (2024 voter, hawk) are also scheduled to speak later in the NA session.

What to look for around USD

The index remains offered on Thursday, although it manages well to keep the trade north of 102.00 for the time being.

Other than risk appetite trends, the dollar could face extra headwinds in response to the data-dependent stance from the Fed against the current backdrop of persistent disinflation and cooling of the labour market.

Furthermore, speculation that the July hike might have been the last of the current hiking cycle is also expected to keep the buck under some pressure for the time being.

Key events in the US this week: Inflation Rate, Initial Jobless Claims (Thursday) – Producer Prices, Flash Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft or hard landing for the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023 or early 2024. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is losing 0.23% at 102.24 and faces initial support at 101.74 (monthly low August 4) seconded by 100.55 (weekly low July 27) and then 100.00 (psychological level). On the other hand, the breakout of 102.84 (weekly high August 3) would open the door to 103.37 (200-day SMA) and finally 103.57 (weekly high June 30).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.