USD Index extends the decline and challenges 103.00

- The index moves lower and approaches 103.00.

- US yields maintain the march north unabated.

- Fedspeak, housing data will take centre stage later on Tuesday.

The greenback, in terms of the USD Index (DXY), grinds lower and puts the 103.00 region to the test on turnaround Tuesday.

USD Index looks at Fedspeak, Jackson Hole

The index grinds lower and flirts with the key 200-day SMA in the 103.20/15 band amidst further improvement in the risk complex during the first half of the week.

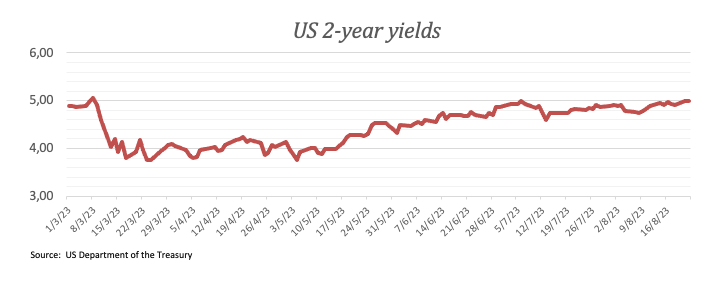

The so far weekly corrective move in the greenback also comes amidst the continuation of the upside momentum in US yields, where the short end revisits tops around the key 5.0% threshold and the 10-year benchmark navigates levels last seen in November 2007 past 4.30%.

In the meantime, market participants maintain a cautious trade ahead of the imminent Jackson Hole Symposium and Chief Powell’s speech (Thursday and Friday), where consensus expects his message to fall in line with the latest FOMC meeting on July 26.

In the US data space, Existing Home Sales for the month of July are due seconded by the August Richmond Fed Manufacturing Index and speeches by Richmond Fed T. Barkin (2024 voter, centrist), FOMC Governor M. Bowman (permanent voter, centrist), and Chicago Fed A. Goolsbee (voter, centrist).

What to look for around USD

The index appears to have entered a corrective phase after hitting new highs around 103.70 last week.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which seems to have reignited the narrative around the tighter-for-longer stance from the Federal Reserve.

Furthermore, the idea that the dollar could face headwinds in response to the data-dependent stance from the Fed against the current backdrop of persistent disinflation and cooling of the labour market appears to be losing traction as of late.

Key events in the US this week: Existing Home Sales (Tuesday) – MBA Mortgage Applications, Flash Manufacturing/Services PMIs, New Home Sales (Wednesday) – Jackson Hole Symposium, Durable Goods Orders, Chicago Fed National Activity Index, Initial Jobless Claims (Thursday) - Jackson Hole Symposium, Final Michigan Consumer Sentiment, Chief Powell (Friday).

Eminent issues on the back boiler: Persistent debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

USD Index relevant levels

Now, the index is down 0.18% at 103.13 and faces initial support at 102.30 (55-day SMA) followed by 101.74 (monthly low August 4) and then 100.55 (weekly low July 27). On the other hand, the breakout of 103.68 (monthly high August 18) would open the door to 104.69 (monthly high May 31) and finally 105.88 (2023 high March 8).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.