USD/IDR Price News: Indonesian Rupiah stays pressured ahead of BI Rate decision

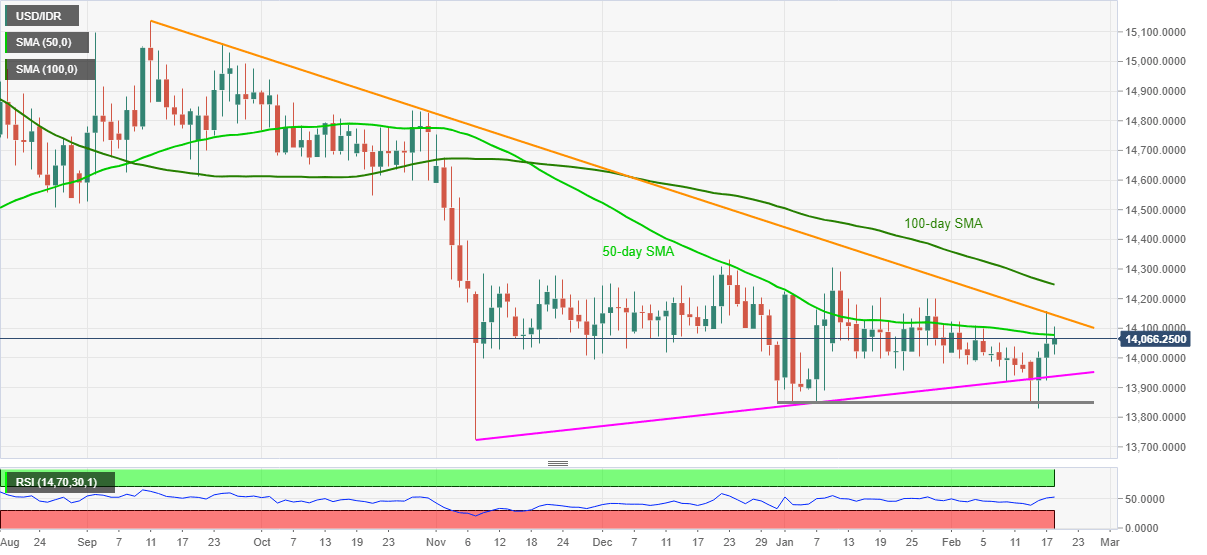

- USD/IDR prints three-day uptrend while attacking 50-day SMA.

- Five-month-old resistance line, 100-day SMA adds to the upside filters.

- Ascending trend line from November offers immediate support.

- Bank Indonesia (BI) is expected to announce 0.25% rate cut.

USD/IDR picks up bids around 14,060, up 0.10% intraday, during early Thursday. In doing so, the quote rises for the third consecutive day, currently attacking 50-day SMA, despite the previous day’s pullback from falling trend line resistance established since October 11.

Considering the expected 0.25% rate cut from the Indonesian central bank, coupled with the strong RSI conditions, USD/IDR is likely to cross the immediate hurdle of 14,080 while trying to cross the key resistance line, currently around 14,150.

However, 100-day SMA and the yearly high, respectively near 14,250 and 14,300, could challenge USD/IDR bulls afterward.

In case of a surprise no rate cut, USD/IDR may revisit a three-month-long support line, at 13,940 now, before eyeing the yearly horizontal support around 13,850.

Should, the USD/IDR bear dominate past-13,850, November 2020 low of 13,726 will return to the charts.

Overall, BI’s rate is the key event for USD/IDR traders that have been witnessing sideways moves so far in 2021.

USD/IDR daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.