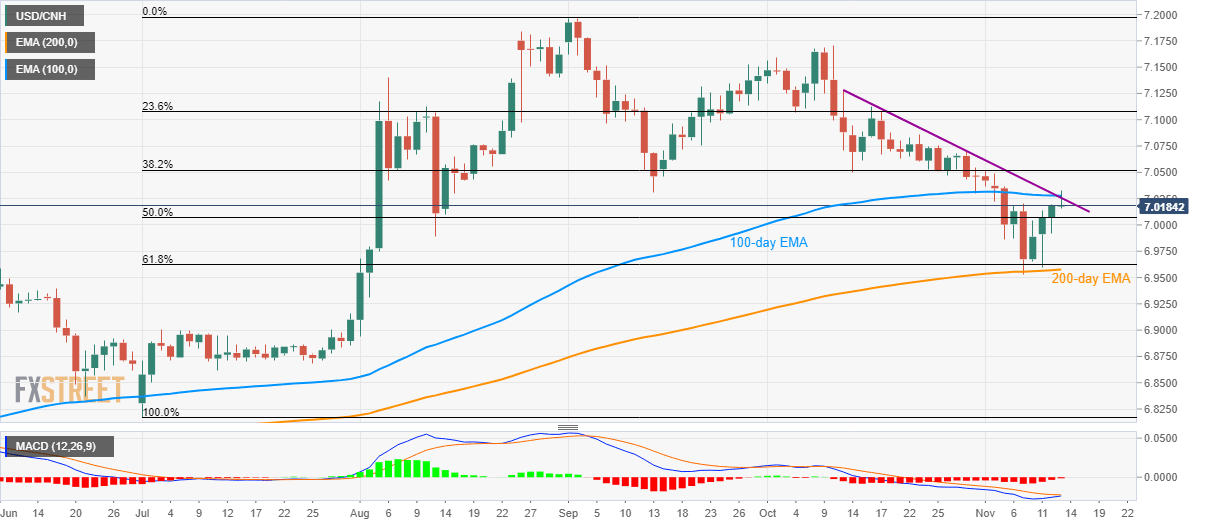

USD/CNH Technical Analysis: Slips from 1-week-high amid bearish MACD

- USD/CNH pulls back from 100-day EMA, monthly resistance line.

- 61.8% Fibonacci retracement, 200-day EMA limits near-term declines.

USD/CNH fails to hold on to recovery gains as 100-day EMA and one-month-old falling trend line restrict the pair’s near-term upside. The quote currently takes the rounds to 7.0200 by the press time of the pre-European session on Wednesday.

Considering bearish conditions of 12-bar Moving Average Convergence and Divergence (MACD) indicator, prices are expected to stretch the latest pullback towards 50% Fibonacci retracement level of July-September upside, at 7.0070, whereas August 18 low near 6.9889 could please sellers afterward.

Even so, pair’s further declines will find it hard to prevail unless breaking 61.8% Fibonacci retracement level of 6.9620 and 200-day EMA level of 6.9576 on the daily closing basis.

Meanwhile, the pair’s sustained rise beyond a 100-day EMA level of 7.0280 could trigger fresh rise to 38.2% Fibonacci retracement level of 7.0520. However, pair’s further advances will be guarded by the mid-October top near 7.1130.

USD/CNH daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.