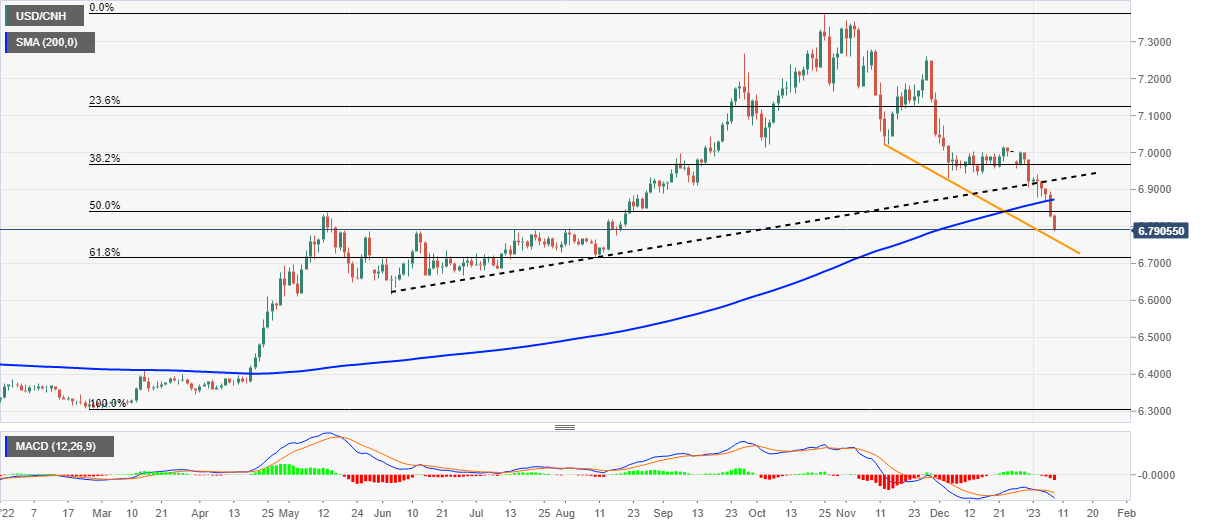

USD/CNH Price Analysis: Refreshes multi-day low as bears approach 6.7650 support

- USD/CNH drops to the lowest levels since August 17, 2022.

- Clear break of 200-DMA, bearish MACD signals favor sellers as they eye two-month-old descending support line.

- Previous support line from June adds to the upside filters.

USD/CNH takes offers to renew a multi-day low around 6.7900 heading into Monday’s European session. In doing so, the offshore Chinese Yuan (CNH) pair extends the previous day’s downside break of the 200-DMA to poke the lowest levels since mid-August 2022.

Also adding strength to the bearish bias is the pair’s sustained trading below the support-turned-resistance line from early June, as well as the bearish MACD signals.

That said, USD/CNH bears are on their way to meeting a downward-sloping support line from November 14, close to 6.7650 by the press time.

The pair’s further downside, however, appears limited as the 61.8% Fibonacci retracement level of its February-October upside, near 6.7150, could challenge the USD/CNH sellers afterward. If not, then the mid-2022 low surrounding 6.6170 and the 6.6000 round figure will be in focus.

On the contrary, recovery moves may initially aim for the 50.0% Fibonacci retracement level surrounding 6.8420 ahead of confronting the 200-DMA level of 6.8730.

Following that, the seven-month-old support-turned-resistance line near 6.9240 will be in focus as it holds the key to the USD/CNH run-up towards the 7.0000 psychological magnet.

Overall, USD/CNH remains on the bear’s radar even if the downside room appears limited.

USD/CNH: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.