USD/CHF Price Prediction: Potential start of an up leg within range

- USD/CHF might be starting a new up leg within its sideways market range.

- MACD is starting to bend and if it crosses its signal line bulls may pile in.

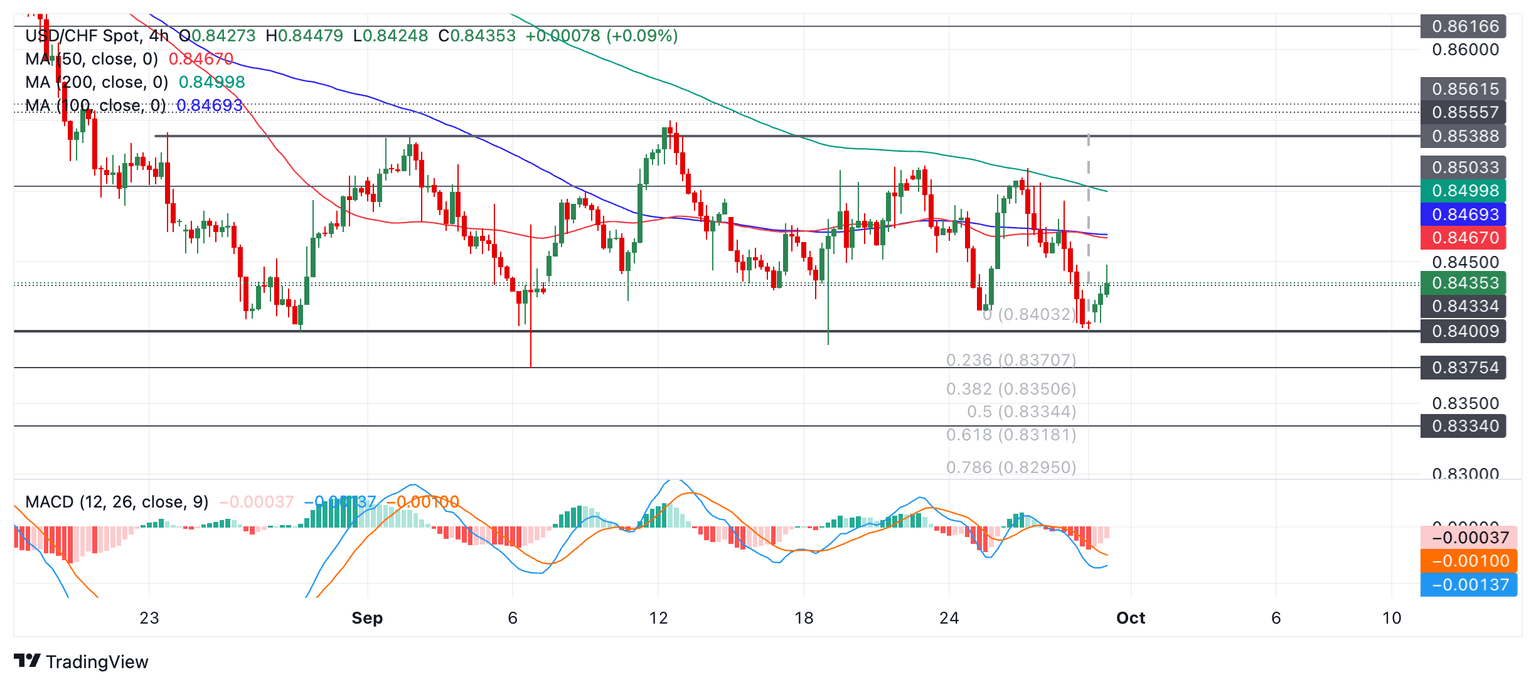

USD/CHF has fallen to the 0.8400 floor of the range and rebounded. It is too early to decide whether this is the start of a new up leg within the range but given the established sideways trend the odds favor such a move developing and the range extending.

USD/CHF 4-hour Chart

The Moving Average Convergence Divergence (MACD) momentum indicator is below the zero line and turning. If the blue MACD crosses above the red signal line it will provide a stronger signal that a new up leg within the range-bound consolidation is forming. MACD is a more reliable indicator within sideways compared to strongly trending markets.

If the MACD line crosses above its signal line and price continues to rise it will probably continue all the way up to an initial target at about 0.8517 (September 23 and 26 highs) followed by the roof of the range at 0.8539.

There is a possibility the pair could breakout of the range and given the prior trend to its formation was bearish, a downside break is mildly favored. A close below 0.8375 (September 6 low) would signal such a breakout. A decisive break would be one accompanied by a longer-than-average red candlestick that closed near its low or three consecutive bearish candles that broke below the level. Such a move would be expected to go as low as 0.8318, the 61.8% Fibonacci extrapolation of the height of the range extrapolated lower.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.