USD/CHF Price Forecast: Drops further below 0.8500 post US data

- USD/CHF retreats 0.20%, testing support levels after US labor data fuels expectations of aggressive Fed rate cuts.

- The pair eyes a retest of the year-to-date low of 0.8400, with further downside targeting 0.8332 and 0.8300.

- For a bullish recovery, USD/CHF must clear the August 15 swing high at 0.8748.

The USD/CHF retreated late in the New York session, down 0.20%, as US jobs data revealed the labor market is cooling, which could warrant the Federal Reserve's (Fed) “aggressive” rate cuts. At the time of writing, the pair trades at 0.8447 after hitting a daily high of 0.8490.

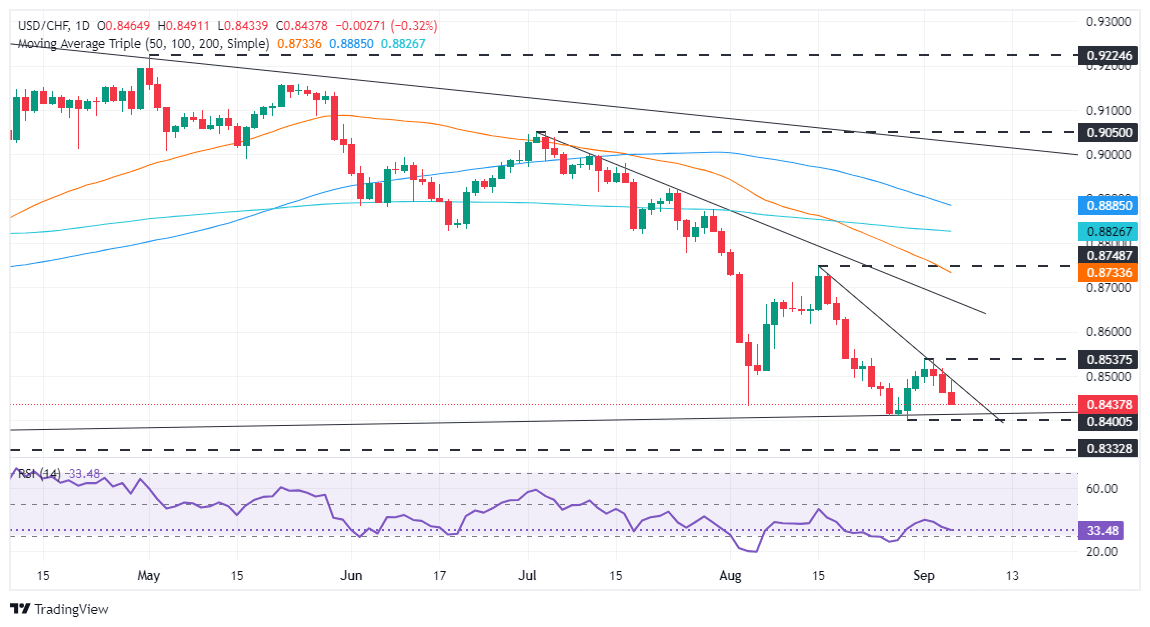

USD/CHF Price Forecast: Technical outlook

USD/CHF's failure to clear the key resistance trendline around 0.8530-50 sponsored a leg-down on the pair. On its path toward the current exchange rate, the pair cleared the 0.8500 figure, tested today.

Momentum favors sellers, as the Relative Strength Index (RSI) shows. This could help refresh the year-to-date (YTD) low of 0.8400, hit on August 29.

If USD/CHF clears 0.8400, the next support would be last year’s low of 0.8332 before challenging 0.8300.

The USD/CHF pair must clear the August 15 swing high at 0.8748 for a bullish recovery.

USD/CHF Price Action – Daily Chart

Swiss Franc PRICE Today

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.23% | -0.24% | -0.02% | -0.22% | -0.41% | -0.32% | |

| EUR | 0.25% | 0.03% | 0.02% | 0.27% | 0.04% | -0.11% | -0.07% | |

| GBP | 0.23% | -0.03% | -0.02% | 0.23% | 0.00% | -0.15% | -0.10% | |

| JPY | 0.24% | -0.02% | 0.02% | 0.22% | 0.02% | -0.15% | -0.07% | |

| CAD | 0.02% | -0.27% | -0.23% | -0.22% | -0.19% | -0.36% | -0.31% | |

| AUD | 0.22% | -0.04% | -0.01% | -0.02% | 0.19% | -0.17% | -0.10% | |

| NZD | 0.41% | 0.11% | 0.15% | 0.15% | 0.36% | 0.17% | 0.06% | |

| CHF | 0.32% | 0.07% | 0.10% | 0.07% | 0.31% | 0.10% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.