USD/CHF Price Forecast: Climbs to 0.8059 as Dollar steadies

- USD/CHF rebounds over 0.20% as traders weigh Powell’s dovish tilt and stable Fed cut expectations.

- Pair consolidates between 20 and 50-day SMAs, with RSI neutral and direction awaiting fresh catalysts.

- Key supports lie at 0.8000 and 0.7944, while resistance emerges at 0.8100 and 100-day SMA 0.8139.

USD/CHF advances for the first time of the week, up by over 0.20%, trading at 0.8059 as the Greenback recovers following last Friday’s plunge, as probabilities for a Fed rate cut settled at around 86%. The Fed's dovish tilt by its Chairman, Jerome Powell, provided certainty for investors, who were uneasy amidst a changing scenario.

USD/CHF Price Forecast: Technical outlook

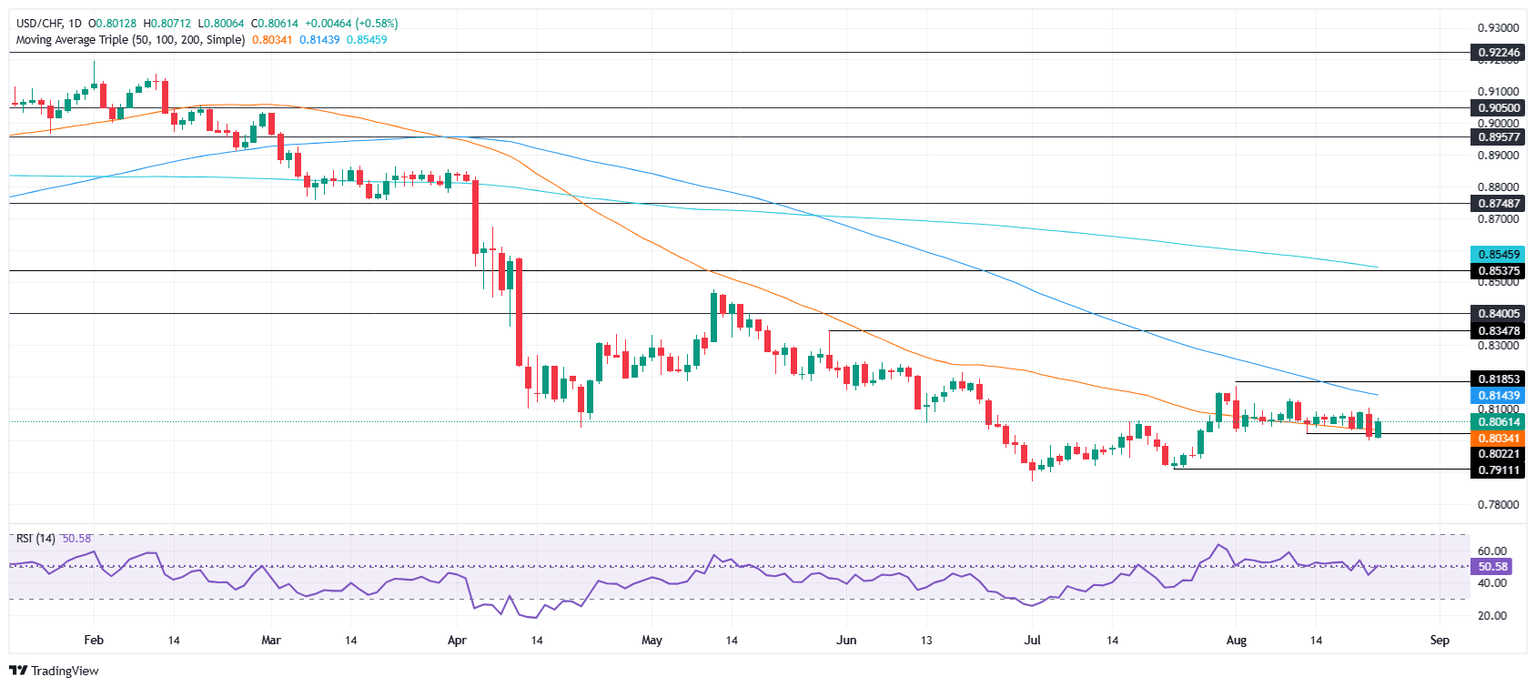

The USD/CHF trades within the 20 and 50-day Simple Moving Averages (SMAs) at 0.8032 and 0.8074, respectively, with the lack of “definite” direction as traders await a busy economic docket during the week.

The Relative Strength Index (RSI) hovers around its neutral line, further confirming the USD/CHF consolidation around current exchange rates. But, as the pair hit a lower low of 0.8000, last seen on July 28, a test of the latter is on the cards.

In that outcome, the next area of interest for sellers would be the July 28 low of 0.7944, ahead of the July 23 swing low of 0.7911. Conversely, a move above 0.8075 clears the path towards 0.8100, putting the 100-day SMA as the next key resistance at 0.8139.

USD/CHF Price Chart – Daily

Swiss Franc Price This week

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies this week. Swiss Franc was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.03% | -0.02% | -0.15% | -0.02% | -0.04% | -0.05% | 0.14% | |

| EUR | -0.03% | 0.02% | 0.02% | -0.04% | -0.02% | 0.15% | 0.15% | |

| GBP | 0.02% | -0.02% | 0.00% | -0.03% | 0.02% | 0.14% | 0.12% | |

| JPY | 0.15% | -0.02% | 0.00% | -0.00% | -0.08% | 0.18% | 0.02% | |

| CAD | 0.02% | 0.04% | 0.03% | 0.00% | -0.02% | 0.17% | 0.02% | |

| AUD | 0.04% | 0.02% | -0.02% | 0.08% | 0.02% | -0.01% | 0.02% | |

| NZD | 0.05% | -0.15% | -0.14% | -0.18% | -0.17% | 0.01% | -0.01% | |

| CHF | -0.14% | -0.15% | -0.12% | -0.02% | -0.02% | -0.02% | 0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.