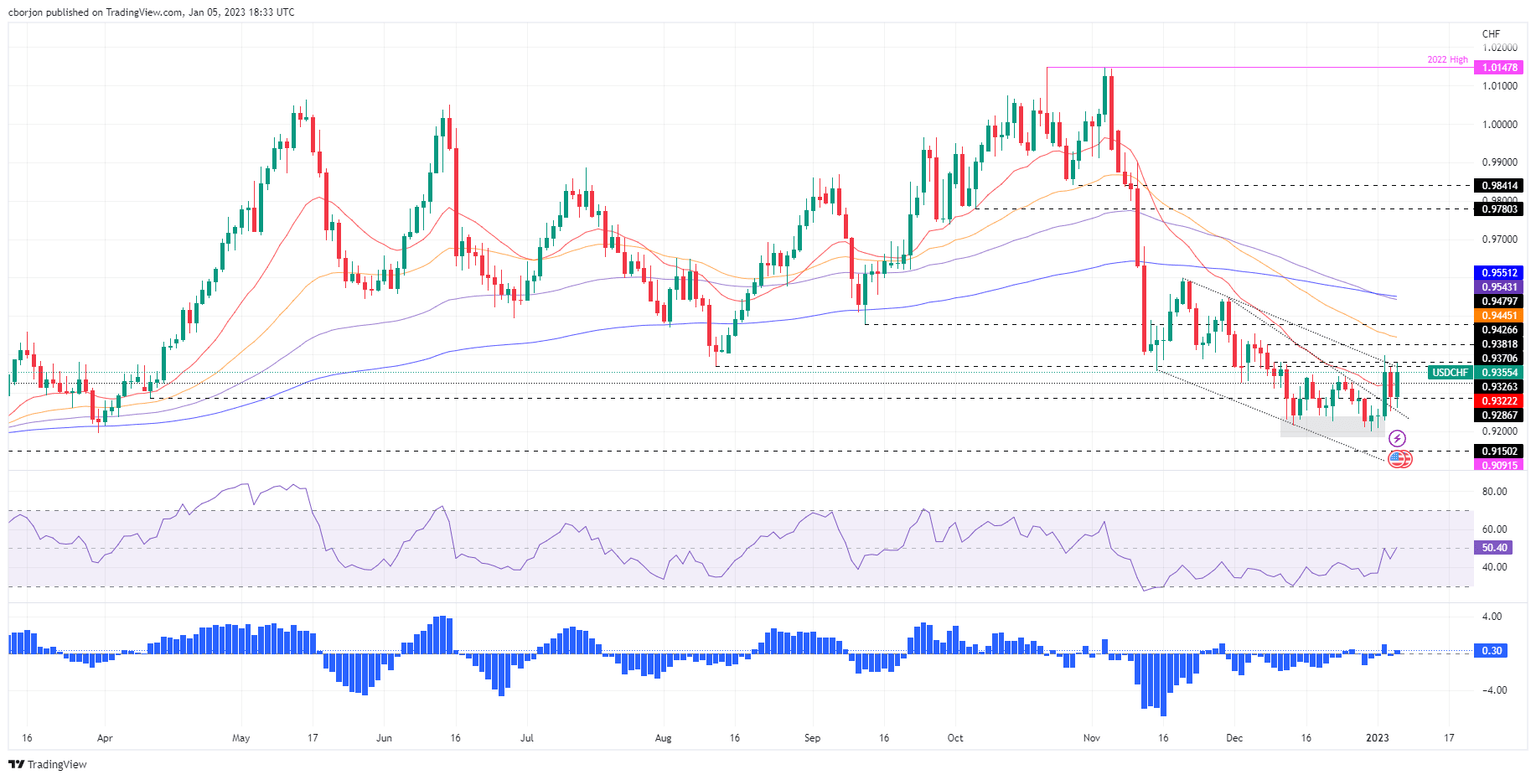

USD/CHF Price Analysis: Steadily advances above 0.9350 after breaking a falling wedge

- USD/CHF climbs steadily, bolstered by US economic data and speculation for further Fed tightening.

- The USD/CHF pairs bounced at around a top-trendline of a falling wedge which turned support around 0.9250.

- A daily close above 0.9366 could send the USD/CHF rallying towards 0.9400 and beyond.

The USD/CHF erases Wednesday’s losses and rises more than 70 pips on Thursday, clearing on its way north solid resistance levels, like the 20-day Exponential Moving Average (EMA) at 0.9322. Factors like the release of robust labor market data in the United States (US) lifted the USD/CHF from around daily lows of 0.9260. At the time of writing, the USD/CHF is trading at 0.9360.

USD/CHF Price Analysis: Technical outlook

After finding support at around 0.9200, the USD/CHF resumed its uptrend, eyeing a break above Wednesday’s daily high of 0.9366. The USD/CHF dropped towards the top-trend line of a falling wedge, previously broken during the week, turned support. Hence, the major bounced at around 0.9250 and aimed toward a downslope resistance trendline that passed around 0.9370.

If the USD/CHF achieves a daily close above 0.9366, that could open the door for further upside, implying a test of the 0.9400 mark, which, once cleared, would send the USD/CHF aiming towards the 100-day EMA at 0.9445, followed by a test of 0.9500.

As an alternate scenario, the USD/CHF first support would be the 20-day EMA at 0.9322, followed by the 0.9300 figure and the top trendline of a falling wedge that resides around 0.9250.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.