USD/CHF Price Analysis: Soars, extends its rally to 10 days, as bull's eye 0.9100

- USD/CHF is on a bullish trajectory, ending the week with over 1% gains,

- Pair is eyeing the 0.9100 mark, with a breach potentially exposing the May 31 cycle high at 0.9147, following a rally to the March 16 daily high at 0.9340.

- Key support levels for sellers include the 200-DMA and the 0.9000 mark; breaching these could lead to a test of the September 20 daily low at 0.8931.

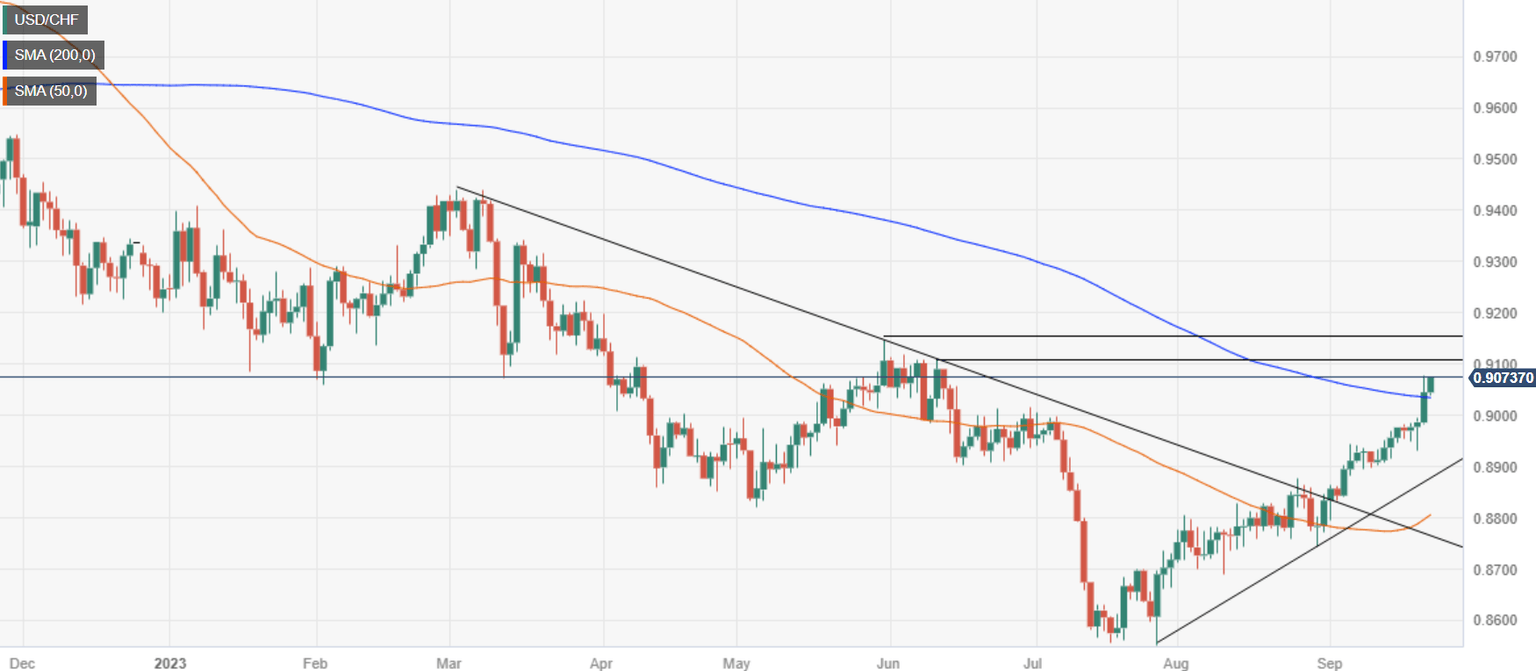

USD/CHF is set to end the week with decent gains of more than 1%, while breaking above the 200-day moving average (DMA), which could open the door for further upside, with buyers eyeing a new cycle high. Therefore, the pair is trading at 0.9071, edges up 0.30% late in the New York session.

The daily chart portrays the pair extending its gain past the 0.9032 (200-DMA), and puts a challenge of the 0.9100 figure into play. A breach of the latter will expose the May 31 cycle high at 0.9147, which, if cleared, the USD/CHF could rally back to the March 16 daily high at 0.9340.

Conversely, sellers would face the 200-DMA and the 0.9000 mark. Those two levels hurdled, and the USD/CHF would dive and test the September 20 daily low of 0.8931 before testing the 0.8900 figure.

USD/CHF Price Action – Daily chart

USD/CHF Key Technical levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.