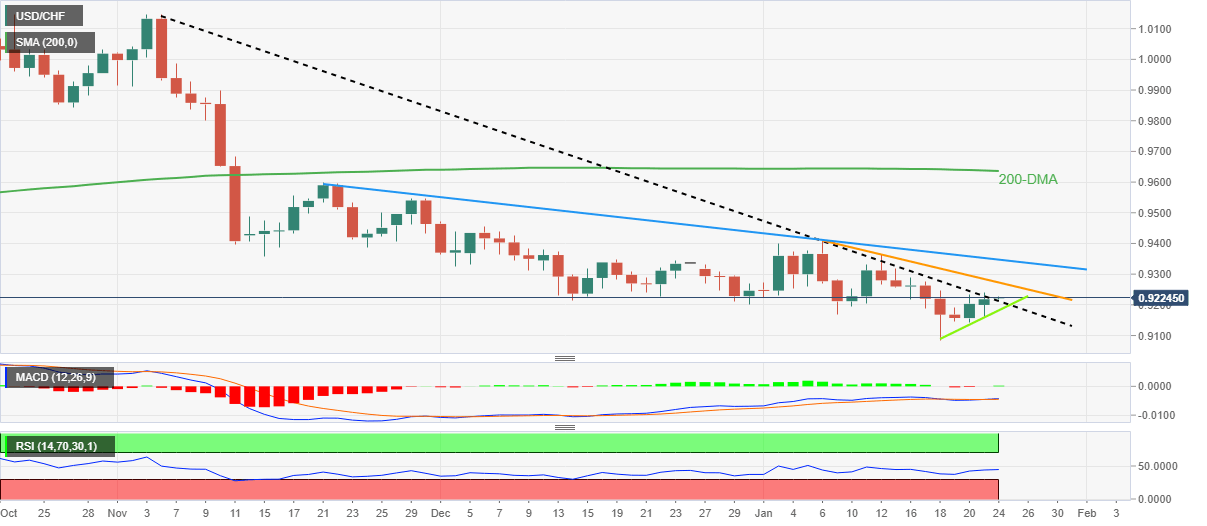

USD/CHF Price Analysis: Slips from bear’s grip on crossing 0.9200 hurdle

- USD/CHF grinds higher after two-day uptrend crossed 11-week-old resistance line.

- Sluggish oscillators, multiple hurdles to the north challenge buyers.

- Sellers need validation from 0.9180 to retake control.

USD/CHF makes rounds to 0.9220-25 as it struggles to extend the key resistance break during Tuesday’s sluggish Asian session. In doing so, the Swiss Franc (CHF) pair probes the previous two-day uptrend at the latest.

That said, the major currency pair crossed a downward-sloping resistance line from November 04 the previous day, now support around 0.9200. However, the sluggish MACD and RSI indicators show the buyers’ lack of conviction ahead of a slew of hurdles to the north.

Among them, a 12-day-old resistance line close to 0.9275 appears the immediate challenge for the USD/CHF buyers to tackle.

Following that, a descending trend line from November 21, surrounding 0.9350 at the latest, could probe the USD/CHF pair’s upside moves.

It’s worth noting that the quote’s successful trading above 0.9350 could enable the buyers to aim for the 200-DMA hurdle near 0.9640, which holds the key to the bull’s dominance.

On the flip side, pullback moves remain elusive unless the quote stays beyond the 0.9200 previous resistance.

Following that, a one-week-old ascending support line, close to 0.9180 by the press time, will be important for the USD/CHF bears to conquer to retake control.

In a case where the USD/CHF price remains weak past 0.9180, the odds of witnessing a fresh month low, currently around 0.9085, can’t be ruled out.

USD/CHF: Daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.